Russian rouble rises on crude oil bounce but weak data limits gains

The Russian currency has strengthened more than 11% from the six-week low it hit against the dollar last week helped by the rebound in crude prices, but data pointing to faster output contraction in the country and technical resistance have limited the rouble rally.

The USD index fell to a 13-day low of 93.26 on Tuesday before edging back up to 93.84 by Wednesday while the spot delivery Brent crude rallied to a more than 1-month high of $58.95/bbl.

The US currency is off 2.3% from the 12-year high it hit on 23 January whereas the Brent is up 30% from the multi-year low it hit on 13 January.

USD/RUB fell to a nine-day low of 64.47 on Wednesday before edging back up to 66.66. The pair has broken below the 14-day moving average on Tuesday and is still holding below that despite the slight gains following the HSBC/Markit PMI data.

The Markit press release showed that Russia's composite output index based on the purchasing managers survey for January has fallen to a 68-month low of 45.6, with the total business activity declining at its fastest pace since May 2009.

The rate of job shedding was the fastest in five-and-a-half years, Markit said, and added that input price inflation remained substantial though it has eased from December's 79-month record. Output price inflation has hit a new record high.

Analysts say that with persistent inflation risks, aggressive monetary easing will not be a comfortable tool now for the central bank to boost growth in Russia.

"Judged by past correlation between PMI and GDP, the Russian economy would contract 1.5% q-o-q in 1Q if the headline PMI Index stays at its January level throughout the rest of the quarter," said Alexander Morozov, the Russia economist at HSBC.

"Overall, the PMI and other macroeconomic data stay in line with our forecast of 3.5% GDP contraction in Russia in 2015, which is milder than the 7.8% output fall seen in 2009, said Morozov, adding that a decline or recovery in oil prices may change this outlook for worse or better.

Crude oil is now seeing a technical reversal thanks to the strength of the support provided by a long term upward channel dating back to 1998. Still, the commodity has to break through levels like $67 and $77 to significantly weaken the downtrend that has begun in June last year.

Key resistance levels for oil are much higher and therefore difficult to break and so is the case of rouble if it wants to rally further.

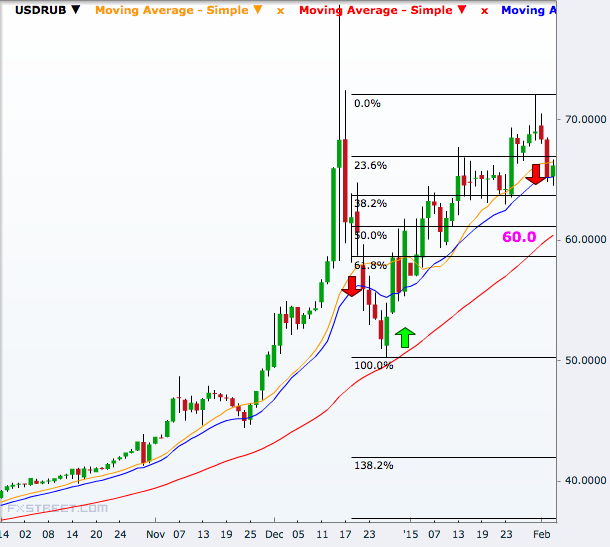

Charts show that the USD/RUB pair failed to break through the 50-day moving average in December, the last time it managed to break through the 14-day average. That makes breaking the support barrier of 60 a crucial achievement for the pair.

To break the 60-mark, the pair has to pass through the 38.2% Fibonacci retracement of 63.60, which is now being tested, and then the 50% mark coming at 61.05.

The rouble will also take cues from the overall dollar performance, which is now favourable with its decline since late last month. For the USD index, levels like 92.50, 92.0 and 91.10 are crucial on the downside, as per charts.

© Copyright IBTimes 2025. All rights reserved.