Harvey Nash to Beat Full-Year Forecasts; Better Placed than Peers to Prosper, Says Panmure Gordon

Harvey Nash Group raised its profit outlook as it expects full-year results to be ahead of expectations, driven by skills shortages in niche markets and fast growing digital and mobile markets which continue to boost demand for technology professionals. The group is scheduled to report its preliminary results for the year ended 31 January, 2012 on April 30.

The professional recruitment and outsourcing consultancy firm's market leading brand positioning and broad portfolio of services have resulted in market share gains and client wins. The group intends to recommend an increased final dividend of 10 percent.

Due to the group's increased focus on the Asia Pacific region, it will invest £0.75 million in new offices in 2012 to meet growing demand and also intends to relocate its London office to achieve significant economies of scale and take advantage of a subdued rental market.

Harvey Nash estimates total revenues for the full-year ended January 31, 2012 at £532 million with gross profit of £78.0 million and profit before tax of £8.2 million, up 31 percent on the previous year.

"A much better update than anticipated from Harvey Nash after a strong finish to Q4, more than underlining what we believe are its key niche strengths. With net cash on the balance sheet and a progressive dividend, we believe it remains better placed than most to prosper," Panmure Gordon said in a note to its clients.

The group said its net fee income (NFI) would be £78 million ($123 million) for the year to January, which Shore Capital says marginally ahead of its £77.2 million forecast.

"The trading update highlighted that contract NFI remained strong, particularly in IT and specifically involving mobile technology convergence," Shore said in a note to its clients.

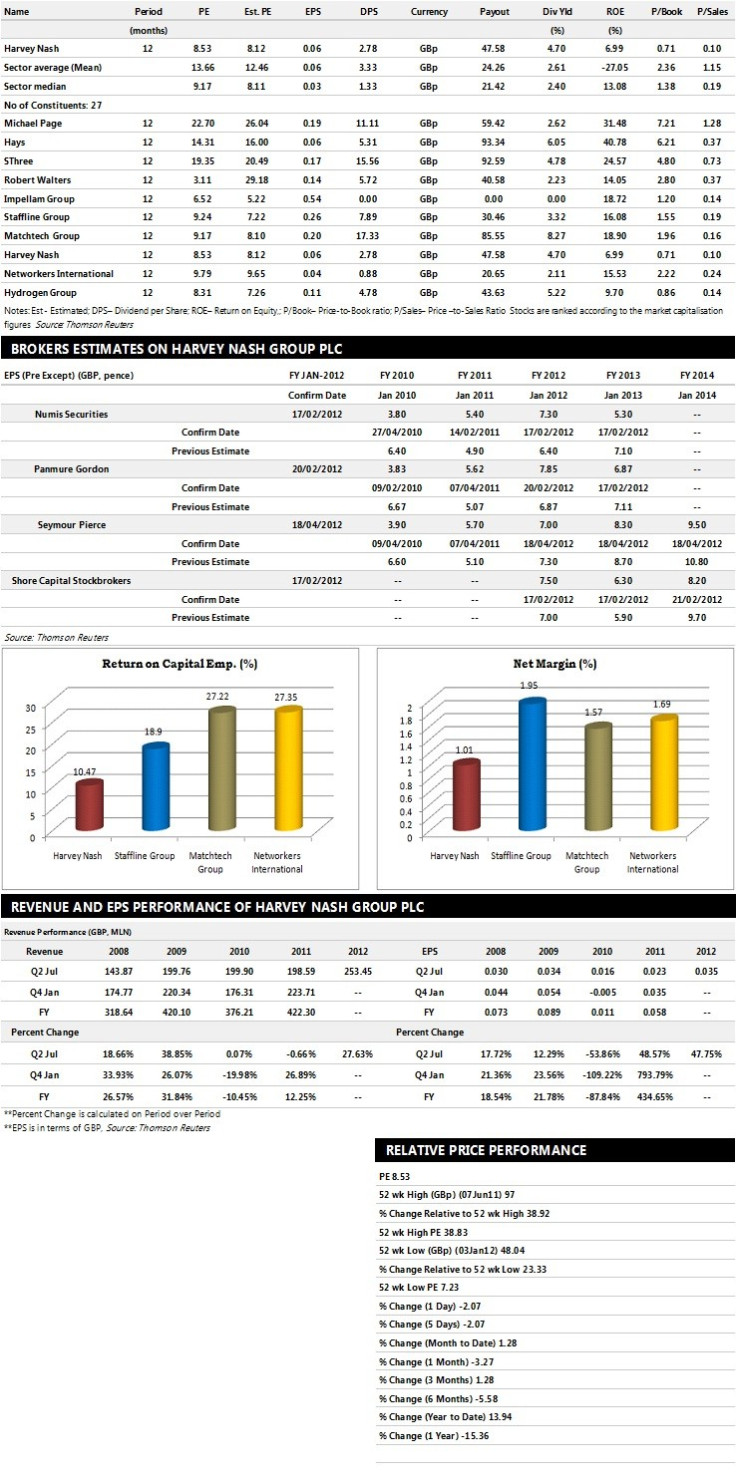

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

Brokers' Views:

- Seymour Pierce recommends 'Buy' rating on the stock with a target price of 100 pence per share

- Panmure Gordon recommends 'Hold' rating with a target price of 62 pence per share

- Numis Securities gives 'Buy' rating with a target price of 90 pence per share

- Shore Capital Stockbrokers assigns 'Outperform' rating

Earnings Outlook:

- Seymour Pierce estimates the company to report revenues of £443.40 million and £465.60 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £7.40 million and £8.80 million. Earnings per share are projected at 7 pence for FY 2012 and 8.30 pence for FY 2013.

- Panmure Gordon projects the company to record revenues of £532 million for the FY 2012 and £549 million for the FY 2013 with pre-tax profits (pre-except) of £8.24 million and £7.23 million respectively. Profit per share is estimated at 7.85 pence and 6.87 pence for the same periods.

- Shore Capital Stockbrokers expects Harvey Nash to earn EBIT of £8.00 million for the FY 2012 and £7.00 million for the FY 2013 with pre-tax profits of £8.20 million and £6.60 million respectively. EPS is projected at 7.50 pence per share for FY 2012 and 6.30 pence per share for FY 2013.

© Copyright IBTimes 2025. All rights reserved.