JPMorgan 'London Whale' Loss Reveals a Banking System of Encouraging People to Do 'Bad Things'

The two former JPMorgan traders charged by US authorities for their role is allegedly covering up the bank's $6.2bn in legal losses, generated by the 'London Whale' Bruno Iksil, show that this was "not just the work of one deluded or evil individual."

According to the Cass Business School Professor of Organisational Behaviour, Andre Spicer, the court filings should remind the public that the giant legal losses were borne out of a banking culture that pressurises staff to deliver high returns and take more risks.

"[The London Whale losses] was not just the work of one deluded or evil individual. It was the work of a series of people all trying to deliver their numbers, preserve their power base and protect their reputation," said Spicer.

"The documents filed in New York allege that blame lays with two managers of the rogue trader who were trying to cover up irregularities in their division and hit their quarterly objectives.

"They also point to control systems that were 'neither independent nor rigorous'. But beyond this, there appeared to be a wider culture within the bank that required employees to hit profit targets, no matter how they did it. This meant that looking good on paper became more important than doing good in practice."

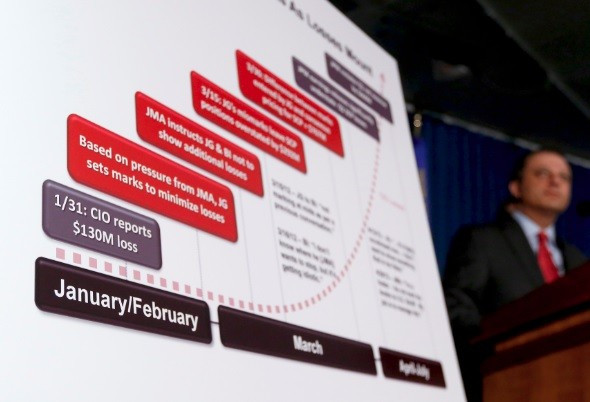

Martin-Artajo, who headed up the JPM team that made a series of catastrophic trades resulting in a $6.2bn (£4bn, €4.7bn) loss for the bank, and Grout, who was tasked with recording and distributing daily values on the team's positions, have been charged with four counts, including wire fraud, falsifying books and records, making false filings with a US regulator, and conspiracy.

"The Whole System Encourages Good People to Do Bad Things"

In May 2012, Iksil, nicknamed the "London Whale" for his preference for huge trades, and his colleagues at the London unit of JPM's CIO lost billions of dollars through legal bad bets in a portfolio that was specifically designed to hedge the bank's risk exposure.

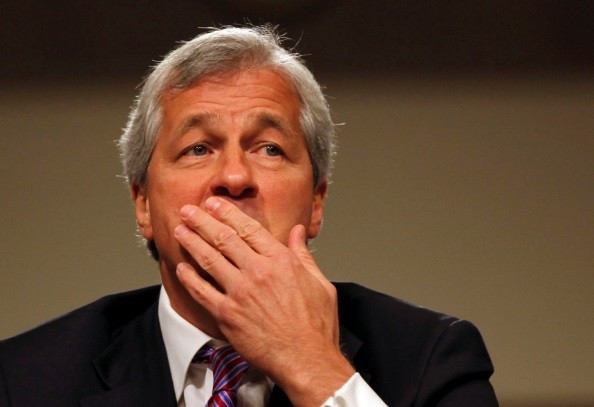

This prompted an investigation by several US authorities and Dimon explained to the US senate why he didn't ensure that the CIO's risk managers adequately kept pace with the nature of the unit's business.

Reports surfaced on Thursday that two former members of JPMorgan chief Jamie Dimon's inner circle, Ina Drew and Achilles Marcis, are likely to avoid criminal charges related to event, as well as Iksil himself.

However, while the JPM losses were legal, the bank's chief executive Jamie Dimon has admitted that CIO's strategy was "flawed, complex, poorly reviewed, poorly executed and poorly monitored."

"These revelations are part of a longer string of rogue trading scandals which have revealed the fault often laid not at the feet of a single bad individual, but a whole system which could encourage otherwise good people to do bad things," said Spicer.

"The broader culture and system that each rogue trader worked required constant delivery on tough targets, encouraged extreme risk taking, and provided few meaningful circuit breakers which allowed people to question activities.

"Also the complexities of modern banking make it possible for these trades to be covered up until it is too late."

Overhauling the Risk Management Process

JPM has since drafted in Michael Cavanagh to replace Drew, who stepped down after the London Whale losses were confirmed, to strengthen its risk management profile. It has also hired a new chief risk officer and has pledged to overhaul its risk management process.

"Ensuring this kind of rogue trading does not happen in the future will be difficult. As history has repeatedly shown, where there is a market, there is also likely to be a rogue," said Spicer.

"However, the big institutions can take some steps. They are already strengthening their risk and compliance departments. They can also begin to foster a culture that encourages responsibility and safety over extreme risk taking.

"They also might reconsider the ever-escalating numerical targets people are managed by. They need human resources systems which ensures staff are rewarded for rigor as well as riskiness and staff are not strung out and operating on only a few hours sleep.

"We know this leads to flawed decision-making and potentially fatal mistakes. Finally it is vital banks put in place circuit breakers such as no fault reporting policies. These are the kinds of measures that have been in place in other industries for years."

© Copyright IBTimes 2025. All rights reserved.