Precious Metals Headed For Weekly Gains with Palladium Outshining the Rest

The precious metals have been on the rise in line with the major currencies over the past few days as the US dollar has been seeing some correction, of late strengthened by the dovish FOMC minutes.

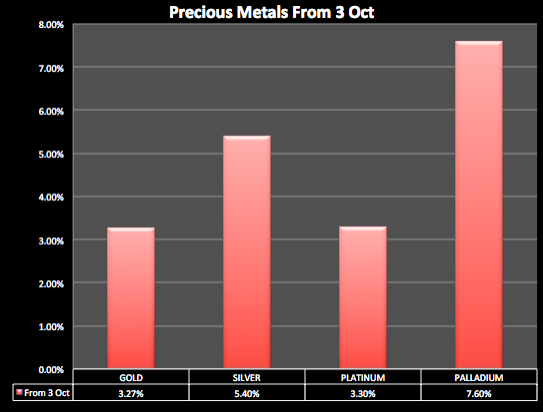

So far this week, gold is 3.2% higher, platinum up 3.3%, silver 5.4% and palladium has strengthened 7.6% - all are trading at two-week highs now.

The rise in the metals marked their move off 8-9 month lows in all but silver, which had touched a four-year low of $16.81 last week.

The US dollar index dropped off reflecting the whole move in the FX as well as metals. It has fallen to a two-week low of 84.93 on Thursday, translating to a 2% drop from the multi-year high of 86.74 touched on 3 October.

The Fed minutes on Wednesday showed that the policymakers were concerned about the aggressive market positioning for a sooner rate hike by the US as they opted to clarify at the last rate setting meeting that policy tightening will be data-dependant.

The central bankers also showed that they are worried about the sharp rally in the US dollar over the last few months as it would affect some sections of the economy. The Fed also said that its current inflation projections are somewhat aggressive.

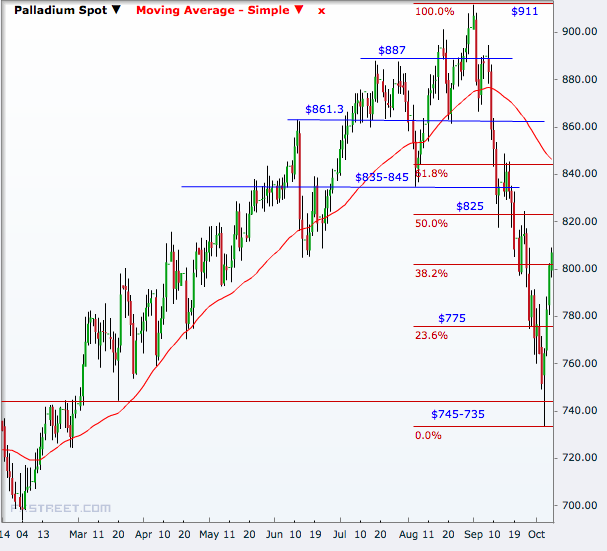

Palladium Technical Analysis

With the rally so far this week, palladium has broken above the 38.2% Fibonacci retracement of the September selloff in the metal.

The next resistance level is the 50% mark of $825, break of which will open doors to the range of $835-845.

A break of that will resume the uptrend since early this year and then target the levels like $861 and $887 ahead of a retest of the early September multi-year high of $911.

On the downside, palladium will test support first at $775, the 23.6% level and then the over seven-month low of $733 touched before this week's rebound.

© Copyright IBTimes 2025. All rights reserved.