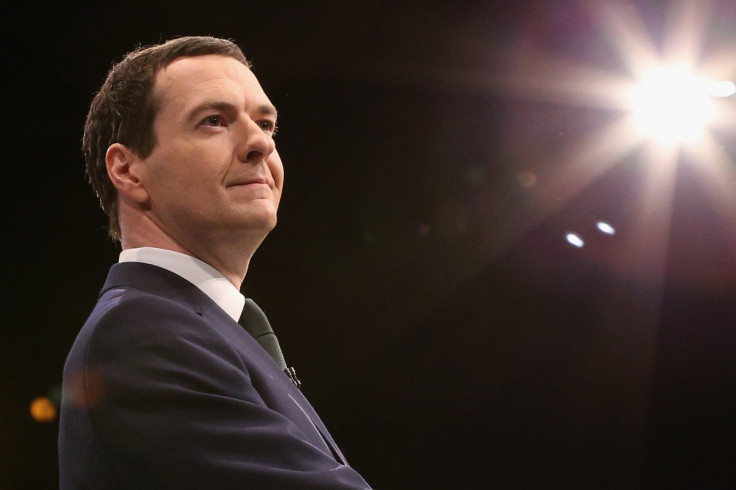

George Osborne under fire for tax credit cuts that could force 200,000 children into poverty

The UK Chancellor George Osborne has come under increased pressure to reconsider his planned tax credit cuts with a number of MPs including Conservative ministers rallying against the policy. Members of the House of Lords have threatened to vote against the cuts that will impact on the poorest in society tomorrow (26 October).

Liberal Democrats in the Lords have now tabled a "fatal" motion that would bring the policy to a halt. The Labour Party has said that it would support the Conservatives were it to delay the introduction of the cuts due to come into action in April. Shadow Chancellor John McDonnell has urged the government to put the cuts on hold and study the impact on those affected.

However, Osborne has remained resolute that rising wages will offset the impact of any cuts, but it is believed that he may unveil measures to soften the blow of any cuts in the Autumn Statement he will reveal to the Houses of Parliament on 25 November. An analysis by the Institute for Fiscal Studies (IFS) has concluded that the introduction of a higher minimum wage will not offset the losses to families with a decrease in tax credits.

Scottish Conservative leader Ruth Davidson told the Sunday Telegraph that any cuts would have to be carefully introduced. She said: "It's not acceptable. The aim is sound, but we can't have people suffering on the way. The idea that there's a cliff edge in April before the uptake in wages comes in is a real practical human problem and the government needs to look again at it."

Opponents of the plan have said that the cuts could take more than £1,000 per year from the average family. The tax credit policy is said to cost the government £30bn a year. It is thought that 200,000 children could be forced into poverty as a result of the cuts. Under the new rules the income threshold for Working Tax Credits - £6,420 - will be cut to £3,850 a year from April.

© Copyright IBTimes 2025. All rights reserved.