Huntsworth to Deliver Improved Trading in 2012 with New Business Pipeline and Longer-Term Contracts

With its new business pipeline being strong, Huntsworth Plc, the global public relations and integrated healthcare communications group, is confident of improving trading in 2012 compared to 2011 and is scheduled to report its preliminary 2011 results on Tuesday.

Despite the challenging macro-economic backdrop, the benefits of the brand re-organisation continue and the group is well positioned to service larger international clients on longer contract terms. Work has now started on a number of new mandates announced in the second half of 2011. Group's budgets for 2012 are underpinned by a number of such clients, reducing dependence on one-off project revenues.

The international public relations firm said in its pre-close season trading update that it is on track to meet current year's market expectations.

"We believe that the market will be reassured by comments over the balance sheet and dividend," said Numis Securities in a note by repeating its "Buy" rating and price target of 62 pence per share.

Huntsworth expects revenue stream to increase, driven by the progress in its global and multi-office accounts and margins to move back in line with historic norms during 2012.

It is also waiting for larger accounts to come on stream in 2012, it has been necessary for it to hold resources in place to service the expected revenue increases, in turn putting short-term pressure on margins.

The group's dividend increase reflects not only the highly cash generative nature of its business but also confidence in its global strategy and growth prospects moving forward.

"The group strategy is to win two and three year global and multi-office contracts. The pipeline for these larger mandates is good and following our brand rationalisation, our success in winning them has considerably improved in the third quarter. These new global and multi-office wins which we announced will be on stream in early 2012," said Sally Withey, Chief Operating Officer of Huntsworth.

The balance sheet remains robust and it continues to operate within its banking covenants. The group's annual general meeting is scheduled to be held on May 18, 2012.

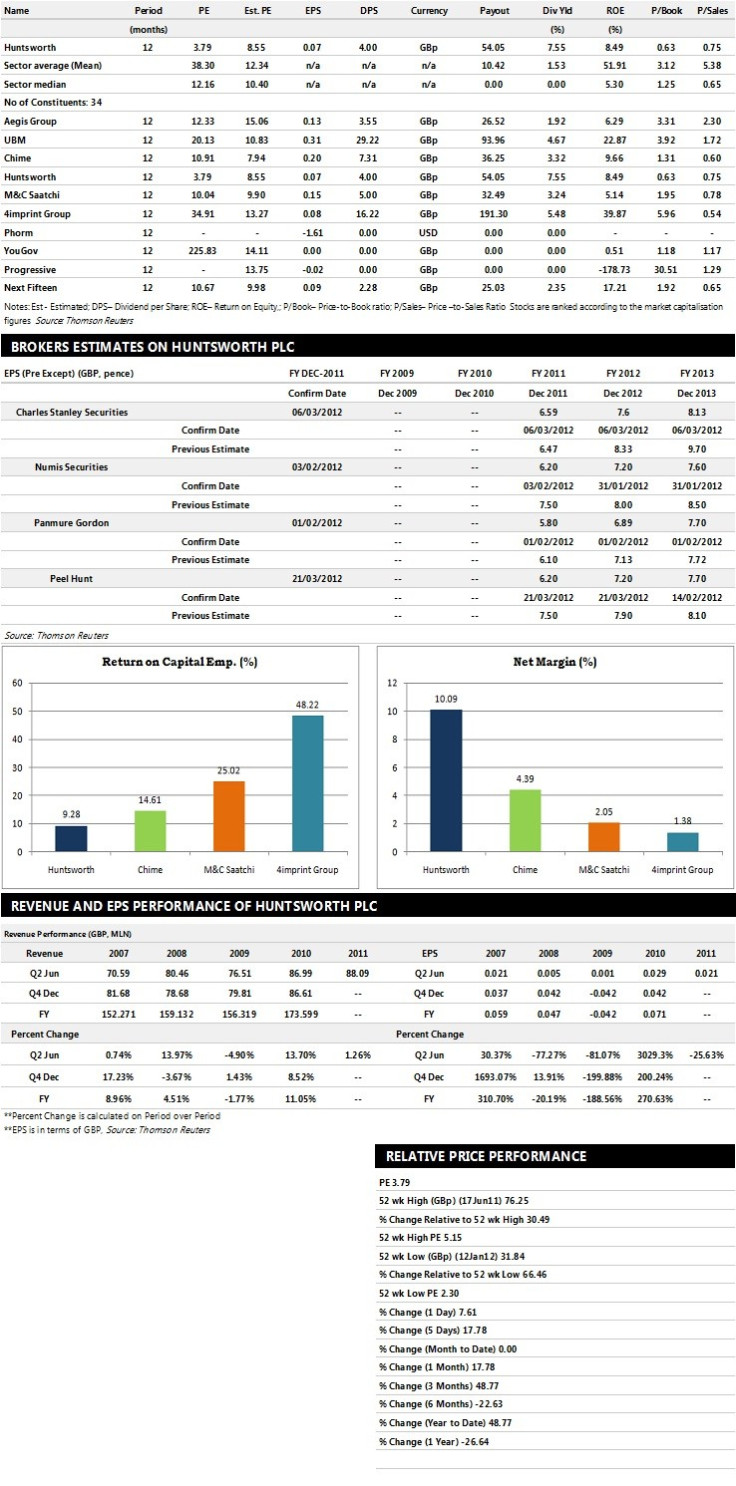

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

Brokers' Views:

- Charles Stanley recommends 'Out Perform' rating on the stock

- Peel Hunt recommends 'Hold' rating on the stock

- Numis Securities assigns 'Buy' rating on the stock

- Panmure Gordon assigns 'Buy' rating

Earnings Outlook:

- Peel Hunt estimates the company to report revenues of £178.30 million and £180.60 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £18.90 million and £23.60 million. Earnings per share are projected at 6.20 pence for FY 2011 and 7.20 pence for FY 2012.

- Charles Stanley projects the company to record revenues of £176.10 million for the FY 2011 and £180.30 million for the FY 2012 with pre-tax profits (pre-except) of £19.00 million and £23.50 million respectively. Profit per share is estimated at 6.59 pence and 7.60 pence for the same periods.

- Numis Securities expects Huntsworth to earn revenues of £176 million for the FY 2011 and £180.10 million for the FY 2012 with pre-tax profits of £19.00 million and £23.50 million respectively. EPS is projected at 6.20 pence for FY 2011 and 7.20 pence for FY 2012.

© Copyright IBTimes 2025. All rights reserved.