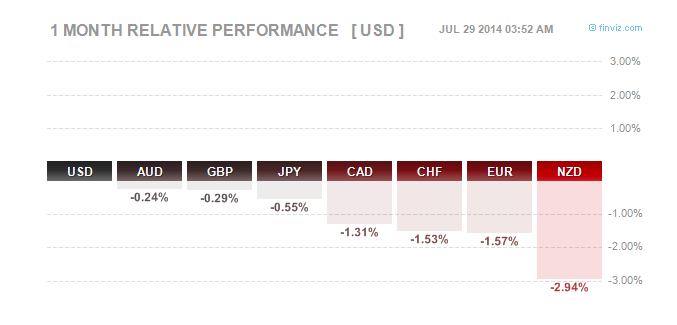

Kiwi Dollar Worst Performer in July, Euro and Swiss Franc Next

After trading near its record high earlier in the month, the New Zealand dollar is on track to become the weakest performer among G10 currencies in July as the central bank on 25 July hinted at a pause in the tightening cycle and increased fears of likely central bank interventions to curb the kiwi dollar rally.

As on 29 July, the NZD is down 2.94% against the greenback in the month while euro and Swiss franc are more than 1.5% lower. The Canadian dollar is 1.3% down, the yen is 0.55% down and the British pound and the Australian dollar are down 0.29% and 0.24% respectively.

"With the exchange rate yet to adjust to weakening commodity prices, the level of the New Zealand dollar is unjustified and unsustainable and there is potential for a significant fall," the Reserve Bank of New Zealand said after hiking the main rate to a four and a half-year high of 3.5% on 25 July.

The Kiwi dollar has lost more than 2.2% since the policy decision.

The common currency has been on a weakening trend since May and at the near eight-month low of 1.3430, EUR/USD is down more than 3% since end-April.

The Swiss currency has lost ground of late after the June trade surplus came far below expectations as per the data on 22 July.

Data from Australia and the UK too weren't strong enough to reverse the impact of a broadly stronger dollar, talked up by the Federal Reserve at the Senate testimony of Yellen.

NZD/USD Technical Outlook

The recent fall in the pair has broken below the 23.6% Fibonacci retracement of the year long rally through June and the next downside target is the 38.2% level of 0.8400.

A break of that is necessary to weaken the uptrend since June 2013 and the next support line will be 0.8260, the 50% line, ahead of the 0.8130-0.8050 region, underpinned by the 61.8% level.

On the higher side, NZD/USD will look at 0.8650 and 0.8720 ahead of a retest of the 10 July peak of 0.8838.

© Copyright IBTimes 2025. All rights reserved.