Jeff Bezos-Backed Real Estate Investment Startup Lets You Own Prime US Residential Properties Online with Only $100

Arrived's REITs offer annual dividend yields up to 8.1%

Tangible assets like real estate have been among the top investment choices for the wealthy, given their intrinsic global demand, limited supply, passive income, and non-correlation to stock markets. While investing in real estate isn't a feasible option for most due to the high capital entry barrier, the industry has rapidly transformed in recent years to accommodate more non-accredited investors through investment vehicles like real estate investment trusts (REIT).

REITs are like mutual funds where investors' money is allocated to multiple properties proportionate to the fund structure. Investors benefit from gains via regular rental income and property appreciation. REITs have democratized real estate investing since you can buy a portion of all the properties in a fund for a fraction of the actual property costs. Online real estate investing platforms have witnessed strong momentum over the years driven by millennials, who are increasingly seeking access to US markets online, which wouldn't be possible otherwise.

Bezos' Startup Also Backed By Uber and Salesforce CEO

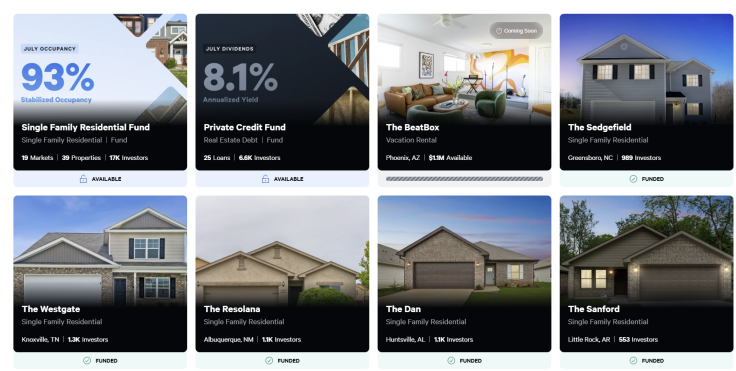

Amazon founder Jeff Bezos heavily invested in the seed and the Series A round of the online real estate investing platform Arrived, which has over $177 million worth of real estate assets under management. The company has received over $40 million in funding since its inception in 2020 and is also backed by Uber CEO Dara Khosrowshahi and Salesforce Co-CEO Marc Benioff. Arrived lets you invest in hundreds of single-family and vacation rentals individually or via a REIT in major US markets for as low as $100. You can buy a portion of a single property or portions of multiple properties via a fund.

There is also an option to invest in high-quality real estate debt via Arrived's private real estate debt fund, a mortgage REIT of 25 loans, currently offering an 8.1% annual dividend yield. You essentially invest in loans that finance real estate projects and receive cash collected as interest payments on the loans. However, the yield may increase in high-interest-rate environments, and risks are low since the loans are secured by the properties. Meanwhile, the single-family residential fund's historical annual dividend yield is 4.03%, amounting to an annual rental income of nearly $1 million across 39 properties worth over $15.6 million. The REIT boasts a stabilized occupancy of 94%.

Investors can create an account, verify documents online, sign deeds electronically, and make payments with a click to begin their real estate investing journey with Arrived. The startup owns, operates, and maintains its properties while finding new tenants for vacant houses, making it more convenient for investors looking to own real estate without the hassles of being a landlord.

Why Trust Property Listings on Arrived?

The platform has over 670,000 registered users and has paid back almost $7 million in dividends since 2020. Arrived claims that only 0.2% of analyzed properties are listed on their platform due to the stringent vetting process powered by data science and insights from local real estate agents that help identify single-family rentals in vibrant markets with long-term growth potential.

Arrived's investment committee, with decades of industry experience, subjects the shortlisted properties to further checks and verifications before approving them for listing on the platform for investors. The company's acquisition approach considers market scalability, infrastructure, job opportunities, and competitive landscapes to narrow down on properties with strong appreciation potential. They also focus on value creation by continuously exploring ways to improve property management and tenant relationships.

Furthermore, bundling several properties in a fund structure enables Arrived to share costs linked to LLC fees, auditing, taxes, and enhancing unit economics for investors. While real estate is a relatively safe asset, and prices have historically jumped between 5% and 12% yearly, liquidity challenges have always remained. Arrived addresses the bottleneck by allowing you to sell your REIT shares at any time, but there's an exit load fee of up to 2%, depending on when you sell.

Disclaimer: Our digital media content is for informational purposes only and not investment advice. Please conduct your own analysis or seek professional advice before investing. Remember, investments are subject to market risks and past performance doesn't indicate future returns.

© Copyright IBTimes 2025. All rights reserved.