R3's Smart Contract Templates Summit: Time is right to start on standards

IBTimes UK speaks to Todd McDonald of R3, Clive Ansell of ISDA, Lee Braine of Barclays, Emmanuel Aidoo of Credit Suisse, and Daniel Franks of Norton Rose Fulbright.

The Third R3 Smart Contract Templates Summit this week galvanised the financial services industry over the pressing need for standards to simplify the implementations of smart contracts and distributed ledger technologies.

The event, which was simultaneously held in London and New York, gathered 100 representatives from banks, market infrastructure firms, trade associations, law firms and academia, with a further 50 representatives participating remotely.

There were presentations from R3, three banks (Barclays, Credit Suisse, and Royal Bank of Scotland), five law firms (Norton Rose Fulbright, Baker McKenzie, Allen & Overy, Holland & Knight, and Hogan Lovells), trade association ISDA, software company Monax, and University College London. The event was hosted at the Barclays Rise open innovation hubs in London and New York simultaneously, connected via live video screens.

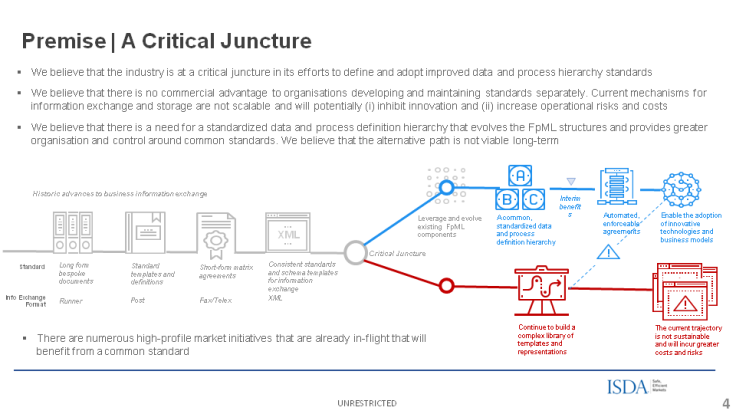

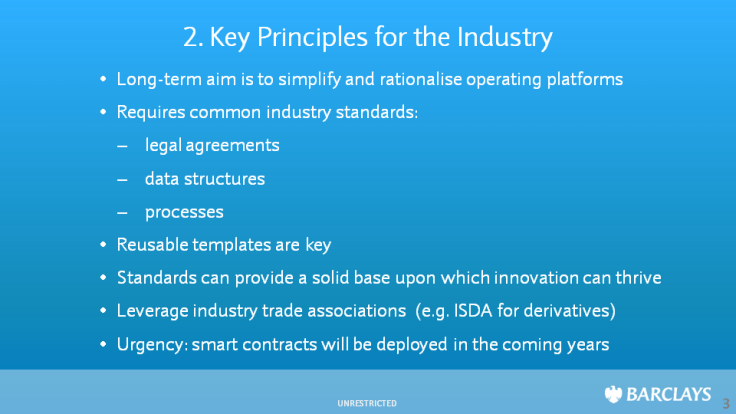

There was a consensus on the need for industry standards to be developed by trade associations, such as ISDA's bold new initiative to standardise data and processes for derivatives smart contracts via a common domain model.

Clive Ansell, Head of Market Infrastructure and Technology at ISDA, said convergence is now critical. "The industry is struggling with the complexity in the current internal infrastructures and that's largely due to the fact that individual firms have their own models of processes and process steps. There is therefore no guarantee about the answer that one party gets; in theory, counterparties should obtain the same answer in the same way."

Ansell said there is a need to be able to identify all the events that take place in the life cycles of financial derivatives. "We think about things in terms of - what's the before state; what's the after state. We need to get the first transformation step underway and start to move the industry away from its existing activities of data transfer, transformation, reconciliation, which I think is at the heart of a lot of the complexity that firms are struggling with today.

"Importantly, it allows us to say to the industry, to regulators, to FinTechs, to anybody - this is what is intended; this is what we collectively agree we expect to happen at certain points in a trade life cycle.

"That can then be encapsulated in smart contracts, and I think if we can all look back to a single source, a library or an encyclopaedia that articulates this, then it's going to make transformation and progress much simpler."

Ansell pointed out that this is the sort of work ISDA has been doing for the last 30 years, not just in the technology space but also more generally in how master agreements are developed, how definitions booklets have developed, credit support documents, and so on.

Smart contracts are very similar, he said. "It's looking for those opportunities that market participants want to converge on and reach agreement on in order to have a set of common standards, whether that's technological, legal, documentational, or otherwise."

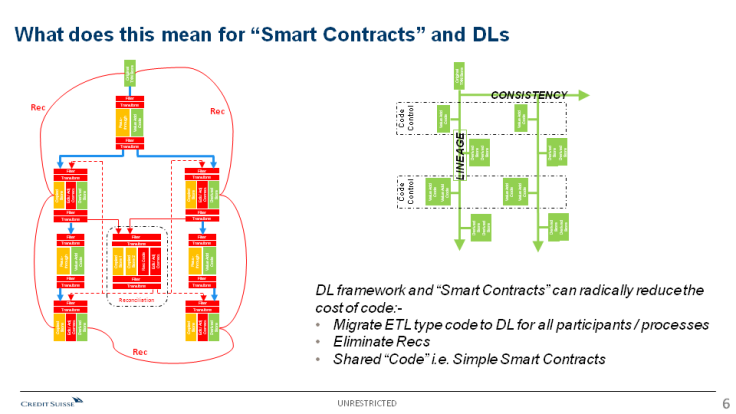

Emmanuel Aidoo, head of the distributed ledger and blockchain effort at Credit Suisse, said he tends to delineate two major streams within the topic of smart contracts. Making them contractually legal is one stream, and automating their operational processes is another stream.

Also referencing the need for standards, Aidoo said: "If you and I have a contractual agreement to swap a cash flow at the end of the month, and let's say the right answer is £55,227, then we might have different operational steps to arrive at that answer.

"We are contractually obligated to swap that cash flow by a certain date, but we are not contractually obligated to follow the exact same steps in order to arrive at that number. So, some of the work happening with smart contracts could be described as is a 'lean project' on operational processes."

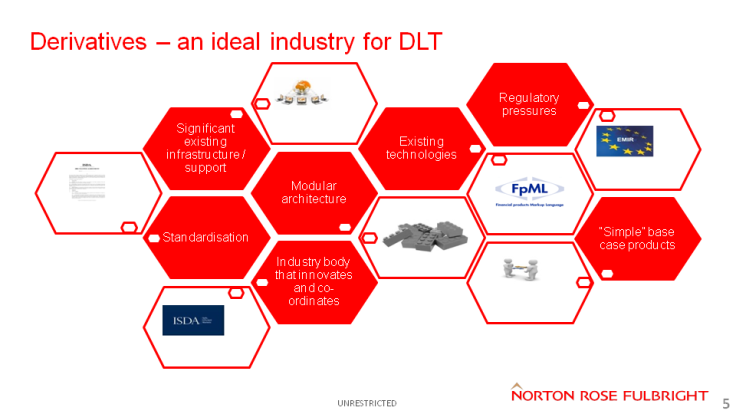

Daniel Franks, a derivatives partner at global law firm Norton Rose Fulbright, added: "There is a huge range of ways in which people are looking to use distributed ledger technology and only some of them involve a relationship between two participants; others are back office functions behind the scenes. There's a real range of applications of the technology and only some involve an exchange of data or an exchange of processes between two participants.

"One of the things that came out of the summit was recognition amongst a number of different people that when we talk about smart contracts, we are not really talking about automating the entirety of the contractual relationship.

"There are only certain provisions and terms that one would want to automate and turn into a computer code. There are inevitably going to be provisions in any agreement, whether it's a derivatives agreement or anything else, where you want a degree of discretion, you want some ambiguity or you want flexibility, which doesn't lend itself to coding."

Todd McDonald, Co-Founder and Head of Ecosystem Development at R3, acknowledged there is plenty of divergence, especially given the explosion of distribute ledger technology solutions out there today. He said: "From R3's perspective, we are obviously very focused on the innovation and building side, and that can lead to a divergence of options for the industry to adopt. So, it's important to get the balance right, including when the time is the right time to bring convergence through standards.

"It's very evident from participants at the summit that the timing is right to start on this standards effort. That's why we are very excited to support ISDA's leadership role in this when it comes to derivatives standards.

"Distributed ledgers are really a peer-to-peer technology, and that's why I think the industry has looked at derivatives on the OTC side as a very interesting application. We want to be able to not only keep that as a peer-to-peer bilateral, but also apply industry-wide automation, simplification, and the ability to do that at scale."

"We can only do this through some level of standards, specifically data and business process standards. It's something that FinTechs such as R3 need to support - but it's difficult for FinTechs to lead that, because they are trying to push for innovative change on the technology side.

"So that's why it's critical to have an industry trade association such as ISDA to be leading that and bringing the industry along. We see that the timing is right and there's demand from the industry: buy-side, sell-side and vendors as well."

Summing up, Lee Braine of the Investment Bank CTO Office at Barclays, also highlighted the role that ISDA was playing in bring the industry together to develop standards. He said it would be unrealistic to expect the large differences in distributed ledger architecture stacks to converge on a common architecture design in the near or medium term, and so this leads us to a pragmatic approach of instead developing process standards to sit on top of those different stacks – common processes that are clearly defined and can be transformed to run on each different platform.

He said: "We have assessed many innovations in depth in the distributed ledger field, including the motivations behind them, and it has been inspirational to see that novelty and variety. However, if we also look from an architectural perspective where banks are looking to identify opportunities to rationalise and simplify operating platforms - including back-office and post-trade processing - then it's beneficial for third-parties to also look to rationalise and simplify the platforms they are operating.

"That could range from incumbent financial market infrastructures operating hub-and-spokes models to upcoming decentralised peer-to-peer networks. Currently, many of the third-party processes, data structures, etc are sufficiently different that that it's necessary for banks to effectively perform parallel versions of certain key steps of each third-party process and then reconcile. There's an opportunity to simplify across the industry by reducing variance across those third-party processes as well as within the banks.

"So, we are encouraging greater standardisation and in both processes and data. This is now the time when some key aspects of innovative divergence in the distributed ledger space should start to progress on to standards convergence instead. The key point is that smart contracts innovation could thrive on top of a solid base of common standards."

The presentations for The Third R3 Smart Contract Templates Summit are publicly available online: https://www.r3.com/slides/third-smart-contract-templates-summit-slides.pdf

© Copyright IBTimes 2025. All rights reserved.