Scots face higher buying costs on homes worth over £254,000 after stamp duty and land tax reform

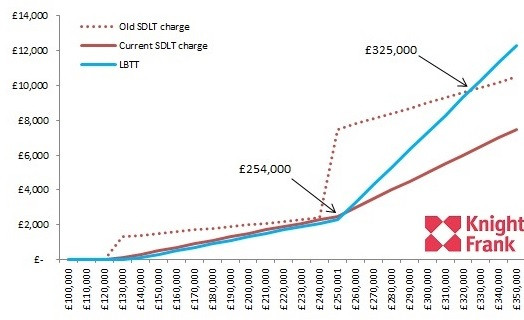

New research has shown that the UK Chancellor's stamp duty system reforms combined with Scotland's new Land and Building Transaction Tax (LBTT) will make it more expensive for Scots to buy a property worth over £254,000.

According to Knight Frank research, the new LBTT system coupled with George Osborne's abolition of the old stamp duty system, will leave many Scots worse off than their English counterparts.

"Under the current system, a house costing £390,000 (€491,530, $610,747) will incur a stamp duty payment of £9,500, whereas the upfront costs under the new LBTT system for the same property will be 72% higher at £16,300," said Oliver Knight at Knight Frank.

"Prior to the introduction of the new levy in four months' time, we expect to see an increase in the number of prime sales and homes coming to the market as both buyers and vendors look to move before costs rise."

The average price of a detached property is higher than £254,000 in nearly a third of all the local authorities in the country, according to Scottish land registers.

Meanwhile, The average UK house price in September 2014 stood at £273,000 as compared to £274,000 in August.

A regional breakdown shows that the average property price in England stood at £285,000; £172,000 in Wales, £143,000 in Northern Ireland and £197,000 in Scotland.

In October, Scotland's government unveiled details about how it will scrap stamp duty, in favour of its LBTT, which will widen the tax bracket and bump up the rate for those buying properties worth over £135,000. People buying a house worth £135,000 and under will not have to pay tax at all.

The scrapping of stamp duty marks the first time the Scottish Parliament has levied taxation since the Union in 1707.

However, in December Osborne abolished the old stamp duty system for the UK.

Prior to 4 December, stamp duty worked on a "slab" basis, by which the percentage paid applies to the purchase price band. This made it difficult to sell houses priced just above each threshold, for example £250,001.

However, under the new rules, stamp duty on a property will be paid in a method comparable to the system of income tax.

"Following the LBTT announcement we crunched the numbers and found that, based on the rates announced and compared to the stamp duty system that was in place across the UK at that time, the new LBTT would favour buyers of properties at £325,000 or less, where less tax would be payable. Sales above £325,000 would incur a higher rate of tax," said Knight Frank.

"However, according to our revised calculations (which take into account the new rates of SDLT which came into force on December 4th 2014), the point at which it now becomes more expensive to buy a property under the new LBTT system has fallen from £325,000 to £254,000."

© Copyright IBTimes 2025. All rights reserved.