Prime London property: 'Brexit has been a trigger to make overdue reductions to asking prices'

Knight Frank says vote 'reinforcing pricing trends' after stamp duty hikes dampened demand.

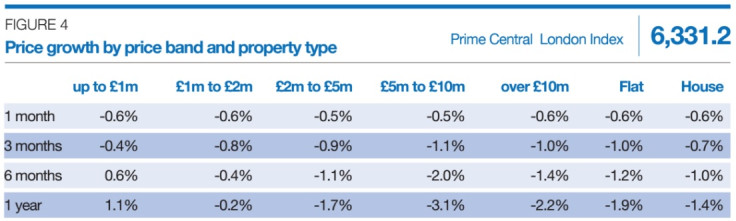

Prices in the prime central London property market fell by 1.5% over the year in July 2016, the month following the EU referendum in which the country voted for Brexit, said the estate agent Knight Frank. The political and economic uncertainty surrounding Brexit appears to have exacerbated an existing decline in activity in the prime central London market, brought about by stamp duty hikes on expensive homes and buy-to-let investors.

The Treasury increased stamp duty on properties worth over £1.1m ($1.46m) at the end of 2014, while cutting it for those valued below.

As of 1 April, 2016, it also put a 3% surcharge on basic stamp duty rates for purchases of additional properties, i.e. those not intended to be the buyer's main residence.

"Early indications suggest the Brexit vote is reinforcing existing pricing trends and viewing the referendum in the context of the preceding two-year period is helpful," said Tom Bill, head of London residential research at Knight Frank.

"In June 2014, annual growth in prime central London was 8.1%, the last peak before a period that saw growth fall steadily to -1.5% in July 2016.

"This slowdown was a natural consequence of strong price rises between 2009 and 2013, however the process was accelerated by two stamp duty increases and a series of other tax measures...

"The result of this two-year slowdown is that vendors had already begun to adapt to the new pricing environment and in many cases Brexit has been a trigger to make overdue reductions to asking prices."

© Copyright IBTimes 2025. All rights reserved.