MPs 'Horrified' by HMRC Overriding Magna Carta by Raiding Bank Accounts

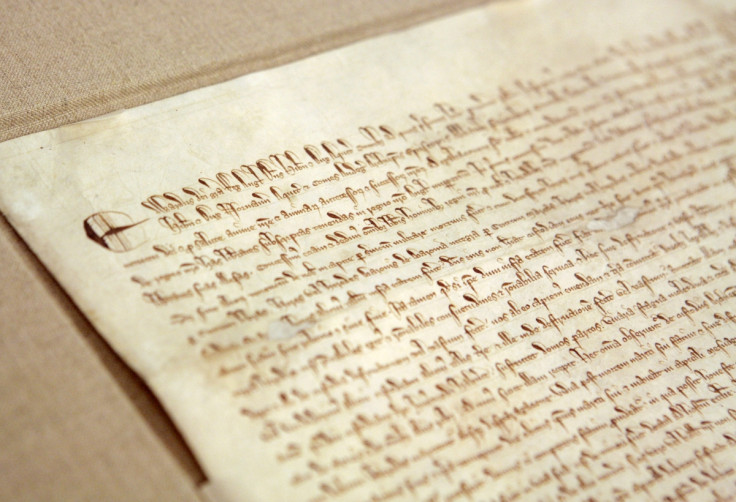

Politicians have slammed HMRC's new proposals which would allow Britain's taxman to take money directly out of bank accounts without a court order - breaching the 800-year-old protection of ordinary people inscribed in the Magna Carta.

During a three hour Treasury Select Committee hearing, MPs said they were "horrified" by proposals allowing HMRC to siphon cash directly out of ordinary Britons' bank accounts, especially given the taxman's history of mistakes.

"We are talking about the ability of one organ of the state to have the unique right to go against the Magna Carta charter and go in and seize - without judicial process or review – a bank account," said John Thurso, Liberal Democrat for Caithness, Sutherland and Easter Ross.

The Magna Carta was originally installed over 800 years ago to protect British citizens from kings looting ordinary people's pockets.

HMRC boss Lin Homer insisted that the move would only hit a few thousand people and would never leave the individual without enough money to live on.

Steve Baker, Tory MP for Wycombe, attacked the proposal by invoking former Prime Minister William Pitt's view that "necessity is the plea for every infringement of human freedom".

HMRC revealed in a consultation document that the process of "direct recovery" would allow it to take money straight out of joint accounts if the holder had failed to act on four formal warnings requiring payment.

It said that if the new law came into force, it would immediately target 17,000 accounts.

People who owe tax authorities £1,000 (€1,223, $1,690) or more could see that money seized directly from their bank accounts. However, this could only happen provided there was £5,000 left in their accounts afterwards.

TSC chairman and Conservative MP, Andrew Tyrie, tried to obtain middle ground and said if the "account raiding" powers were ratified, "prior independent oversight" was needed.

However, HMRC's Homer hit back and said this would "diminish the effect" of the new power in the first place.

"This is not disputed tax, this is tax that is due, that people who are not subject to PAYE are choosing simply not to pay and they are creating an environment within which the normally very low collection cost of tax is made substantially higher by their action, in a way which in the vast majority of cases is wilful," she said.

"I believe that for the taxpayer as a whole, it is right that we have sufficient powers to stop these limited numbers of people avoiding paying tax."

© Copyright IBTimes 2025. All rights reserved.