Hedge funds set to mark worst returns in 14 years

Global hedge funds are set to register their worst returns in 14 years in 2022 after aggressive U.S. interest rate rises hit asset prices hard.

Global hedge funds are set to register their worst returns in 14 years in 2022 after aggressive U.S. interest rate rises hit asset prices hard, however, their declines are overall smaller than the slump seen in equity and bond markets this year.

Some hedge fund strategies that put money in commodities and currencies using macro-focused strategies and exploited price differences between related securities outperformed in 2022, handing decent gains to investors.

Hedge funds' yearly price returns:

"More than at any time in recent history, both equities and bonds have been very sensitive to macro events, particularly to inflation prints," said Meisan Lim, managing director of hedge fund research at Cambridge Associates.

According to investment data firm Preqin, hedge fund returns have fallen 6.5% this year, their biggest since a 13% decline in 2008.

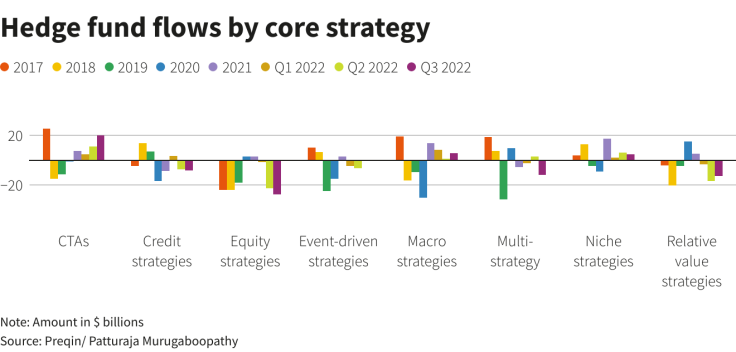

Hedge fund flows by core strategy:

That compares with the MSCI World index's decline of 18.7% and the ICE BofA U.S. Treasury index's decline of 11.9%.

Strategy-wise, macro funds gained 8.2% through November this year, while equity-hedged and event-driven strategies lost 9.7% and 4.7%, respectively, according to HFR data.

"As a strategy, macro has historically been less correlated to movements in the broader stock market, helping to diversify portfolios," said UBS in a note.

"We think a continuation of tight monetary policy and high volatility should prove favourable for macro managers in 2023."

Activist funds, which use minority stakes to push for strategy and management changes to unlock shareholder value, slumped 13.8%, according to the HFR data.

Trend-following strategies succeeded in 2022 because of the inflationary environment, said Andrew Hendry, head of Asia at Janus Henderson Investors, a global asset manager that also runs a 900 million euro ($955.17 million) long-short Global Multi-Strategy Fund.

"Trend-following works on the idea that markets process information inefficiently and at different speeds, and markets that move in one direction to start with, are more likely to continue to move in that direction," Hendry said.

"The trend has had a great 2022 with things like strong commodity prices and weak bonds contributing substantially to performance."

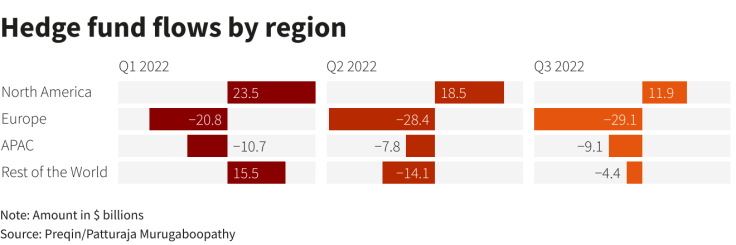

Hedge fund flows by region

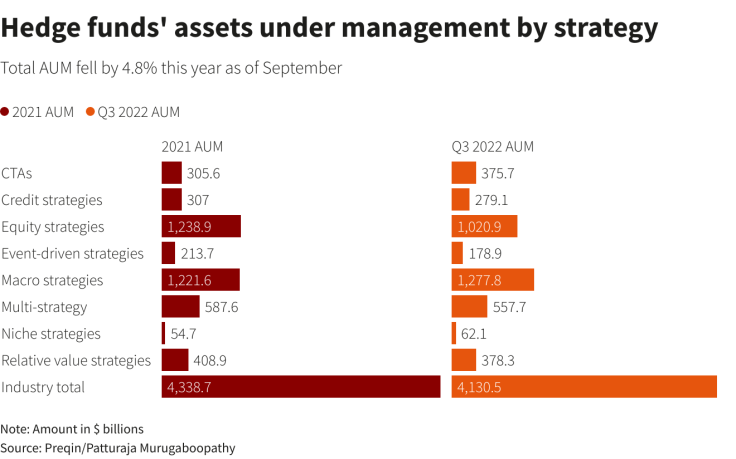

Alongside the tumble in traditional assets from equities to bonds, net assets of global hedge funds fell 4.8% in the first three quarters of this year to $4.3 trillion. They saw a combined outflow of $109.8 billion in that period, according to Preqin data.

Hedge funds' assets under management by strategy:

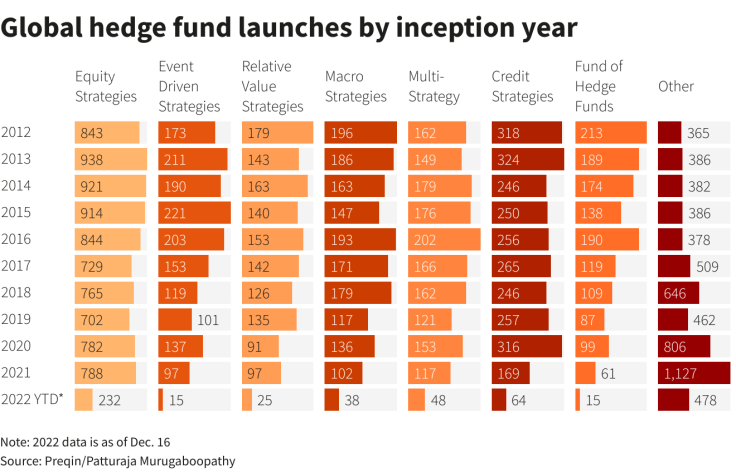

Just 915 funds were launched this year, the fewest in 10 years, the data showed.

Global hedge fund launches by inception year:

($1 = 0.9422 euros)

Copyright Thomson Reuters. All rights reserved.