Pension freedoms: Five biggest risks to taking out your savings early

Over 450,000 people have taken cash out of their private pensions since the rules were introduced in 2015.

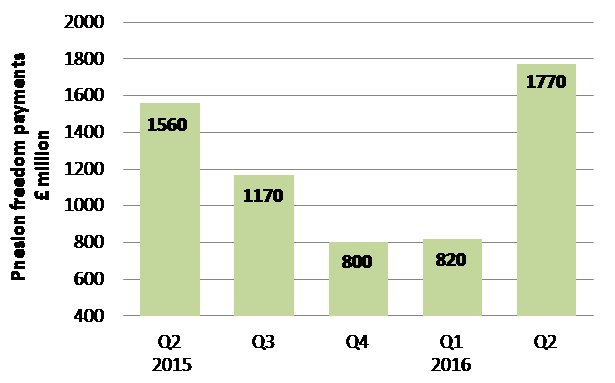

The pension freedoms' rules brought in by the government in April 2015 have proved very popular with the over-55s. So far, 465,000 individuals have taken advantage of these new rules to take out cash lump sums from their private pensions, with a total of over £6bn cashed in so far (Chart 1).

That is an average lump sum of over £13,000 withdrawn from pensions each time, of which 25% is generally tax-free.

While this may sound very tempting to those over-55 and with private pension pots, there are a number of risks to be aware of before going ahead and raiding the pension piggy bank.

Five risks with pension freedoms

Thanks to the pension freedoms' rules, there are now lots of options available to pension holders. Probably, if anything, far too many.

These include, but are not limited to, keeping the pension fund invested, cashing in or swapping the pension pot for a guaranteed income for the retirement period.

So what are the five risks a prospective pension freedomer should wary of?

1. Not taking professional advice, and not shopping around

Recent research from Citizens Advice has found that seven in 10 people that have accessed their pension since the freedoms were introduced did not shop around for different products. This suggests that they did not take any independent advice from a specialist.

But for an issue as complex as pensions, this is one area of finance where I would really implore people to seek professional advice.

The government offer information on private pensions via their Pension Wise service, with information online and also offering free appointments over the phone or face to face to discuss the various options available to the over-55s.

For further advice, there are financial advisers who can go into more detail and provide a wider range of options – these can be found via the unbiased.co.uk website.

2. Not properly estimating your private income in retirement

This is a very difficult subject, as it implies that we need to have an idea of how many years we expect to live in retirement.

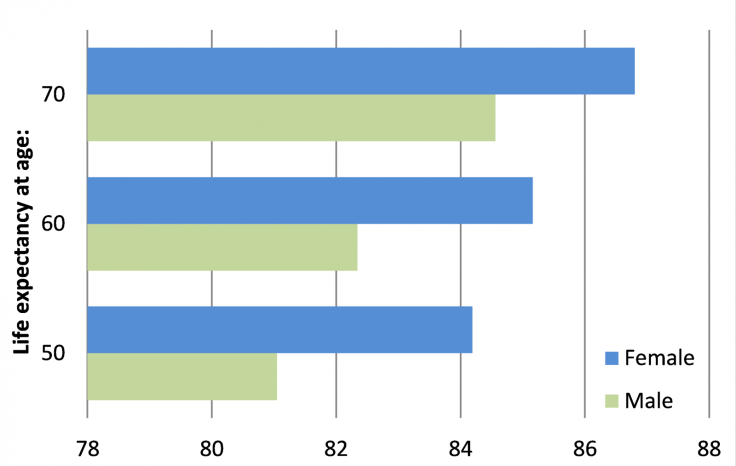

At age 55 in the UK, a man can expect to live to nearly 82 and a woman to nearly 85 (Chart 2). So if you were thinking of retiring at 55 once you can access your private pension, think about the fact that on average, you will need to fund 27 years of retirement for a man, and an even longer 30 years for a woman.

You should also bear in mind that the age at which you can claim a state pension has now been raised to 67 years for most people (apart from those already very close to the current state retirement age).

It may also mean that it is not a good idea to take a lump sum out before 67 to spend on a new car, holiday or home improvements, as it could instead be used to provide a steady income until the state pension kicks in.

3. Assuming that you will get the maximum state pension per week

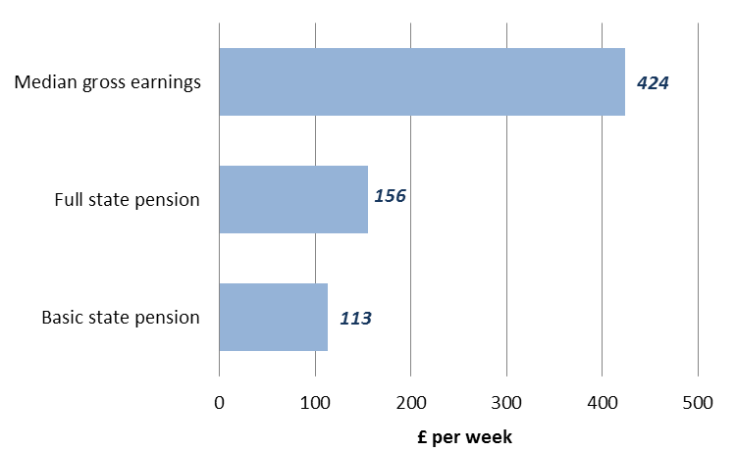

The state pension has changed recently. The maximum amount that a single person can receive is now £155.65 per week, on the basis of paying in 30 years of National Insurance contributions.

However, many prospective retirees will not receive this amount, or anything like it. Firstly, many people have not paid in 30 years of full-time national insurance contributions.

Secondly, they may at some point have contracted out if their employers ran a contracted-out pension scheme, meaning that over this period they paid lower national insurance contributions. This may mean that the government deducts some money from your state pension.

The difference between the basic state pension (which everyone should receive at 67) and the maximum state pension is significant: £43 per week, or over £2,000 per year (Chart 3).

4. Paying high charges and taxes

Many people accessing their pension, for instance via drawdown (taking a regular annual income while leaving the pension pot invested) are ending up paying high fees to the pension provider, particularly for small pension pots. So this is a key point to check before rushing to cash in any private pensions – how much will my pension provider charge me?

Also, for people taking lump sum payments out of their private pensions, income tax is a big consideration. Any amount over the 25% tax-free portion is counted as income. So if you are still in work, you could end up paying as much as 40% of the cash from your pension in extra income tax! So do your calculations carefully to see if taking a cash lump sum will push you into a higher income tax band.

5. Putting any cash lump sums in low-yielding deposit accounts

There is little point taking a cash lump sum from a pension just to put it in a cash deposit account yielding virtually nothing in interest. But that is exactly what people taking cash lump sums out of their pensions have done.

So before deciding to take a cash lump sum in this way, it pays to decide where you want to put this money. In the end, the best decision might just be to leave it in your pension until you are sure you need the money.

© Copyright IBTimes 2025. All rights reserved.