NEXT on Cautious Edge, Expects Recovery in Q2

NEXT PLC, the Britain's second-largest clothing retailer expects to deliver its FY2011 earnings in line with the previous guidance on Thursday with an approximate increase of 4 percent in its profit before tax between the range of £558-572 million.

The group narrowed its guidance range to £7 million on either side of £565 million with the financial objective to deliver sustainable long term growth in earnings per share and would be further enhanced through cash generation and share buybacks.

For the first half of 2011, NEXT reported an increase of 3.6 percent in revenues at £1,565 million with profit before tax up 8.5 percent to £228 million. Earnings per share rose by 18.6 percent to 98.3 pence compared to 82.9 pence during the same period a year ago.

"Although margin and cost management means hitting FY consensus, trading over the peak period appears to have been weaker than feared in Retail. Coupled with concerns about employment and nervousness about the Eurozone, this has led management to issue cautious guidance for Jan'13 which may lead to downgrades of circa 3 percent," said Singer Capital Management in a note while commenting on the latest trading update.

Analysts at Numis Securities cut their 2012-13 profit forecast by 3 percent to £574 million.

While Atif Latif, Director at Guardian Stockbrokers said: "Although the headline numbers are better than expectation the forward looking forecast looks increasingly delicate and difficult. The UK consumer has had a tough year and this has resulted in weak numbers on the high street."

According to NEXT, it seems likely that other inflationary pressures will begin to moderate in the first half of this year. If the current VAT increase annualises in January, if commodity prices rise no further, many essential commodities will progressively annualise during the course of the first half. Importantly, employment numbers are also holding steady. If this trend continues then consumer finances should be in better shape during the year 2012, says the group.

However, it is not expecting a consumer boom in 2012, nor has it factored in any shocks from weakening in European sovereign finances. Any recovery in spending is likely to be slow and take a long time, but it seems reasonable to believe that by the second quarter of this year the group will begin to see some recovery in the consumer environment. The board anticipates that NEXT will generate £200 million of surplus cash after capital investment, tax and dividends which it intends to return to shareholders through share buybacks.

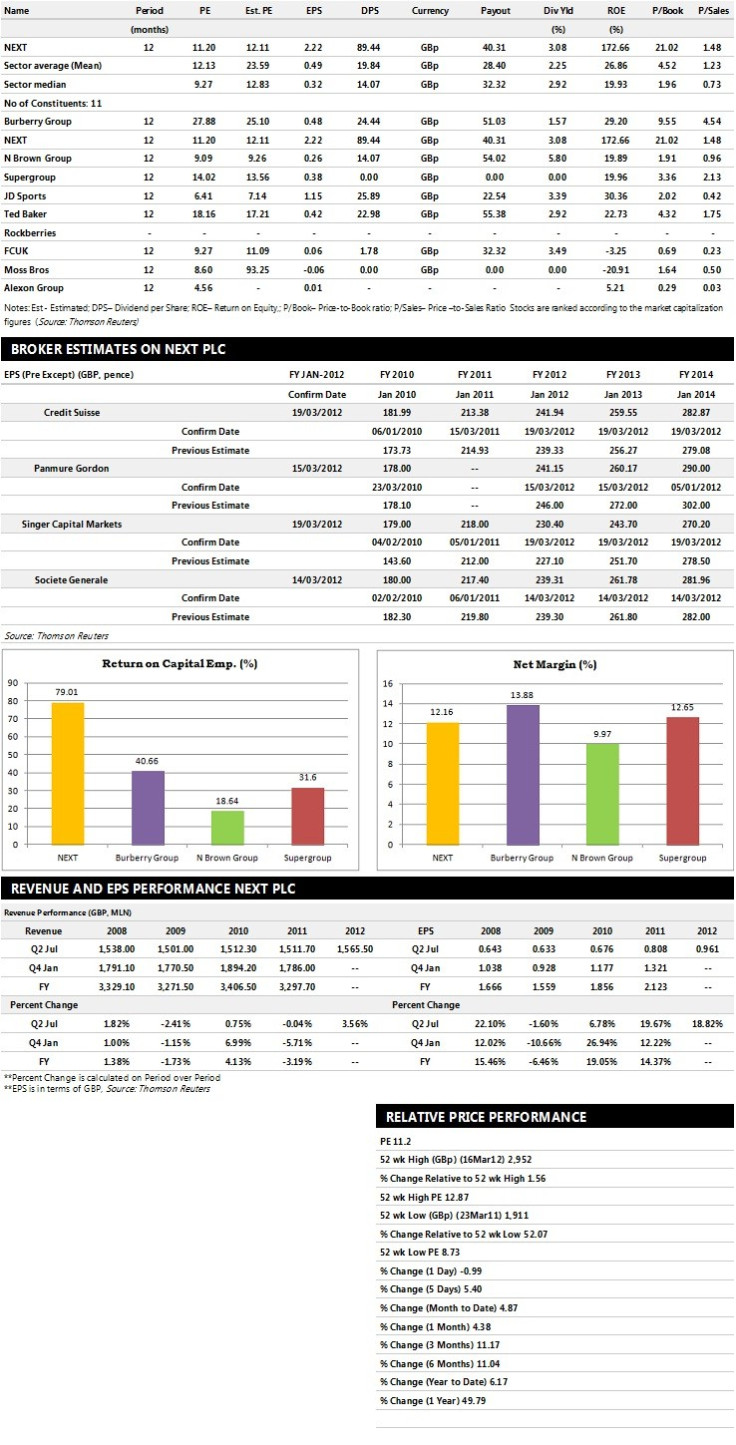

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

Brokers' Views:

- Singer Capital Markets recommends 'Hold' rating on the stock

- Credit Suisse assigns 'Outperform' rating with a target price of 3000 pence per share

- Panmure Gordon gives 'Buy' rating with a target price of 3135 pence per share

- Charles Stanley assigns 'Outperform' rating

Earnings Outlook:

- Singer Capital Markets estimates the company to report revenues of £3,474 million and £3,490 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £558 million and £568 million. Earnings per share are projected at 230.40 pence for FY 2012 and 243.70 pence for FY 2013.

- Credit Suisse projects the company to record revenues of £3,408 million for the FY 2012 and £3,493 million for the FY 2013 respectively with pre-tax profits (pre-except) of £564 million and £593 million. Profit per share is estimated at 241.94 pence and 259.55 pence for the same periods.

- Panmure Gordon expects NEXT to earn revenues of £3,412 million for the FY 2012 and £3,458 million for the FY 2013 respectively with pre-tax profits of £573 million and £593 million. EPS is projected at 241.15 pence for FY 2012 and 260.17 pence for FY 2013.

© Copyright IBTimes 2025. All rights reserved.