Panama Papers: Fallout hits Strauss-Kahn while Ukraine's Poroshenko denies wrongdoing

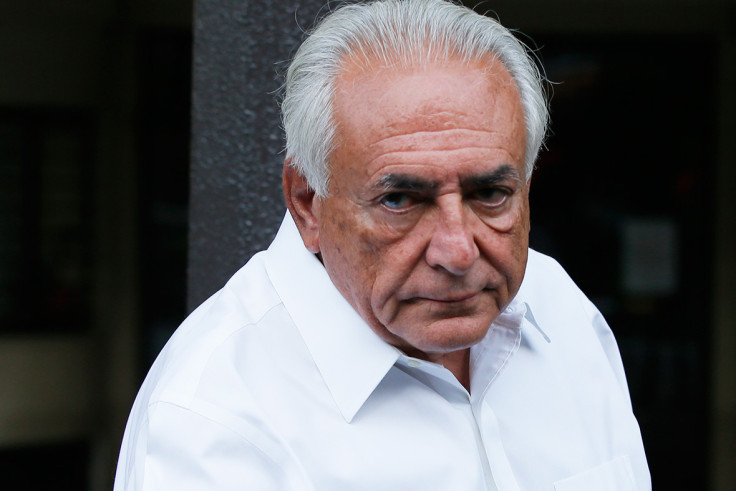

The fallout from the Panama Papers leak continued on 6 April with new names under the spotlight and denials of wrongdoing. The disgraced former head of the International Monetary Fund (IMF) Dominique Strauss-Kahn was thrown into the grinder as it was revealed his Luxembourg-based investment company helped dozens of clients set up shell companies in tax havens.

Le Monde newspaper, part of a coalition of more than 100 world media outlets with access to 11.5 million documents leaked from Panamanian law firm Mossack Fonseca, reported that Leyne Strauss-Kahn & Partners created 31 companies registered in the Seychelles, the British Virgin Islands (BVI), Hong Kong and Panama for its clients in recent years.

The companies were then used to open bank accounts in Switzerland, Luxembourg and elsewhere with the primary aim of dissimulating the real owners' identity. Strauss-Kahn, a former French presidential hopeful had in 2013 testified against the "opaque" offshore system that "deprives the state of tax revenue" before a senate committee in Paris.

A spokesperson for the man who resigned from the IMF over a sex-scandal told Le Monde that as chairman of the financial services firm he was "not involved in the daily management of the fund" and "was not aware of LSK offshore activities".

Meanwhile, Ukraine's President Petro Poroshenko defended the creation of a holding company for his candy business as war raged in the east of the country as an "absolutely normal procedure". Poroshenko denied the move was aimed at avoiding taxes saying it was instead necessary to put his assets into a blind trust after becoming president in 2014.

"If we have anything to be investigated, I am happy to do that," he told a news conference. "But, this is absolutely transparent from the very beginning. No hidden account, no associated management, no nothing."

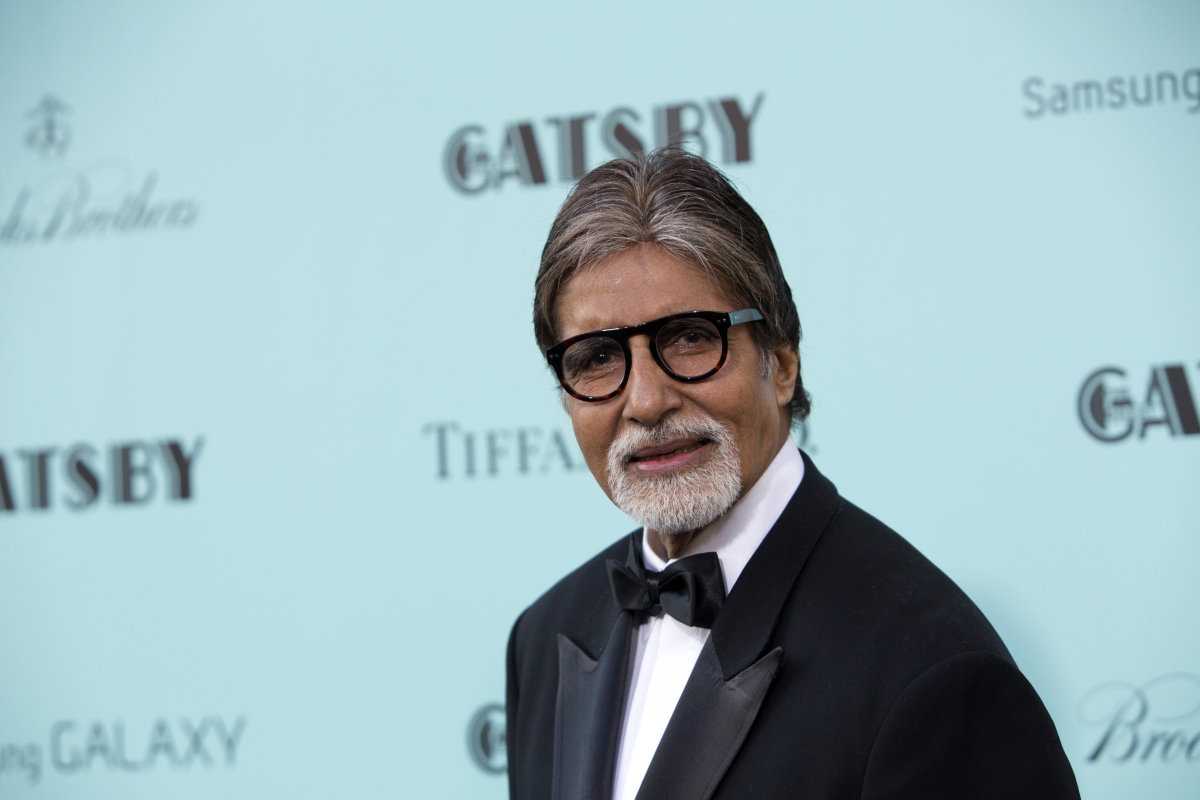

Similarly, Bollywood star Amitabh Bachchan also spoke out against accusations which appeared in the Indian Express alleging links to four offshore shipping companies, claiming he knew nothing about them and that his name had been possibly fraudulently used.

"I have paid all my taxes including on monies spent by me overseas. Monies that I have remitted overseas have been in compliance with law, including remittances through LRS (Liberalised Remittance Scheme) after paying Indian taxes," he wrote in a statement posted on Twitter. "In any event the news report in the Indian Express doesn't even suggest any illegality on my part."

On 5 April Icelandic Prime Minister Sigmundur Gunnlaugsson became the first head of state to resign over the massive data leak that revealed how the world's rich and powerful stash wealth away in offshore tax havens.

Records from Mossack Fonseca also confirmed London was the prime destination of choice for millionaires and heads of state investing anonymously in the real estate market.

Among individuals who purchased properties worth a total of hundreds of millions of pounds in the British capital through offshore vehicles are the son of the former Egyptian president Hosni Mubarak, Alaa; Kojo Annan, son of the ex-UN secretary-general; United Arab Emirates president Sheikh Khalifa bin Zayed al-Nahyan; president of the Nigerian senate, Bukola Saraki, who is facing corruption charges at home; Three children of Pakistani prime minister Nawaz Sharif; and a fixer for Syrian dictator Bashar al-Assad.

Separately, Ramon Fonseca, one of the founders of the firm at the heart of the scandal said the company had lodged a criminal complaint against outside hackers that broke into its data system. Fonseca said the leak was the fruit of crime and not an inside job. "Nobody is talking of the hack, and that is the only crime that has been committed," he told AFP. "We have lodged a complaint. We have a technical report that we were hacked by servers abroad".

The firm denies any wrongdoing. Holding offshore companies and accounts is not inherently illegal but they can be used to hide assets from the taxman or launder money from illicit sources.

© Copyright IBTimes 2025. All rights reserved.