Gold Prices Passes Four-Month High as Ukraine Unrest Boosts Demand

Gold prices jumped to a more than four-month high in London on 3 March as fears about a probable conflict between Russia and Ukraine boosted the yellow metal's safe-haven investment allure.

Bullion for immediate delivery rose as much as 1.8% to $1,350.37 an ounce, the highest since 30 October and was at $1,344.25 as of 10:38GMT.

Gold for delivery in April climbed 1.9% to $1,346.30 on the Comex in New York, where trading volume was 84% above the average for the past 100 days for this time of day, Bloomberg data showed.

Gold prices rose amid news that China has backed Russia in the tense standoff with the US and Europe that has erupted following the pro-West revolution in Ukraine.

Russian troops now control strategically important Crimea, an isolated Black Sea peninsula. Crimea, which belonged to Russia until former Soviet Union premier Nikita Khrushchev gave it to Ukraine in 1954, is home to Russia's largest overseas naval base

"It's a bit of a safe-haven story," said Ole Hansen, a Copenhagen-based commodity strategist at Saxo Bank.

"The market is pricing in some uncertainty and we need to see an escalation for that to be a driver to take gold higher. If we are seeing a slowdown in economic activity that obviously also lends support to gold," Hansen told Bloomberg.

"Gold has been in an upwards trend since the start of the year and today was pushed higher by risk aversion," said Bjarne Schieldrop, the chief commodity analyst in Oslo at SEB AB.

"US quantitative easing does push $65bn into the market with a need for a home," Schieldrop added.

Commerzbank Corporates & Markets said in a note to clients: "Gold remains on its upward trajectory and has climbed to a four-month high of $1,350 per troy ounce as the new week begins. At around €980 per troy ounce, gold has achieved its highest level in euro terms for 3½ months. Contributing to the rise in the gold price are no doubt the geopolitical risks in Eastern Europe, where tensions between Russia and Ukraine have escalated.

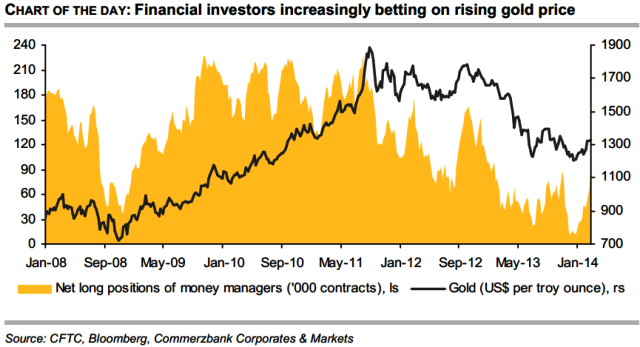

"A glance at the CFTC's statistics reveals that it is not only ETF investors who have rediscovered the merits of gold in recent weeks - speculative financial investors are also betting more on rising gold prices again. In the week to 25 February, net long positions were expanded by 40% to 96,300 contracts. This was the third weekly rise in a row, putting net long positions currently at a 13-month high."

"In the US, buyers of gold coins have exercised noticeable restraint of late: in February, the US Mint sold only 31,000 ounces of gold coins, which is 61% down on the year-on-year figure. Since the beginning of the year, US coin sales have been only just over half as high as last year. Sales of US silver coins, on the other hand, are "only" just short of 22% below the year-on-year level," the German firm added.

Hedge Funds Bullish on Gold

Hedge funds and other money managers increased their net-long position, or bullish bets, on gold by 25% to 113,911 contracts in the week to 25 February, the highest since December 2012, US Commodity Futures Trading Commission (CFTC) data showed.

Holdings in gold-backed exchange-traded products expanded 6.9 metric tons to 1,746 tons in February, the first monthly increase since December 2012, Bloomberg data showed.

Gold is the fourth-biggest gainer in 2014 on the Standard & Poor's GSCI index of 24 commodities. The metal trails coffee, lean hogs and corn.

© Copyright IBTimes 2025. All rights reserved.