Retiree Regrets Having Kids And Says He Was Just Their ATM: 'I Gave My Life To Them... It's Been 9 Years Since I've Heard From Them'

Retirement savings come first, financial advisors warn

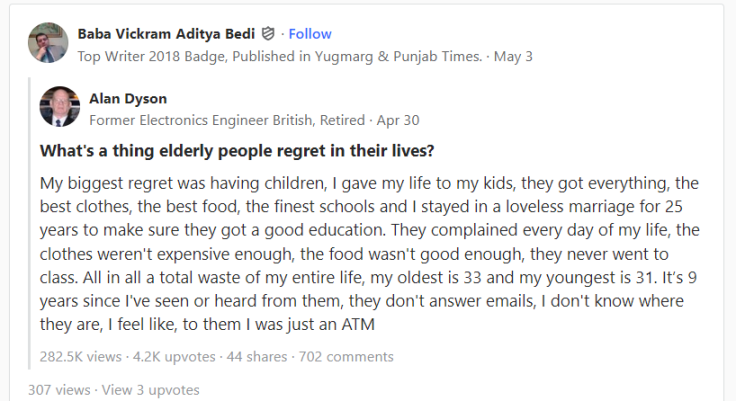

In a Quora post titled "What's a thing elderly people regret in their lives?", former electronics engineer Alan Dyson offers a surprising perspective. While many might expect regrets about missed adventures, Dyson highlights a different source of regret for some: "having children."

In his post, Dyson states, "my biggest regret was having children." According to his bio, Dyson, who relocated to the Philippines in 1980, devoted everything to his children, providing them with the best clothing, the finest food, and access to top-tier schools.

Dyson further alleges he remained in a loveless marriage for 25 years solely to provide his children with a strong education. Despite his sacrifices, he maintains they were never satisfied, constantly complaining about their clothes and food quality and neglecting their studies.

When Supporting Adult Children Strains Retirement Security

"All in all a total waste of my entire life," Dyson added. He says his eldest child is 33 and his youngest is 31. According to a post Dyson wrote online, they haven't had contact for nine years. He claims his children don't respond to messages, and their whereabouts are unknown. "I feel like, to them, I was just an ATM," they wrote in conclusion.

The Publishing Corporation YourTango shared Dyson's story on TikTok, which resonated with some viewers. The video highlighted that some parents identified with his emotions, suggesting that raising children requires significant resilience.

@yourtango Parenthood isn't easy, and for one dad, it's his biggest regret in life #parenting #dadsoftiktok #fatherhood #regret

♬ original sound - YourTango - YourTango

"I understand. We gave them everything. That was our first mistake," one TikTok user commented. "You are not alone, dude. Lots of parents feel this way," another user shared.

"Being a teacher, I see this daily. No matter what parents do or give, it is never enough," another user wrote.

However, the video also sparked scepticism from other viewers. They questioned whether the whole story was being told. Some viewers felt Dyson might omit details about their relationship with their children, potentially explaining the estrangement.

The financial strain of raising children is significant, with a recent study by Pregnant Then Screwed finding that nearly half of new parents go into debt due to childcare costs, and a quarter of mothers on maternity leave resort to skipping meals to save money.

"Adult children will treat their parents how they felt as children," one TikTok user noted. "Maybe he didn't do dad stuff, just ATM stuff," another user suggested. While strong emotions can cloud financial decisions in parent-child relationships, it's important for retirees to be mindful of their spending habits.

How To Stop Footing The Bill For Adult Children

Finances and family can be a complex dance, especially during retirement. While it's natural to want to help your adult children, it's crucial to prioritise your financial security. Let's explore some strategies to ensure your retirement savings aren't overshadowed by ongoing support for your grown kids.

1) Prioritising Your Golden Years

Financial advisors emphasise that retirement savings should be your top priority, even when helping adult children. This might seem counterintuitive, but a recent survey paints a concerning picture.

According to a February 2024 Savings.com survey, parents supporting adult children contribute significantly more to their children's well-being than their retirement. The survey found that, on average, parents contribute $1,384 a month to their adult children compared to only $609 towards their retirement savings.

2) Having An Open Dialogue

Having an open and honest conversation with your adult children about financial support can be a delicate dance. Part of you might recognise it's time for them to be financially independent, while another part might be guilty about reducing or stopping support altogether.

Financial therapist Shannon Kautzer suggests a helpful first step: identify your reasons for adjusting the financial dynamic and validate those reasons for yourself. This emotional preparation will strengthen your foundation for the conversation.

3) Offering Support Beyond Money

While reducing financial contributions might be necessary, it doesn't mean you have to withdraw your support entirely. There are many ways to empower your children on their path to financial independence.

Consider offering guidance on budgeting or even assisting them in their job search for a higher-paying position. Your wealth of life experience can be invaluable in helping them build financial resilience.

"You want to be teaching them some ability to say no and live with the discomfort of not having what [they] want," Lester says. It's important to remember that unforeseen circumstances can arise. Financial therapist Shannon Kautzer suggests leaving room for flexibility.

"You can say, 'For this period or the next three months, we'll help you,'" Kautzer says. However, the ultimate goal is to empower your children towards financial independence.

As the financial landscape for retirees evolves, taking a proactive approach to retirement planning becomes even more critical. The 25X Rule offers a powerful yet straightforward strategy to navigate these challenges and build a secure and hopeful future for your golden years.

© Copyright IBTimes 2025. All rights reserved.