QinetiQ Group Expects FY Earnings to Exceed Guidance by 20% Despite Unclear Outlook

QinetiQ Group, the provider of technical advice to customers in the global aerospace, defence and security markets, says market uncertainties are making it difficult to visualise outlook beyond the current year. However, the board is confident that the group is able to build significant value over the medium-term.

According to QinetiQ, conditions in US and UK defence markets are expected to remain challenging, hence its priority is to complete two year self-help programme, nesting the improvements already made and continuing to build a robust competitive group with more predictable earnings growth. The group is scheduled to release its pre-close trading update on March 30, 2012.

"Rapid execution of our self-help plan is building a stronger QinetiQ. The group is better focussed on delivering its customers' changing needs, and this is starting to come through in its underlying performance. The board believes that, absence of any material change in customer requirements, the group will exceed its original expectations for the current year by approximately 20 percent, although market uncertainties mean that visibility beyond the current year remains lower than normal. Our confidence in QinetiQ's ability to build significant value over the medium term is demonstrated by the payment of the interim dividend of 0.9p," said CEO Leo Quinn while commenting on outlook for the

group.

QinetiQ reported revenues of £739.6 million for the first half of FY 2011-12, compared to £864.9 million during the same period a year ago. The revenues were down 9 percent on an organic basis at constant currency. The group's underlying profit before tax increased by 45 percent to £74.9 million, with underlying earnings per share up by 42 percent at 9.2 pence.

The group maintains and continues to build a strong existence in the areas like test and evaluation, acquisition support, simulation, cyber security and C4ISR to deliver value by providing trusted and flexible independent expertise, though the group says that the outlook beyond the current year is unchanged.

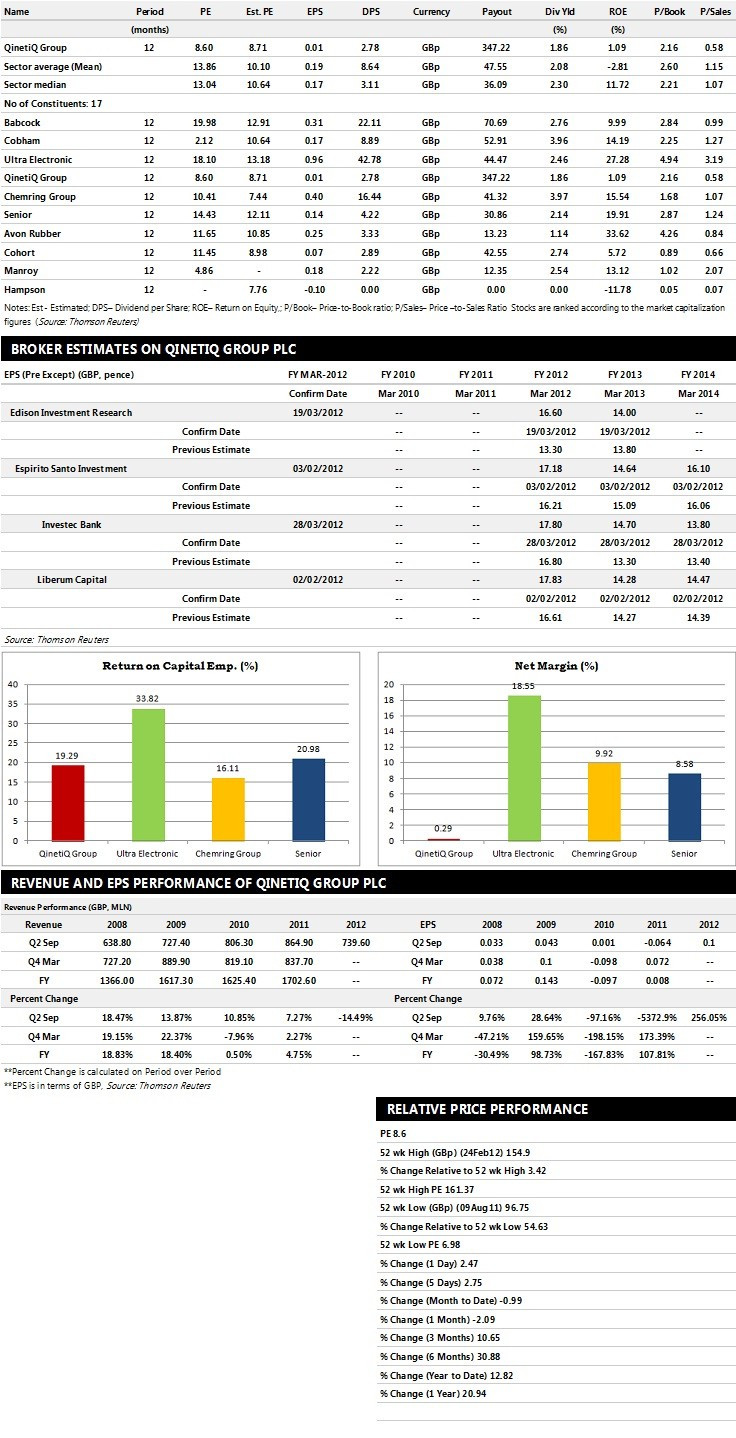

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

Brokers' Views:

- Investec Bank recommends 'Hold' rating on the stock with a target price of 150 pence per share

- Espirito Santo Investment Bank assigns 'Outperform' rating with a target price of 160 pence per share

- Liberum Capital gives 'Hold' rating

Earnings Outlook:

- Investec Bank estimates the company to report revenues of £1,433.80 million and £1,426.20 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £145.80 million and £120.50 million. Earnings per share are projected at 17.80 pence for FY 2012 and 14.70 pence for FY 2013.

- Espirito Santo Investment Bank projects the company to record revenues of £1,445 million for the FY 2012 and £1,426 million for the FY 2013 with pre-tax profits (pre-except) of £134 million and £120 million respectively. Profit per share is estimated at 17.18 pence and 14.64 pence for the same periods.

- Liberum Capital expects QinetiQ to earn revenues of £1,456.78 million for the FY 2012 and £1,443.61 million for the FY 2013 with pre-tax profits of £146.99 million and £118.35 million respectively. EPS is projected at 17.83 pence for FY 2012 and 14.28 pence for FY 2013.

© Copyright IBTimes 2025. All rights reserved.