New Zealand Dollar Plummets to New Seven-Month Low Ahead of GDP Data

The New Zealand dollar dropped to a new seven-month low on Friday despite a rebound in the REINZ house price index, as the recent central bank comments on the currency continued to weigh on it.

The NZD/USD plunged to 0.8155 on Friday, its lowest since 4 February, from the previous close of 0.8185.

The Kiwi dollar has fallen more than 2% so far in the week, making it the third worst performer among G10 units after the Australian dollar and the Japanese yen.

At the policy review on 10 September, the Reserve Bank of New Zealand (RBNZ) left the official cash rate unchanged at 3.5% but warned against the strength of the local dollar.

"The exchange rate has yet to adjust materially to the lower commodity prices. Its current level remains unjustified and unsustainable," RBNZ Governor Graeme Wheeler said.

"We expect a further significant depreciation, which should be reinforced as monetary policy in the US begins to normalise."

As per the REINZ data, house prices in New Zealand increased 1.1% month-on-month in August after falling 0.7% in July.

The Business NZ PMI for August, which came on Thursday, had also showed an uptick, to 56.5 from 53.5.

Another release showed food prices in the country increased 0.3% month-on-month, rebounding from the 0.7% fall in the previous month.

Further Rate Hikes And Data

According to the central bank, inflation remains moderate in New Zealand.

"The house price inflation continues to ease, despite strong net immigration. CPI inflation remains moderate, reflecting subdued wage increases, well-anchored inflation expectations, weak global inflation, and the high New Zealand dollar," the RBNZ said.

The central bank sees the likelihood of more rate hikes to accelerate price rises to the targeted level of 2%. But the market has not turned bullish on the Kiwi dollar based on that remark as it awaits more data to confirm that further rate hikes are near.

The RBNZ also seems to be waiting for the recent rate hikes to have their impact before moving again.

"It is expected that the OCR will need to increase towards a more neutral level for annual CPI inflation to settle around the 2% target mid-point and growth to continue at a sustainable pace," the RBNZ said in its policy statement.

"However, with the OCR having increased 100 basis points since the start of this year it is prudent to spend some time assessing how the economy is responding to higher interest rates and the collection of other forces acting on it."

That the central bank has talked about the need to continue the sustainable growth rate before further rate hikes, the 17 September GDP data is going to be especially important.

In the first quarter, New Zealand had grown 3.8% from a year earlier and 1% sequentially. The second quarter numbers on next Wednesday will likely arrest the fall of the Kiwi dollar, if they manage to surprise the market on the higher side.

NZD/USD Technical Analysis

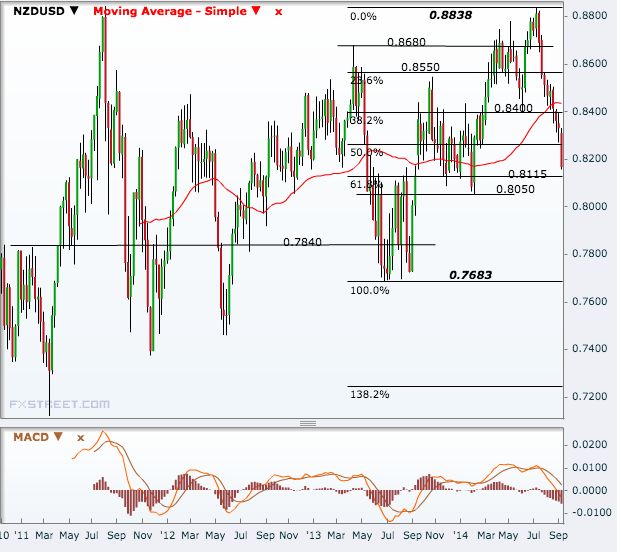

The NZD/USD has dropped below the 50% Fibonacci retracement of the June 2013-July 2014 rally this week and the next downside target is the 61.8% level at 0.8115.

Further south, the pair will aim 0.8050, which seems to be a stronger support. A break of that will straight away open doors to 0.7683, the 2013 low, but 0.7840 may be a level to watch ahead of that.

On the higher side, the 50% level at 0.8310, which was also last week's low, has turned the first resistance line ahead of the 38.2% line of 0.8400.

A break of that will lead the pair to 0.8550, the 23.6% line, 0.8680 ahead of a retest of the July peak of 0.8838.

However, with the MACD well below zero, the bias is more towards the downside.

© Copyright IBTimes 2025. All rights reserved.