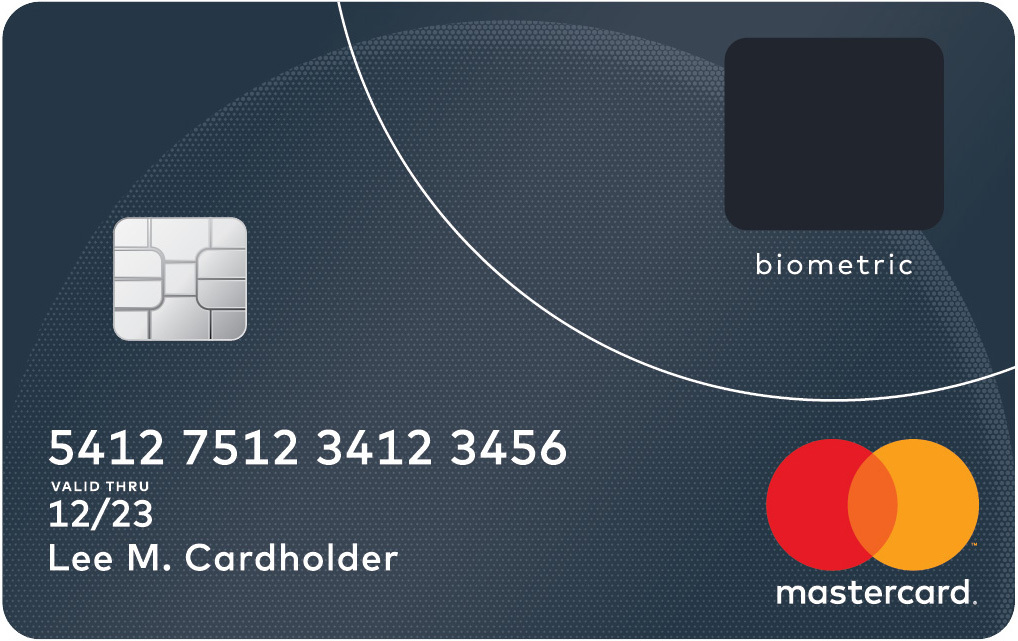

Mastercard reveals safer fingerprint-activated credit card following successful trials

Fingerprints replace PINs on new card that Mastercard plans to roll out later this year.

Credit card provider Mastercard plans to introduce a new payment card activated with a fingerprint rather than a PIN later this year as it continues to trial the new technology in South Africa.

Following two successful trials, Mastercard has revealed the new card format which is safer than existing security methods. Experts have called it a "sensible" use of biometric technology, but it's still not entirely safe.

"All I need is a glass or something you have touched in the past," Karsten Nohl, chief scientist at Berlin's Security Research Labs, told the BBC before adding that fingerprint security is still "better than what we have at the moment".

"With the combination of chip and PIN, the PIN is the weaker element. Using a fingerprint gets rid of that. Fingerprints have helped us avoid using terrible passwords, and even the most gullible person is not going to cut off their finger if [a criminal] asks nicely."

The new cards house the user's biometric data and a small fingerprint scanner in the top right-hand corner, used in tandem with the card's chip when it is inserted into a card machine at the point of sale.

For this reason, it will only be available for in-store transactions rather than online purchases.

To date, an external fingerprint scanner has been required for biometric security with payment cards, which wasn't convenient enough to take off.

Even when Mastercard introduces the card, however, banks will need to sign up to use them before any consumers receive one of their own. If a bank does this, then their customers will have to go to their local branch to scan in their fingerprints and get set up.

© Copyright IBTimes 2025. All rights reserved.