Hong Kong Dollar Recoups Protest Losses, Central Bank May Step in For Holding 7.7500

The Hong Kong dollar has rallied back near its peg rate against the US dollar despite broad greenback strength and negative data surprises from Hong Kong, indicating the demand for the local currency with the Bank of Japan loosening the liquidity tap a little more in its 31 October policy decision.

The BoJ move pushed the Japanese yen to a 7-year low while the Nikkei 225 share index soared to a 7-year high, indicating the extent of boost risk assets gained from Japanese authorities.

The BoJ said it will purchase more shares of exchange-traded funds and real estate investment trusts and extend the duration of its portfolio of Japanese government bonds (JGBs).

The central bank also said that it will expand the monetary base by 10-20trn yen to 80trn yen, as it sees continued downside risks to price pressures.

HKD and Hang Seng

The Hang Seng 50 index too strengthened to a 5-week high of 24,133 following the BoJ move before easing to 23,587. The lower than expected HSBC PMI from Hong Kong on 3 November weighed on the stocks but failed to prevent the HK dollar rally.

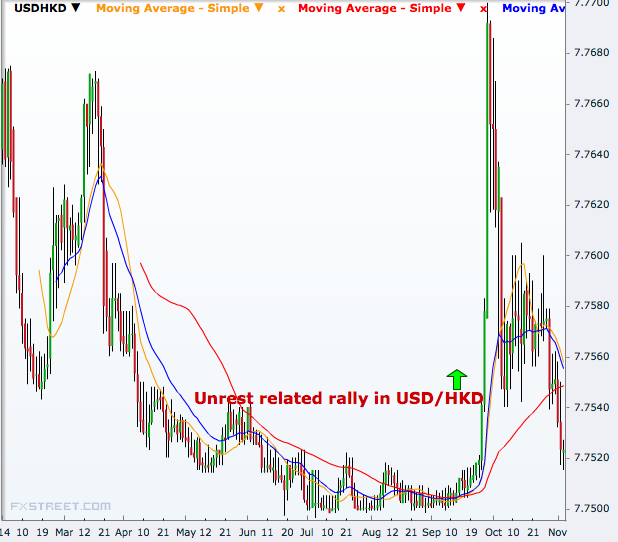

USD/HKD has fallen to as low as 7.7515 on Wednesday, its lowest since 25 September, when the striking youths in the Hong Kong streets really started weakening the HK dollar. The pair is now close to 7.7500, a level the Hong Kong Monetary Authority hasn't allowed to break since June.

The HK dollar had fallen to a more than 2-year low early last month following the political upsurge calling for more freedom from the Chinese authorities.

The mighty China tackled the issue within a few weeks and the Hong Kong currency erased most of the unrest-related losses, but the USD/HKD pair held above the support line of 7.7540 for about four weeks until breaking the same this week.

Renminbi Liquidity in Hong Kong

With the Chinese yuan gaining increased importance in the region as more countries have begun to issue renminbi bonds in the offshore market, which is mainly concentrated in Hong Kong, strength of the HK dollar will also be of market importance for investors as well as policymakers.

The HKMA said on 3 November that they will provide renminbi intraday liquidity to authorized institutions participating in RMB business in Hong Kong, effective 10 November.

In light of the increased volume of payments alongside the growth of the offshore RMB market, the HKMA will provide intraday RMB funds of up to 10bn renminbi to assist the participators in managing their RMB liquidity and to promote efficient payment flows in Hong Kong, according the central bank statement.

This RMB repo facility will also provide banks with greater flexibility in managing their payment flows upon the launch of the Shanghai-Hong Kong Stock Connect in the future, the HKMA said on Monday.

© Copyright IBTimes 2025. All rights reserved.