Japan's Meiji Yasuda acquiring StanCorp of US for $5bn

Japan-based Meiji Yasuda Life Insurance has agreed to acquire US peer StanCorp Financial Group for $5bn (£3.2bn, €4.6bn), as Japanese insurers look to expand overseas amid slow growth in the domestic market due to its ageing population.

Meiji Yasuda, Japan's third-largest life insurer by premium, will pay $115 per share for StanCorp, representing a 50% premium to the US company's closing price on 23 July. Meiji Yasuda intends to fund the acquisition using cash on hand.

The acquisition has been unanimously approved by the StanCorp board, but it still requires approvals from StanCorp shareholders and regulators in both the US and Japan. The parties expect to complete the transaction in the first quarter of calendar year 2016.

Meiji Yasuda said it had been pursuing overseas expansion, while expanding its product and service lineup in the domestic life insurance business.

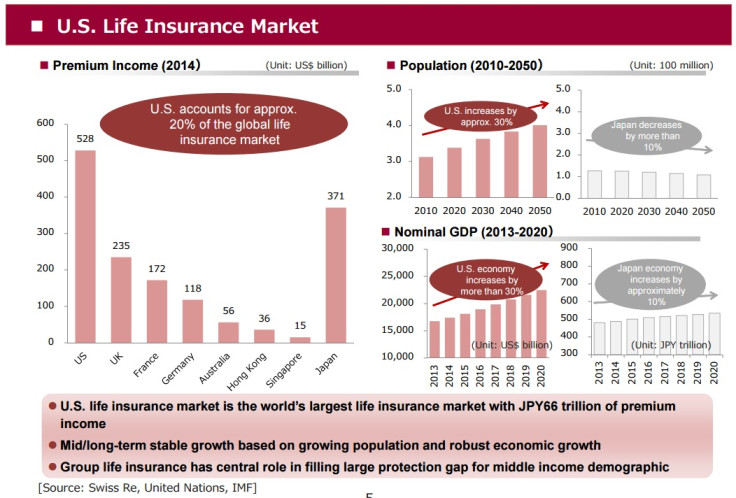

The company entered the US market in 1976 to become the first Japanese life insurer to start operations in the world's largest insurance market, with ¥66tn of premium income.

It added that the combination with StanCorp, which has 6.1 million customers in 50 US states, would significantly expand the "scope and quality of the company's offerings in overseas markets" and provide a "strong business foundation" in the US market.

StanCorp has about $2bn in premium revenues and posted a 2014 net profit of $210 million, Meiji Yasuda said in a statement.

The transaction comes as Japanese insurers are looking to expand in overseas markets, with operations in the domestic market deemed less profitable.

In June, Tokio Marine Holdings agreed to buy US specialty insurer HCC Insurance Holdings for $7.5bn in a deal, which is touted as the biggest in 2015 by a Japanese company.

In February, Dai-ichi Life Insurance completed its $5.6bn acquisition of US insurer Protective Life.

Nippon Life Insurance earlier said it would spend up to $12.1bn on domestic and overseas acquisitions over the next 10 years.

© Copyright IBTimes 2025. All rights reserved.