A G Barr to Report Another Solid Set of FY Earnings, Expects High Input Costs and Competition

A G Barr, the manufacturer, distributor and seller of soft drinks, expects like-for-like total sales in the final quarter to be more than 12 per cent ahead of the previous year and said it is on track to meet expectations for 2012.

With a double-digit growth rate at its core brands, the group is scheduled to report its final results on 26 March for the period ending January 2012. Barr also expects increased input costs in an increasingly competitive market. Trading in the final quarter of the financial year had been strong and ahead of an optimistic total soft drinks market.

For the financial year, overall margins are expected to be in line with the group's expectations, though it experienced continuous volatility in a number of key input costs such as sugar, packaging materials and energy.

In the H1 of 2011/12, total revenue increased by 4 per cent to £124m, with volume growing by 1.4 per cent, driven by revenue increases of 2.3 per cent in carbonates and 9.8 per cent in still brands. Profit before tax, excluding exceptional items was marginally ahead versus last year at £16.2 million compared to £16.0 million a year ago, reflecting Barr's forecasted performance.

In the middle of the challenging economic environment, A G Barr continues to offer choice and value to its increasing number of consumers across the broader portfolio of brands. The group expects to witness continued pressure on consumers' disposable incomes during the current year, however, it is confident of sales growth opportunities across core brands as it continues its product distribution and innovation activities.

Barr will maintain its focus on costs throughout its total operation to ensure the margins are protected, plans to continue its investments in future production capacity in the south of Britain and will provide further updates in due course.

While commenting on the trading update in January, Collins Stewart said: "This is yet another strong trading update which highlights market share gains. The company has an exceptionally strong balance sheet and should be cash positive within the next six months." The broker retained 'Buy' rating on the stock.

"In summary, Barr is set to report another solid set of results despite several challenges and we feel it is well-placed as it enters (the next financial year)," Investec said in a note.

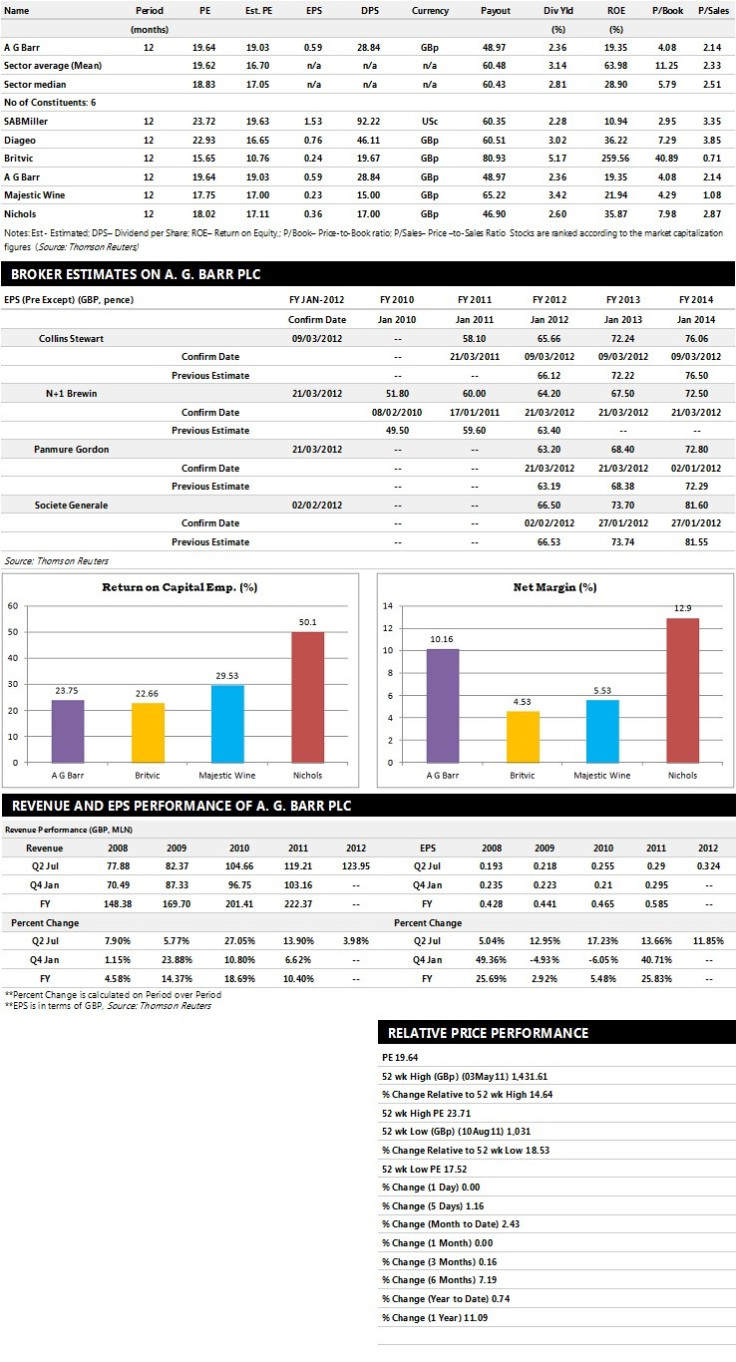

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top six companies based on market capitalisation.

Brokers' Views:

- N+1 Brewin recommends 'Hold' rating on the stock with a target price of 1250 pence per share

- Panmure Gordon assigns 'Hold' rating

- Collins Stewart gives 'Buy' rating with a target price of 1455 pence per share

- Societe Generale assigns 'Hold' rating with a target price of 1250 pence per share

Earnings Outlook:

- N+1 Brewin estimates the company to report revenues of £234 million and £245 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £33.50 million and £35.20 million. Earnings per share are projected at 64.20 pence for FY 2012 and 67.50 pence for FY 2013.

- Panmure Gordon projects the company to record revenues of £235 million for the FY 2012 and £242 million for the FY 2013 respectively with pre-tax profits (pre-except) of £33.20 million and £35.70 million. Profit per share is estimated at 63.20 pence and 68.40 pence for the same periods.

- Collins Stewart expects A. G. Barr to earn revenues of £234.90 million for the FY 2012 and £245.75 million for the FY 2013 respectively with pre-tax profits of £33.57 million and £36.69 million. EPS is projected at 65.66 pence for FY 2012 and 72.24 pence for FY 2013.

© Copyright IBTimes 2025. All rights reserved.