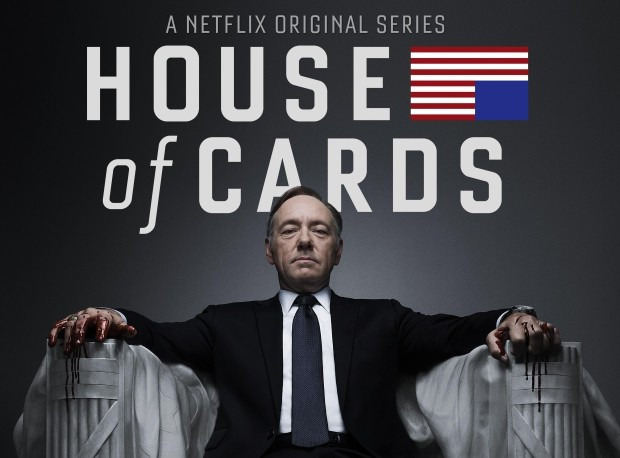

Netflix Moves into TV With Spacey's $100m House of Cards Remake

Video streaming company Netflix has fired the first shot across the bows of the broadcast TV industry with the launch of a $100 million remake of the 1990s BBC drama House of Cards, starring Kevin Spacey

The entire 13-episode series of the Spacey vehicle is available only to Netflix's 30 million subscribers in 40 countries, and represents the company's first attempt to set itself apart in the increasingly crowded "video on demand" marketplace.

"People want the flexibility of being able to watch what they want, when they want, on their choice of device," says Joris Evers of Netflix. "It is a defining moment in the development of internet TV."

The move lays down the gauntlet for US cable channels like HBO and AMC in the race for digital audiences. Those channels have dominated the market in recent years with shows such as The Sopranos, The Wire and Mad Men.

"Our goal is to become HBO faster than HBO can become us," said Evers.

Netflix began as a DVD-by-post business in the late 1990s before switching to video on demand. Around 80 percent of its customer base is in the United States, but its low-cost deals mean it must build a large subscription base internationally.

A year after launching in the UK - where it competes with BSkyB, Amazon's LoveFilm, Tesco's Blinkbox and Apple - it is estimated to have attracted 1.4 million subscribers.

But analysts question whether Netflix has the financial muscle to support its original production levels without raising prices, since users would be able to watch all the House of Cards episodes, but only pay one month's subscription.

"Netflix is showing it is in sync with viewers who are increasingly consuming drama in DVD box sets or via 'all you can eat' on-demand services," Anna Stuart, analyst at Screen Digest, told the Guardian.

"But it is hard to see how this policy would work if Netflix's original programming slate becomes more prolific."

The firm has five more shows in production as part of a $300m original content budget over the next three years, mostly associated with Hollywood names, remakes or revivals including the cult US comedy Arrested Development.

Remakes are also the order of the day at rival Amazon's on-demand service, where a string of "original" productions have been announced from the co-stars of The Big Bang Theory, a director from 30 Rock, and Garry Trudeau, the Doonesbury cartoonist.

However, most of the rights held by Netflix - and many of its online rivals - relate to older TV and film content.

Jeff Henry, head of rival digital service FilmFlex, said original productions were a marketing ploy to attract subscribers.

"It is not surprising that in most cases these original productions come with existing brands," he said. "Most of these TV projects are about marketing, not about large amounts of viewing."

BSkyB, meanwhile, is acting aggressively to protect its hugely profitable subscription TV business.

Last year Sky launched Now TV, an internet service allowing consumers access to content such as Sky Movies for the first time without a TV subscription.

It has now announced it will issue £9.99 "day passes" making its six Sky Sports channels - including live Premier League football action - available via Now TV.

It has also blocked rivals such as Netflix from access to almost all the latest big Hollywood films, tying down deals with the big six US studios, including Warner Bros and Universal.

Sky's deep pockets allow it to spend heavily with an annual £2.3bn budget set aside for content, the lion's share going on sport and film rights, and Sky aims to spend £600m a year on original UK productions alone by 2014.

Sky receives annual revenue of £568 from each customer, compared with Netflix's £5.99 a month.

However, Netflix appears ready for the fight, judging by the tone of its executives.

"Netflix pioneered this. Others are following our lead," said Evers. "We believe we are the best at it and it is our challenge to continue to lead."

© Copyright IBTimes 2025. All rights reserved.