Hammond faces 'White Van Man' backlash after self-employed tax hike in 2017 Budget

Chancellor plans to scrap class two National Insurance Contributions for self-employed on April 2018.

Chancellor Philip Hammond is facing a self-employment related backlash after announcing a hike in National Insurance Contributions (NICs) in his spring Budget on Wednesday (8 March).

Hammond will scrap class two NICs for self-employed workers from April 2018 and increase the main rate (class four) of NICs by 9% to 10%, with an additional 1% hike in April 2019. The levy hike will cost more than 2.4 million self-employed workers £240 a year.

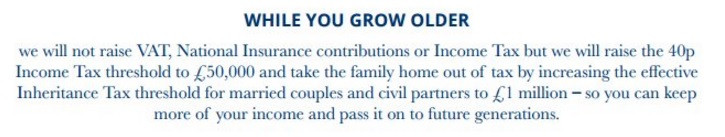

The senior Conservative's move risks denting the party's pro-entrepreneur credentials and could have broken a 2015 general election manifesto pledge. The document promised "not [to] raise VAT, NICs or Income Tax".

Ruppert Harrison, a former aide to ex-Chancellor George Osborne, described the levy increase as "very risky territory for a Conservative Chancellor with a small majority", while the Federation of Small Businesses said it was a "£1bn tax hike on those who set themselves up in business."

"This undermines the Government's own mission for the UK to be the best place to start and grow a business, and it drives up the cost of doing business," said Mike Cherry, the national chairman for the FSB.

"Future growth of the UK's 4.8 million-strong self-employed population is now at risk. Increasing this tax burden, effectively funded by a reduction in corporation tax over the same period, is the wrong way to go."

The Treasury is forecasting that it will raise more than £152m a year by 2021/11 through NICs, with some of that money helping to pay for a £2bn hike in social care grants to councils in England over the next three years.

Almost all the money raised from #Budget2017 self-employment NICs changes will come from top half of households - and especially the richest pic.twitter.com/gS7MaKm7i0

— ResolutionFoundation (@resfoundation) March 8, 2017

Alex Henderson, a tax partner at PwC, said: "The measure technically doesn't break the short lived pledge not to increase NI, IT, or VAT in this parliament, as class 4 NIC was never included.

"But many business owners will be concerned however that they are now in the Chancellor's sights for the remainder of this parliament.

"While the Chancellor's logic about removing anomalies in the system is hard to fault, it has an emotional effect on self-starters – the very people the Chancellor most needs to rely on. My worry is that by binding themselves with the tax lock, the government will continue to look at the entrepreneurial sectors of the economy for the tax rises it."

© Copyright IBTimes 2025. All rights reserved.