FX Technical View: NZD/USD Nears All-Time High on Hawkish RBNZ, AUD/USD Little Moved After Jobs Data

NZD/USD rallied over 1.4% from previous close and hit a 28-day high of 0.8665 on Thursday as the Reserve Bank of New Zealand flagged more hikes after an expected amount of policy tightening at the review on Wednesday at 21:00 GMT. The RBNZ hiked the main lending rate to 3.25% from 3.0%.

"Inflationary pressures are expected to increase. In this environment, it is important that inflation expectations remain contained and that interest rates return to a more neutral level," the policy statement said.

AUD/USD strengthened ahead of the employment data but the pair traded choppy after the mixed data. It fell from near 0.9400 to 0.9365 before bouncing back to 0.9395.

Australian unemployment rate remained steady at 5.8% in May against market expectations of a rise to 5.9% but the employment change was -4,300 versus a consensus of +10,000.

Technical Outlook

The powerful rally on the RBNZ statement pushed NZD/USD through its 50% and 61.8% retracements of the 6 May-4 June downtrend. The pair now has resistance at 0.8679 and then at 0.8781, the 9 May peak, ahead of the all-time high at 0.8844 hit on 5 June 2011.

Near-term downside levels are 0.8546 and 0.8490, a break of which will set the bias downward. Further south, the pair eyes 0.8400.

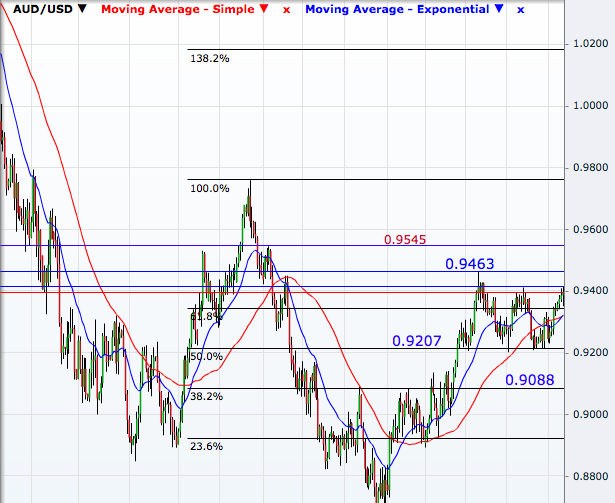

In AUD/USD, only a break above 0.9463 will break the consolidation phase since April and resume the uptrend since late January. Further higher, break of 0.9545 will open up 0.9759 and then will challenge the parity mark.

On the downside, the pair has to break through 0.9207, the 50% retracement of the October 2013 to January 2014 downtrend, to break the sideways track since April and set a downward bias. The next levels are 0.9088, the 38.2% level and the 23.6% retracement at 0.8961 ahead of 0.8821 and 0.8659.

© Copyright IBTimes 2025. All rights reserved.