Rightmove: 'The rising tide of house prices is marooning more and more first-time buyers'

Asking prices rise sharply for first-time buyers as housing market "shakes off" Brexit.

Rapidly rising house prices are leaving first-time buyers struggling to secure large enough mortgages as investors crowd them out at the bottom of the market, according to property listings website Rightmove.

In September, the average asking price for a home in England and Wales rose 4% over the year and 0.7% month-on-month, said the Rightmove house price index, hitting £306,499. But for properties with two bedrooms or less — a sub-sector dominated by first-time buyers — the average asking price hit £194,977 after rising 3.3% over the month and 10.5% annually.

"The rising tide of prices is marooning more and more first-time buyers, out-stripping their ability to meet stricter lending criteria and afford the required deposits and monthly repayments," said Miles Shipside, director of Rightmove.

"Increasing numbers are being cut off from home-ownership altogether and while schemes are in place to help, the additional demand they create is not matched by available and affordable supply."

The Bank of England curbed mortgage lending in 2014. Most new mortgages must be under 4.5 times the borrower's income, restricting the amount of debt people can take on. Regulators were conscious of ultra-low interest rates, which will eventually rise, creating credit bubbles where people took on more debt than they could afford in the longer term.

In areas where house prices are particularly high, such as London, or incomes low, it is harder for first-time buyers to step onto the property ladder, even with support from schemes such as Help to Buy and shared ownership.

And property investors are having to work harder to seek out value after a series of tax rises, intended to cool buy-to-let demand. A 3% stamp duty surcharge is now applied to purchases of additional properties. Tax reliefs for landlords, to offset maintenance and mortgage interest costs, have also been cut back.

"Ironically the post-referendum uncertainty has made some sellers of larger and higher value homes more willing to negotiate, making it easier for those already on the ladder to trade up," Shipside said.

"There appear to be no such positives at present for those hoping to get onto the property ladder, especially as agents report more investor activity attracted by better returns than available elsewhere."

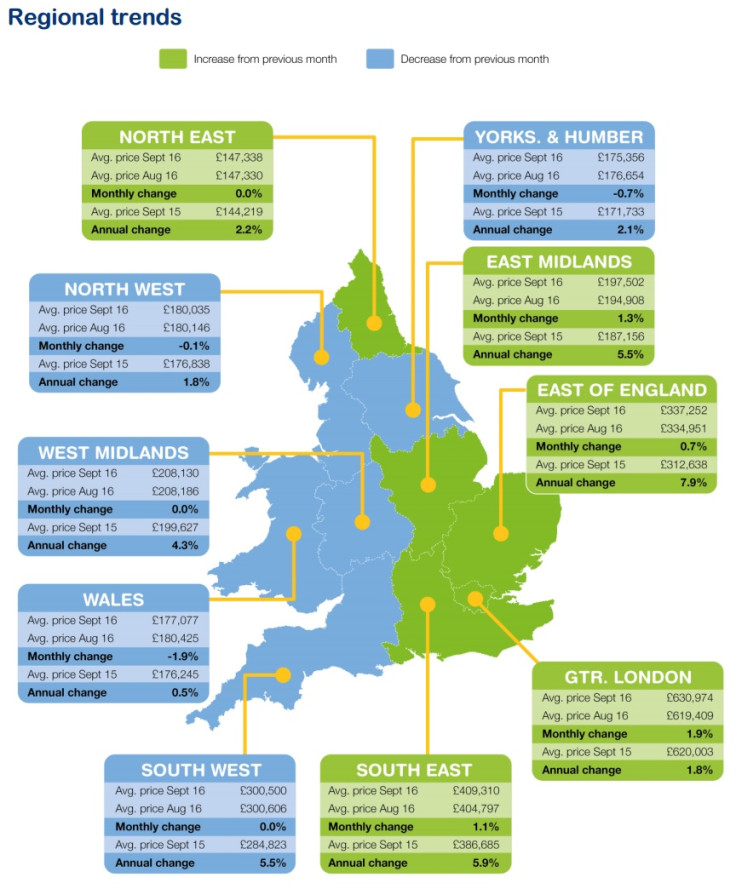

More generally, the effects of the vote for Brexit in the 23 June referendum look to have waned. In August, there were asking price falls in eight out of ten regions. But by September, asking prices had risen or were flat in seven out of ten.

"The market continues to shake off the effect of post-Brexit vote uncertainty, though more so in the lower end sector," Shipside said. "Buyers are still looking and enquiring, but there are limits on their willingness or ability to pay over the odds so sellers should be wary of over-pricing unless their local market can really justify it."

© Copyright IBTimes 2025. All rights reserved.