Japanese insurance claim agents are now being replaced by a robot – the IBM Watson supercomputer

A Japanese insurance company is replacing 34 jobs and outsourcing the work to the IBM Watson supercomputer.

A Japanese insurance company has decided to get rid of 34 jobs and instead get artificial intelligence to take over assessing medical insurance claims over the phone.

Starting from January 2017, Tokyo-based Fukoku Life Insurance Mutual Company is handing over the roles of 34 human insurance agents to IBM Watson Explorer, which is a cognitive search and content analysis platform that uses machine learning and language processing to analyse data for trends and patterns.

According to a press release, Fukoku Life is using IBM Watson Explorer to classify and categorise diseases, injuries and surgical procedures. When insurance policy holders call the company's hotline to make an insurance claim, the IBM Watson supercomputer is able to analyse the customer's voice and detect keywords.

As part of making the claim, the policyholder has to submit a medical certificate showing what condition they have, and IBM Watson can detect the name of the injury or disease listed, as well as dates such as the hospital admission date and surgery date.

Human supervisors still make the final decision

The supercomputer compares the information against company data to assess whether the customer is eligible for a payment, and the system has been trained to handle insurance claims in the same way that a human insurance claim agent would, by following a training model set up by human assessors and seeing how they dealt with previous claims.

"By introducing this system, we anticipate that we can reduce the burden of business processes by about 30%," said Fukoku Life. "IBM Watson Explorer will improve the efficiency of business and speed up payments by carrying out payment assessment of benefits."

Although it might sound rather alarming to let a computer decide whether or not you are eligible to claim on your medical insurance policy, the insurance firm assures users that human supervisors still need to make a "final assessment" of each claim.

The company also aims to keep teaching the IBM Watson system by feeding it the results of the human supervisor's decision to help it improve accuracy and efficiency of payment assessments.

Administration and repetitive tasks most likely to be automated

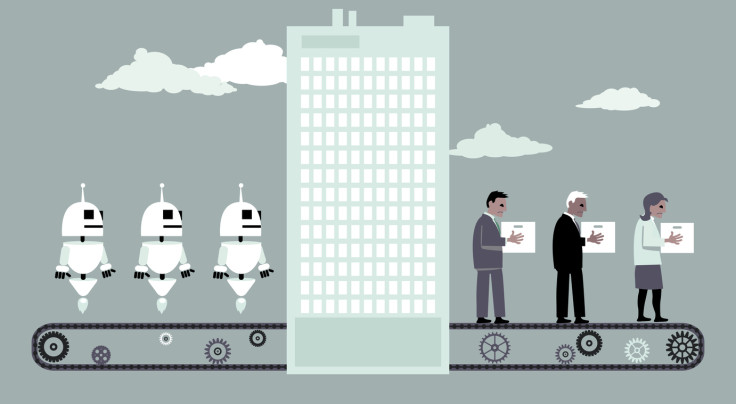

There are great fears that robots will likely take over multiple jobs in both the white and blue collar work sectors, even though most robots at the moment cannot even open a door or independently stand and move around upright.

The most current data we have on job automation comes from researchers at the Oxford Martin School at the University of Oxford, which found that out of 702 distinct professions, the jobs most likely to be automated are those that require a lot of data to be processed or a great deal of routine in repeating the same task over and over again.

These jobs include bank tellers, loan officers, administrators, insurance underwriters in the finance industry, as well as retail roles like cashiers, retail assistants, telemarketers, sales executives and waitressing. Administrative clerks and repairmen jobs are also most at risk.

Jobs that require a great deal of specialist knowledge as well as personal care and in-depth attention are very unlikely to be automated, such as engineers, scientists, astronomers, architects, surgeons, psychologists, dentists, chiropractors, opticians, electricians, dietitians, therapists, teachers, personal trainers, choreographers, air traffic controllers, archaeologists, fashion and set designers, the clergy, lawyers, vets, the police, dancers, journalists, firefighters, tour guides, public relation specialists and most computer-related professions.

© Copyright IBTimes 2025. All rights reserved.