Mears Group to Report FY Earnings In Line With Expectations

Mears Group, a holding company engaged in the provision of a range of outsourced services to the public and private sectors, is delivering a strategy that will join its leadership within the developed markets of social housing and care.

The group leads on quality, innovation and long-term value for money. Its move towards focus on sustainable margins has been ratified from time to time.

The public sector is undergoing important changes and it will continue to support its clients to reach their targets through this difficult period. The group is scheduled to release its preliminary results on Tuesday.

Mears witnesses real opportunities in the next decade. Its housing leadership has never been well-built till now and it has set up what it believes to be the highest quality, most competent national care company in the UK. The developed markets have important opportunities for organic growth and for acquisitions.

In January, the group confirmed in its pre-close trading update that the trading and cash for the FY ended December 31, 2011 were in line with management expectations. Its new contract achievements have boosted the group's order book to £2.8 billion providing forward visibility of consensus forecast revenues of 93 per cent for 2012 and 78 per cent for 2013. Its bid pipeline remains strong at in excess of £3.0 billion with the instant bidding prospect for further agreement due to start over the course of 2012 at £1.1 billion.

Commenting on the group's trading update, Chief Executive David Miles said: "Our social housing division has experienced a particularly strong period in contract tendering, securing new orders to the value of 550 million over the last nine months that has further strengthened our market leading position. The first quarter of 2012 will see the most intense period of new contract mobilisation in our history with five significant new contracts due to start on or around 1 April 2012 with an annual value of 50 million. The care market is going through a period of significant change and I am proud of the robust business we have established. We will continue to be at the forefront of change in the sector in 2012, helped in part by the development and roll-out of our new Care IT system. We will also target further acquisitions to broaden the diversity of Mears' Care offering along the services supply chain and to expand the range of services provided to people in their homes."

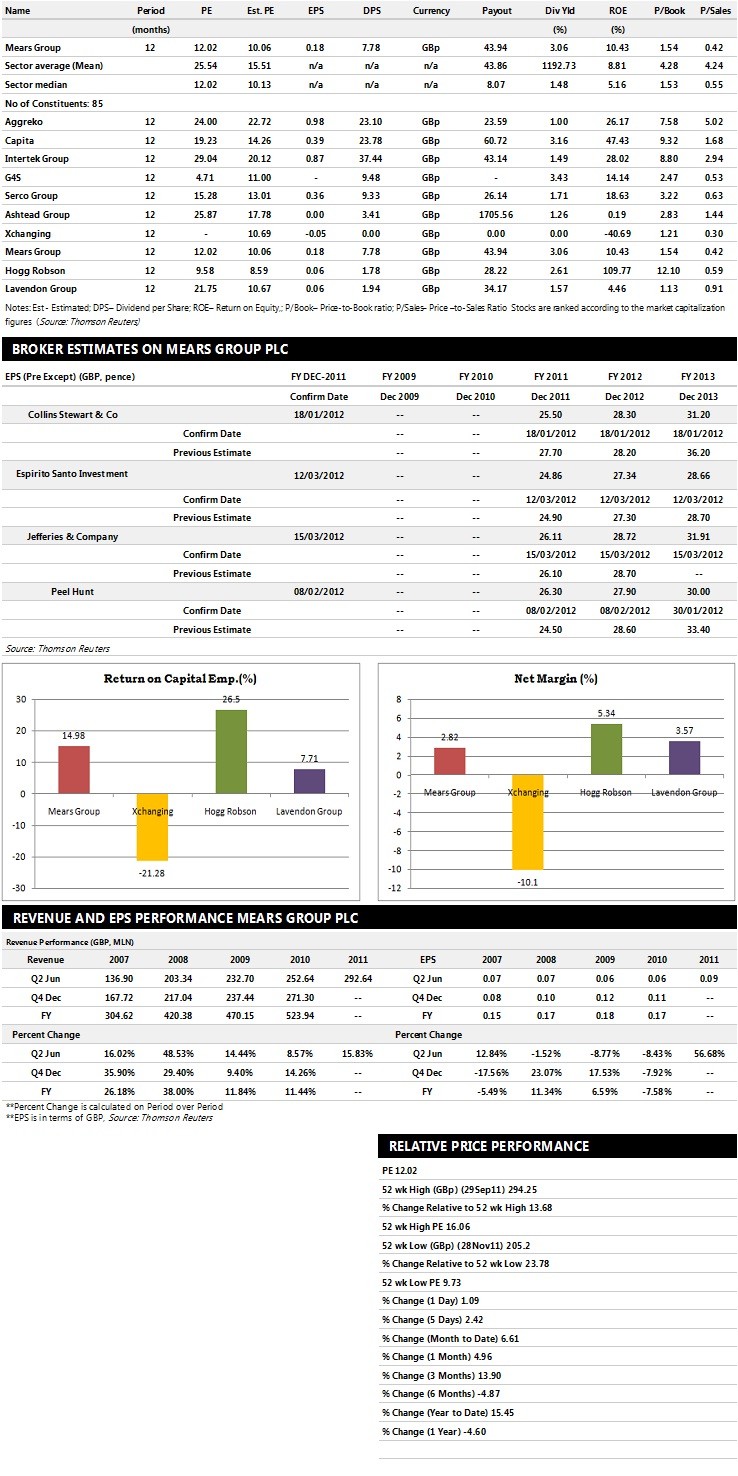

Brokers' Views:

- Jefferies & Co recommends 'Buy' rating on the stock with a target price of 310 pence per share

- Espirito Santo Investment Bank assigns 'Neutral' rating with a target price of 260 pence per share

- Peel Hunt gives 'Buy' rating with a target price of 275 pence per share

- Collins Stewart & Co recommends 'Buy' rating with a target price of 325 pence per share

- Westhouse Securities assigns 'Buy' rating.

Earnings Outlook

- Jefferies & Co estimates the company to report revenues of £618.10 million and £680.30 million for the FY 2011 and FY 2012 respectively with pre-tax profits

(pre-except) of £33.00 million and £36.30 million. Earnings per share are projected at 26.11 pence for FY 2011 and 28.72 pence for FY 2012.

- Espirito Santo Investment Bank projects the company to record revenues of £602.00 million for the FY 2011 and £642.00 million for the FY 2012 with pre-tax profits

(pre-except) of £31.20 million and £34.80 million. Profit per share is estimated at 24.86 pence and 27.34 pence for the same periods.

- Peel Hunt expects Debenhams to earn revenues of £575.10 million for the FY 2011 and £637.10 million for the FY 2012 respectively with pre-tax profits of £31.00 million and £35.00 million. EPS is projected at 26.30 pence for FY 2011 and 27.90 pence for FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.