Autumn Statement 2014: New UK stamp duty tax rates guide

Britain's Chancellor George Osborne shocked the nation when he announced a radical change to the way people pay stamp duty when purchasing a property.

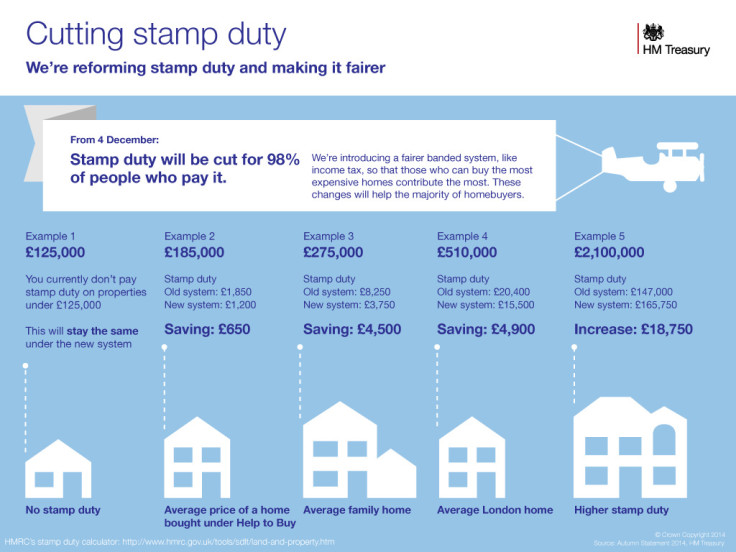

In a bid to hit back at what he called the "unworkable" mansion tax pledged by Labour, Osborne announced in his Autumn Statement in the House of Commons that as of midnight tonight, Whitehall will help "98% of homebuyers" by abolishing the stamp duty "slab system" [Figure 1].

Stamp duty works on a "slab" basis, by which the percentage paid applies to purchase price band. This can have a distorting effect on the housing market, because a house is very difficult to sell at prices just above each threshold, for example, £250,001.

So what does this mean for property buyers?

"Under the new rules, you'll pay nothing on £125,000 and 2% on the remaining £60,000. This works out as £1,200, a saving of £650," said Osborne.

"This will make the system fairer, and means stamp duty will be cut for 98% of people who pay it."

No tax will be paid on the first £125,000 of the property purchase price, 2% on the portion up to £250,000, 5% up to £925,000, 10% up to £1.5m and 12% on everything above that.

To calculate how much you have to pay, check out HMRC's calculator.

© Copyright IBTimes 2025. All rights reserved.