Glencore Bets on Greater Urbanisation in China and India

Glencore International, the supplier of metals, minerals, energy and agriculture products, remains affirmative about the long term global economic prospects and is scheduled to release its preliminary results on March 5, 2012.

The drive towards greater urbanisation and improved living standards in countries such as China and India will continue to underpin the Glencore's growth in global trade.

Despite the financial market uncertainty and some weather and equipment-driven interruptions, the group's overall sound operational and financial performance has continued through Q3 2011. Glencore's marketing operations, trading remain firm and its financial position has continued to strengthen with the current capex programme peaking, balance sheet tractability is expected to improve further. This will provide continuing valuable optionality to further increase its organic and other growth prospects.

The group is is well positioned to support its developments using its expertise, relationships and infrastructure. The short term unpredictability caused by renewed pessimistic on sovereign debt in developed markets is, of course, a concern to the group and it is focused on minimising its adverse impact on its business while remaining alert to the potential opportunities that such an environment uncovers in its end markets.

Last month, Glencore recommended All-Share merger of equals of Glencore International and Xstrata to create an unique $90 billion Natural Resource Group. Combined group will benefit from a robust corporate governance structure with an aligned strategy to create superior shareholder value. Sir John Bond, current Xstrata non-executive Chairman, will be nominated as non-executive Chairman of the combined group and the board will also include Mick Davis, Ivan Glasenberg. The All-Share fusion will be effected by a court sanctioned scheme of arrangement of Xstrata, pursuant to which Glencore will acquire the entire issued and to be issued ordinary share capital of Xstrata not yet owned by Glencore.

The group will also acquire 7.8 percent stake in Trevali Mining Corp, the British Columbia-based group through a private placement deal worth $18 million. Trevali also announced that Chris Eskdale of Glencore will join its board, on closing of the private placement deal.

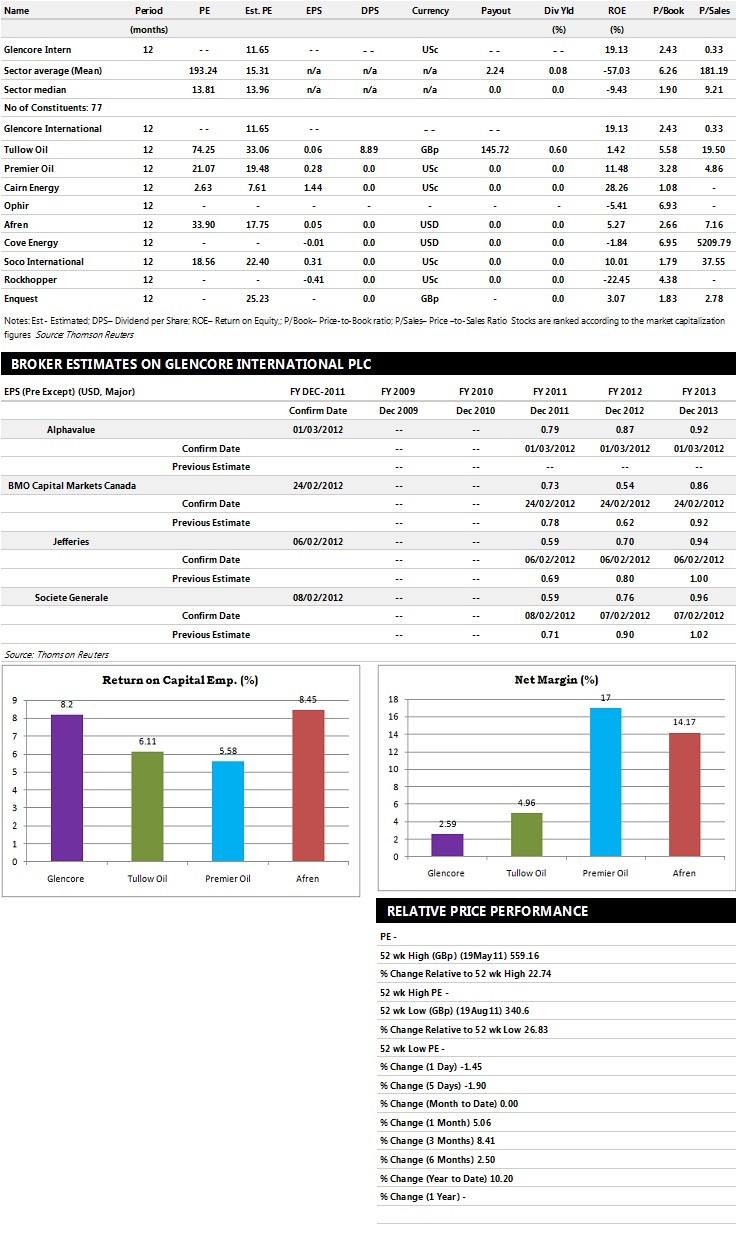

Brokers' Views:

- BMO Capital Markets gives 'Hold' rating on the stock with a target price of $6.86 per share

- Alphavalue recommends 'Sell' rating

- Charles Stanley assigns 'Hold' rating

- BMO Capital Markets assigns 'Hold' rating with a target price of $6.86 per share

- Jefferies recommends 'Buy' rating on the stock with a target price of $9.08 per share

Earnings Outlook:

- BMO Capital Markets estimates the company to report revenues of $186,299 million and $170,092 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of $2,664 million and $2,802 million. EPS is estimated at 73 cents for FY 2011 and 54 cents for FY 2012.

- Societe Generale projects the company to record revenues of $167,080 million and $170,720 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of $4,672 million and $6,441 million. Profit per share is estimated at 59 cents for FY 2011 and 76 cents for FY 2012.

- Jefferies expects the company to post revenues of $173,243 million for the FY 2011 and $184,452 million for the FY 2012 respectively with pre-tax profits of $5,157 million and $6,550 million. Profit earnings per share is projected at 59 cents for the FY 2011 and 70 cents for the FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalization.

© Copyright IBTimes 2025. All rights reserved.