FX Technical View: GBP/USD Uptrend, EUR/USD Downtrend Intact

The US dollar weakened on Thursday as investors awaited stronger cues for an early Fed rate hike but risk trading lower in Asia helped the greenback find some support. Charts suggest the broad uptrend in GBP/USD and downtrend in EUR/USD to continue.

European stock markets are unlikely to provide a major risk direction on Thursday and therefore, French CPI and eurozone industrial production data later in the day will be watched closely.

Bank of England governor Mark Carney will speak at 22:00 GMT and his words will be quite important after the mixed jobs data on Wednesday. Before that weekly jobless claims from the US will likely influence markets.

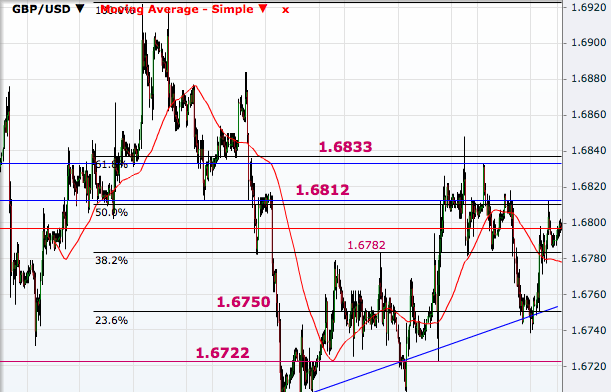

The GBP/USD is trending upward. Wednesday's break above the 1.6782 resistance also took it through the 50-day moving average which is now acting as the nearest support. It has stronger support at 1.6750, a break of which will destabilise the uptrend since last Wednesday and open up 1.6722 ahead of 1.6697. Levels to watch on the higher side are 1.6812 and 1.6833. MACD above zero also shows that the momentum is northward.

The EUR/USD has its southward momentum little affected. But if the base at 1.3521 holds, then the pair may break 1.3558 and move on to 1.3582 and then 1.3603. With MACD indicating a downward momentum, downside levels are rather more important. Below 1.3521, it has support at 1.3477 and then 1.3377, the 50% Fibonacci retracement of the July 2013 to May 2014 uptrend.

The USD/JPY has to break above 102.21 to return to the uptrend since 21 May and then 102.38 comes as the next important level in the near term. A failure below 102.21 will push it through 101.80-86, which is endorsed by the 50% Fibonacci retracement of the 21 May to 4 June uptrend. The next level south is 101.65, the 61.8% retracement.

The USD/CHF has supports at 0.8979, 0.8964 and 0.8952 in the near term but a break of 0.8800 is crucial for resuming the downtrend since early last year. On the higher side, there are several minor levels intraday ahead of 0.9038 but only a break above that will open up 0.9129, the 38.2% Fibonacci retracement of the May 2013-March 2014 downtrend. A break of that level will challenge the downtrend.

© Copyright IBTimes 2025. All rights reserved.