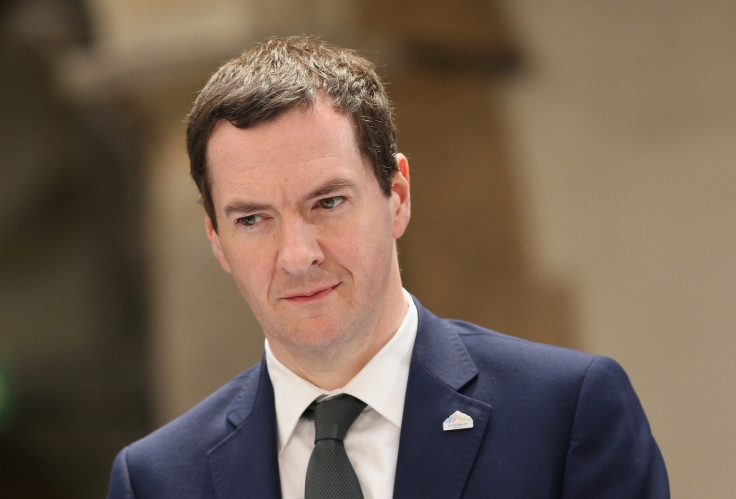

George Osborne swings axe: Chancellor announces £3bn cuts and £1.5bn Royal Mail sale

George Osborne has announced a £4.5bn ($7bn) savings plan that includes selling its remaining £1.5bn stake in Royal Mail.

Addressing the House of Commons in a Queen's Speech debate, the chancellor said the government would sell the final 30% of "the Queen's head" and make cuts of £3bn in 2015.

The Ministry of Defence and Department for Transport are the biggest contributors to the £3bn cuts, offering £500m and £545m of efficiencies respectively.

The Department for Business, Innovation and Skills and non-school spending in the Department for Education are being cut by £450m while the Department of Health will cut £200m.

Osborne's own Treasury department must chop £7m from its annual budget, the least of all government departments.

"We have a structural budget deficit and that is not going to be fixed by economic growth alone, Osborne said. "We have to bring spending down so the country lives within its means."

The chancellor will slash spending by 1% in the next tax year and is yet to announce precisely where £12bn will be found from the welfare budget.

Institute for Fiscal Studies response

"They [cuts] certainly will not feel like just 1% being taken out of each area of spending, nor will it require merely '£13bn from departmental savings' as the Conservative manifesto described. While not inaccurate, these numbers give a misleading impression of what departmental spending in many areas will look like if the manifesto commitment to eliminate the deficit by 2018-19, largely through spending cuts, while not cutting spending in many areas, is to be met."

Osborne also used his speech in the house to announce the government was preparing to sell its remaining stake in Royal Mail.

The Treasury has appointed Rothschild to advise on the sale which, at the current market value, would add £1.5bn to its coffers.

The postal service started the process of privatisation in October 2013, when 60% of Royal Mail shares were sold in its flotation.

Critics said the deal represented poor value for the taxpayer – shares that had been sold at 330p each later peaked at 615p.

© Copyright IBTimes 2025. All rights reserved.