Precious Metals Plunge on Dollar Rally, Silver Worst Hit at Four-Year Low

The dollar rally following the Fed's indication of rate hike at the end of 2015 weakened most major currencies against the greenback and the impact on metals too was severe.

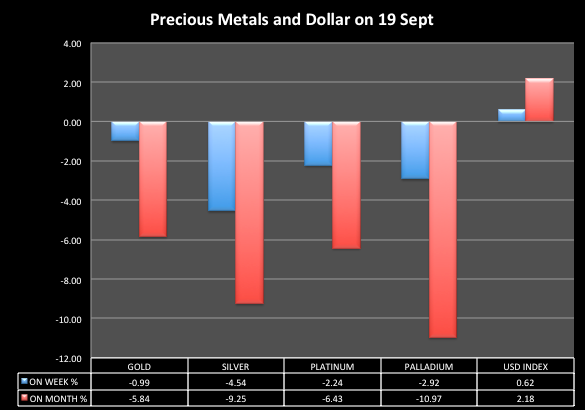

Gold dropped 1% on the week to an eight-month low and platinum more than 2% to a nine-month trough by the end of last week.

Palladium fell nearly 3% in the five days to Friday to a three-month low, making a strong reversal from the more than a decade high it hit recently.

However, the drop in silver was the steepest in the week leading to the break of a key long-term support barrier of the metal. It plummeted 4.5% in the week to 19 September, surpassing the key line of $18.18 to a four-year low of $17.8.

The USD index, the gauge that measures the strength of the greenback against a basket of major currencies, on the other hand, rallied to a more than four year high of 84.8.

On Friday, when the USD index ended its tenth straight week higher, silver ended its tenth straight week of losses. For other metals in the group, it was their third consecutive week of losses.

So far in September, palladium has plunged nearly 11% while silver almost matched it with a 10% drop. Gold and platinum fell 5.8% and 6.4% respectively.

The CFTC data of speculative positioning shows that buy-side speculation has fallen sharply for gold and silver in recent weeks.

By 16 September, gold positions dropped to 72,187 from a high of 147,681 a month ago while silver positions have fallen to 10,912 from 49,278 two months ago, when it started receding.

Silver Technicals

Now that the white metal has broken below a very crucial support line, deeper levels have been exposed. The first one is $17.05 and the next is $16.20.

A break below that region will lower the end of the 50-period simple moving average on a monthly chart which has only got flattened by the recent fall.

That will signal a major bearish signal for silver and open doors to $14.63 and levels below $12.

On the higher side, there seem to be many levels to watch and the first one will be $18.60.

Then come $19.80 and $21.50, a break of which will weaken the downtrend since August last year and open doors to $24.0.

There will still be a lot farther to pass to weaken the big downtrend since 2011 when the white metal touched a record of $49.83.

© Copyright IBTimes 2024. All rights reserved.