Oil recovers from sell-off as Saudi energy minister hints at extending output cuts

Market chatter on fresh Saudi-Russia pact stems oil price decline as threat from rising US shale production rises.

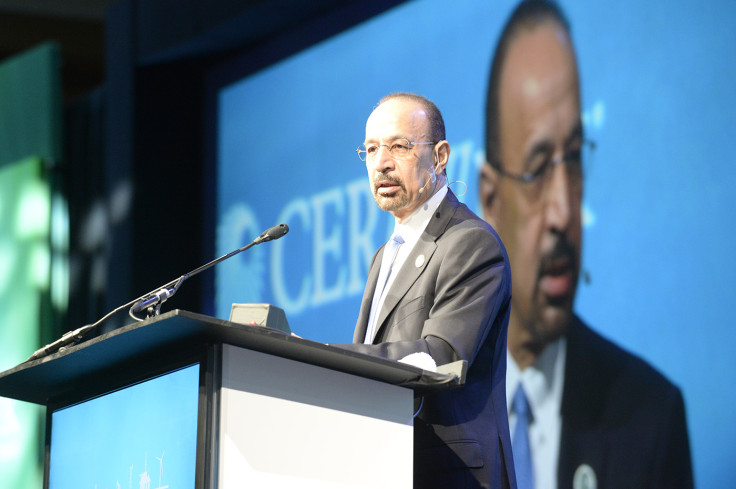

Oil futures stabilised on Thursday (20 April) after Saudi Arabia's energy minister Khalid Al-Falih hinted that a deal aimed at extending output cuts beyond June might be on the horizon.

Following heavy overnight declines, the Brent front month futures contract was up 0.13% or 7 cents to $53.01 per barrel as of 5.25pm BST, while the WTI was broadly flat at $50.42 per barrel.

Speaking at a conference in the Middle East, Falih said: "The consensus is building [on extending output cuts] but it's not done yet."

Earlier in the trading, session Kuwait's oil minister Essam al-Marzouq told Reuters he expected the agreement to be extended. "Russia is on board preliminarily and compliance from Moscow is very good."

The historic Opec and non-Opec output reduction pact – the first of its kind for 15 years – was inked by both sets of producers in December 2016.

It was designed to take almost 1.8m barrels per day (bpd) of crude oil production from Opec and 11 non-Opec producers offline and is due to expire towards the end of June.

FXTM research analyst Lukman Otunuga said some losses were clawed back during early trading, as investors attempted to look beyond the oversupply dilemma and focus on the slight drop in US crude inventories.

"However, the bias remains tilted to the downside. Although Opec remains optimistic that production cuts with non-members may lift oil prices, the resurgence of US shale continues to sabotage the cartel's efforts to stabilise the saturated markets."

Away from the oil market, gold mounted a muted recovery following a torrid session overnight. At 6.09pm BST, the Comex gold futures contract for June delivery was broadly flat at $1,282.90 an ounce, while spot gold was trading at $1,281.32 an ounce, up 0.09% or $1.11.

Elsewhere in the precious metals market, Comex silver was down 1.03% or 19 cents to $17.98 an ounce, while spot platinum was 1.17% or $11.30 higher at $978.75 an ounce.

© Copyright IBTimes 2025. All rights reserved.