How to increase your cash ISA return by five times

Cash ISAs can be easily transferred into stocks & shares ISAs, which can then be used to buy ultra low-cost ETFs.

Individual savings accounts (ISAs) have become a very popular, easy way to save cash tax-free since 1999, when they were first introduced.

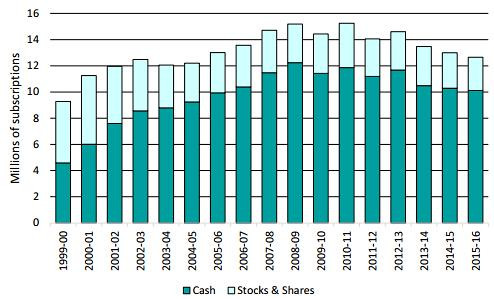

Over the last tax year, 13.4million ISA accounts received subscriptions from savers, both adult and also junior. Of these ISAs, just under 80% were cash ISAs (Chart 1).

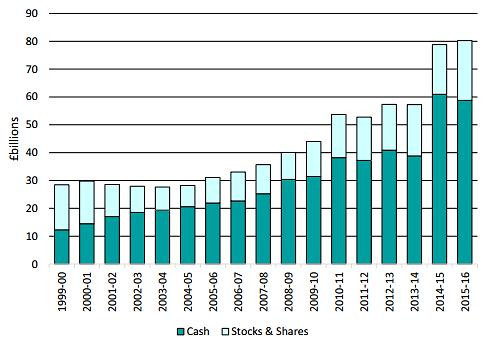

Of the £80bn that was saved in ISAs over the 2015-16 tax year, nearly three-quarters was in cash, with just over £20bn going into stocks & shares (Chart 2).

Does it make sense to save so much in cash?

Now while we may feel somewhat smug at our efforts to save some money "for a rainy day", we should perhaps be asking ourselves the question: "does it make sense to save so much in cash?"

After all, deposit interest rates have done nothing but come down over the past five years.

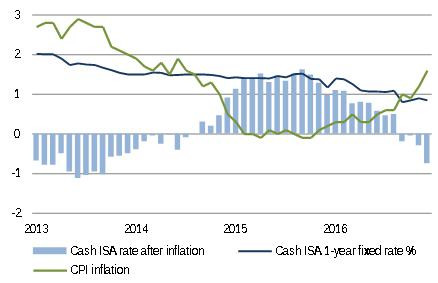

Today, even with the benefit of no tax to pay on the interest earned, cash ISA accounts are not even keeping pace with the annual rate of price inflation. A one-year cash ISA will yield an annual interest rate of around 0.85%, while the latest inflation rate has risen to 1.6%, with economists expecting inflation to hit close to 3% during this year (Chart 3).

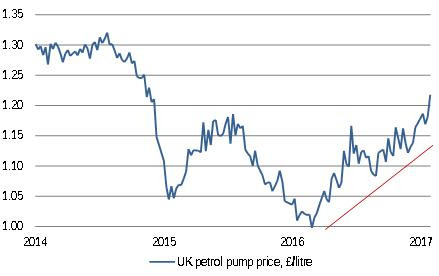

In fact, the only reason that cash ISAs yielded more than inflation over 2015 and the start of 2016 was the sharp fall in petrol prices. But this has reversed sharply over the last few months, which together with the falling value of the pound sterling is pushing inflation back up (Chart 4).

So what's the alternative for our long-term savings?

Now I believe that there is a good reason to keep some cash saved for emergencies, let's say up to three months' worth of regular bills.

But I think that aside from this cash, any extra long-term savings could be invested elsewhere to earn better rates of return.

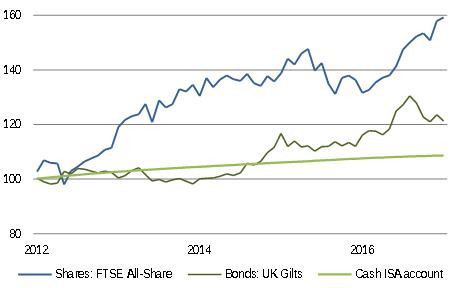

Since 2012, £100 put into a cash ISA would have grown to £108.70 by today. However, the same £100 put into a relatively safe, cheap bond fund such as a UK gilt ETF (exchange-traded fund) would have grown to over £120 by now, while the same amount invested and left in a UK share ETF would have grown to nearly £160 over the same period, including dividends paid (Chart 5).

Long-term savings provider Royal London has even estimated that:

"investors in Cash ISAs have missed out on more than £100bn in tax free gains they could have made over the last ten years by investing in a multi-asset fund."

So what's the alternative for our long-term savings?

Now I believe that there is a good reason to keep some cash saved for emergencies, let's say up to three months' worth of regular bills.

But for other long-term savings, think of putting them into a mixture of bonds and shares, which is very easy to do via funds. Cash ISAs can be easily transferred into stocks & shares ISAs, which can then be used to buy ultra low-cost ETFs such as the:

- Vanguard UK Gilt ETF (code: VGOV) for bond exposure, at an annual management fee of just 0.12%, or £1.20 per £1000 invested;

- iShares core FTSE 100 ETF (code: ISF) for share exposure, at an annual management fee of just 0.07%, or 70p per £1000 invested.

An equal mix of these two held since 2012 would have turned £100 into £140 today, nearly five times better than the return on an average cash ISA. Over the long-term, those sorts of numbers really add up...

© Copyright IBTimes 2025. All rights reserved.