MPs to examine governance of private companies and their pension funds following BHS collapse

Former BHS owner Philip Green heavily criticised and blamed for collapse of retail chain.

MPs are expected to launch two new investigations that will take a closer look at the regulation of the corporate governance of private companies, following the collapse of high street retailer BHS.

Parliamentarians are also seeking to determine if there should be more proactive regulation of private companies' pension funds. "Some of the failures which allowed this to happen are not unique to BHS. Its lessons merit broader consideration of the framework in which companies operate," the report by the committee says.

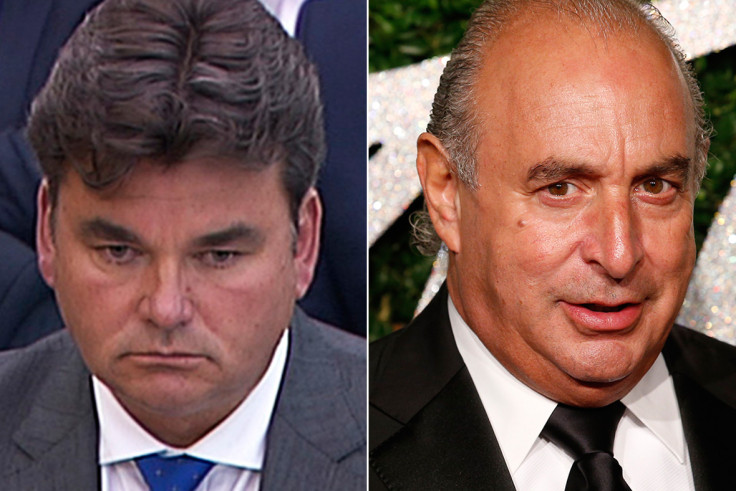

The Work and Pensions Select committee and the Business, Innovation and Skills committee released a report on Monday (25 July) which heavily criticises the former owner of BHS, Sir Philip Green, over the role he played that led to the collapse of the high street chain.

The committees said they would support investigations by the Financial Reporting Council, the Pensions Regulator, the Insolvency Service and the Serious Fraud Office.

It said that the inquiry by the parliamentary committees is only one of a series of probes into the BHS collapse. The Serious Fraud Office is "reviewing material in its possession" while the Insolvency Fraud Office is also carrying out a fast-track inquiry into BHS. The Financial Reporting Council is examining PwC's audit of the chain, reported The Times.

Frank Field, the chair of the work and pensions committee said: "[Green's] reputation of the king of retail lies in the ruins of BHS. His family took out of BHS and Arcadia a fortune beyond the dreams of avarice and he's still to make good his boast of 'fixing' the pension fund. What kind of man is it who can count his fortune in billions but does not know what decent behaviour is?"

The report claims that Green had "systematically extracted hundreds of millions of pounds from BHS, paying very little tax and fantastically enriching himself and his family, leaving the company and its pension fund weakened to the point of the inevitable collapse of both."

It found that Green held prime responsibility for the pensions black hole after years of refusing to provide sufficient funding. All of BHS's remaining stores will close by the end of the August after the store went into administration in April 2016, with a pension deficit of £571m ($750m).

The select committees looked into the sale of BHS by Green to a consortium led by Dominic Chappell for just £1. The high street chain collapsed within 13 months of the sale.

The report urges Green to resolve the pension deficit at BHS by making a "large financial contribution." It said: "He has a moral duty to act, a duty which he acknowledges. We still do not doubt that Sir Philip has heartfelt affection for BHS. To an extent it created him; it could also bring him down."

Despite Green's claims that he had put in £421m ($553m) into the group while he was in charge of the retailer, MPs blamed the failure of BHS on a "series of bad business decisions and personal greed." The report said: "Sir Philip Green, Dominic Chappell and the respective directors, advisers and hangers-on who all got rich or richer are all culpable, with the only losers the ordinary employees and pensioners."

The report also slammed Chappell, who they said had not put money into the retailer and yet "had his hands in the till." It says the former racing driver had personally taken $4.1m from the company in the 13 months he owned BHS, including a £1.5m interest-free loan, which was secured against his father's house.

The Times also notes that Green is believed to currently be on board his 300-ft yacht Lionheart in the Greek Islands. The newspaper said the billionaire and his wife took delivery of the £100m vessel a few months before BHS entered into administration.

© Copyright IBTimes 2025. All rights reserved.