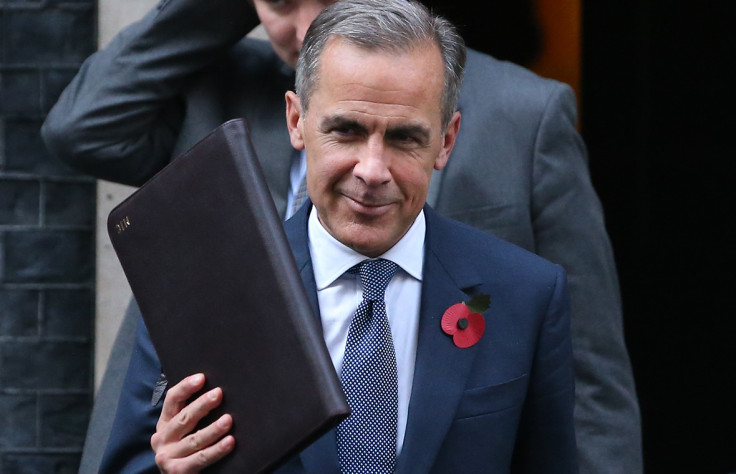

Mark Carney's decision to leave Bank of England before 2021 met by mixed response

BoE Governor will step down in 2019 but analysts are divided over the wisdom of his decision.

Mark Carney's decision to step down from his role as the Governor of the Bank of England two years before the end of his eight-year mandate has been met with mixed reactions by the City of London.

On Monday (31 October), Carney put an end weeks of speculations over his future by revealing he will stay on in his role for an additional year in order to deal with the post-Brexit fallout, but not serve a full second term until 2021. In a letter to Chancellor Philip Hammond, the BoE governor said he will extend his term in office until 2019 to help secure an "orderly transition" while Britain negotiates leaving the EU.

"It is an honour and a privilege to serve in this important role," he wrote. "I deeply appreciate your support, that of the Prime Minister, and that of colleagues at the Bank, and I look forward to continuing to promote the good of the people of the United Kingdom during this crucial time for the country."

The announcement arrived following a meeting between Carney and Prime Minister Theresa May at 10 Downing Street over concerns about his impartiality after predicting "doom and gloom" for the UK's economy following the EU Referendum result.

In August, the Bank predicted growth of just 0.1% in the third quarter of 2016 – which takes in the months following the result of the historic 23 June referendum. However, earlier this month, official figures showed the economy grew by 0.5% in the three months since Britain voted to leave the EU.

Hammond, who had publicly expressed hopes the 51-year-old Canadian would remain in charge until 2021, said he was "pleased" by Carney's decision, while a spokeswoman for Theresa May said the PM believed the BoE Governor would provide stability and continuity during Britain's Brexit negotiations.

However, Andrew Tyrie, the chair of the Treasury select committee, was unimpressed by Carney's choice to step down in 2019, adding he would question him at the next committee's meeting. Toscafund's chief economist Savvas Savouri, meanwhile, suggested Carney was at least partly responsible for the pound's collapse in the aftermath of the Brexit vote.

"I'm amazed by the deification of this man," he said. "Every time Carney opened his mouth in the days and weeks after the referendum, the pound weakened."

In a column for IBTimes UK, Conservative MEP and Brexit supporter Daniel Hannan said on Monday that Carney should step down from his role. He wrote: "Carney's immediate reaction to the referendum result – a further spurt of quantitative easing and another cut in interest rates – seems inappropriate, and probably served to undermine rather than boost confidence."

Meanwhile, Ben Habib, chief executive of fund manager First Property Group, launched a scathing attack on Carney, claiming the Governor should have resigned much earlier on ground of incompetence.

"Carney should have resigned early because he is simply not competent," Habib said, adding his decision to implement a new round of quantitative easing was based on forecast which turned out to be wrong. "His remaining as Governor of the BoE during the Brexit process is going to materially add to the challenges faced by the Prime Minister."

Other analysts, however, met Carney's decision with approval, although they expressed regret that the Governor will not stay on for the full-year term as former Chancellor George Osborne had hoped.

Howard Archer, chief UK and European economist at IHS, said that any extension to Carney's tenure was to be welcomed as the UK economy, despite its current resilience, faced a prolonged very challenging period ahead. He added that any extra instability stemming from Carney going in 2018 would have been highly unwelcome as the government negotiates its exit process from the 28-country bloc.

"Despite the criticism of his stance in the run-up to the EU referendum from many Brexiteers, we believe that Carney was justified in warning of the potential risks to the UK economy and the risks to financial stability," Archer added. "If he had not done so, he could equally have been criticised by the Remain camp for not doing his job and highlighting risks."

Institute of Directors' economist Michael Martins said Carney's move sent "an important signal" to the rest of the world, highlighting the BoE remained an independent policy-making pillar of the UK's business climate.

"It is a relief that the Governor has decided to leave on his own terms and has elected to extend his stay in order to see the UK through the potentially choppy waters of its negotiation with and withdrawal from the EU," he told IBTimes UK.

"Carney proved a steady hand in the immediate days and weeks after the referendum vote and his leadership through these unprecedented times will likely be a key asset for the UK's economy during the remainder of his tenure."

Carney's decision to stay an extra year as the governor of the Bank of England is good news for the UK, according to Labour. "The prime minister clearly recognises the Bank had a plan for the aftermath of the Brexit vote when the government didn't," Jonathan Reynolds MP told IBTimes UK last night.

Meanwhile, Jayne-Anne Gadhia, chief executive of Virgin Money, urged politicians to allow the Governor to get on with his job. "When you take on a big role like that you have to be a public figure and expect to have public comment," she said. "I don't criticise people for making the comments they have made. I do think now he is here we should let him get on with his job. Hopefully that will add to the stability of the country."

© Copyright IBTimes 2025. All rights reserved.