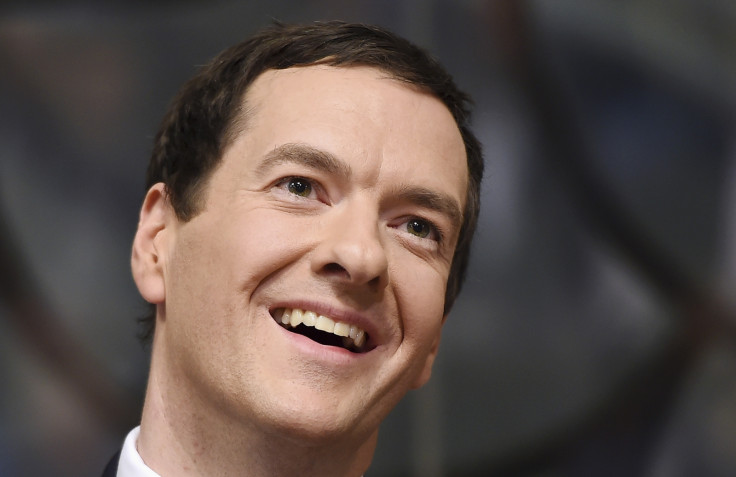

George Osborne woos middle-classes with £1m inheritance tax relief

Chancellor George Osborne plans to allow parents to pass a main property worth up to £1m to their children without paying any inheritance tax, according to Treasury papers leaked ahead of the budget.

The Guardian first reported on the scheme, which would "most likely benefit high income and wealthier households", and would also reduce the inheritance tax bill on properties worth up to £2m by £140,000.

The tax break, which is aimed at middle-class affluent households, would cost the Treasury nearly £1bn. The newspaper said the papers were marked "sensitive". The proposals are not expected to feature in the forthcoming budget statement, but will appear within the next fortnight, according to the report.

By 2019-2020, just over 20,000 fewer estates annually would have any inheritance tax liability under the plan.

The inheritance tax plan involves the creation of a new tax-free band worth £175,000 per person on a family home, which can be transferred between married couples, making it worth a maximum of £350,000, reported the Guardian.

The new nil rate band would apply to the value of a family home or other main residence transferred to a direct descendant of the deceased, including step children and adopted children. Other family members would not be able to benefit.

At present tax is paid at a rate of 40% after the first £325,000, a sum that can also be transferred between married couples making that worth £650,000.

The new threshold when added to the current inheritance tax threshold - the existing £650,000 maximum plus the new maximum £350,000 relief – provides the tax exempt £1m figure.

The tax relief was drawn up under the direct guidance of the Treasury financial secretary David Gauke.

© Copyright IBTimes 2025. All rights reserved.