Shares in Li Ka-shing's firms surge on re-structuring plan

Cheung Kong and Hutchison Whampoa's shares jump in Hong Kong trade

Shares of Hong Kong-based Cheung Kong Holdings and Hutchison Whampoa surged on 12 January after Asia's richest man Li Ka-shing announced a restructuring of his sprawling business empire.

Property giant Cheung Kong's stock finished 14.66% higher after surging over 20% in early Hong Kong trade to HK$150.30, the highest since 31 July, 2014.

Investment holding firm Hutchison Whampoa's stock finished 12.41% higher after jumping some 18% to its highest level since 11 September, 2014.

Cheung Kong and Hutchison have a combined market value of some $85bn (£56bn, €72bn).

Linus Yip, chief strategist at First Shanghai Securities, told Reuters: "The rally was a reflection of the unlocked value for the time being. "The benefits of the restructuring have yet to be seen."

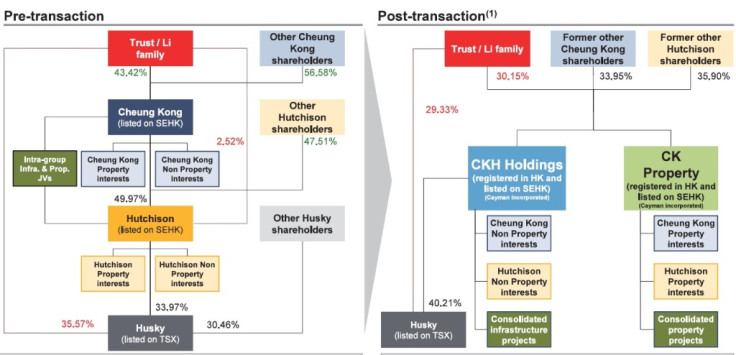

Li last week announced that his Hong Kong conglomerate will split into two listed firms - CKH Holdings will focus on telecoms, retail and energy while CK Property will hold the property business of both groups - in a bid to boost their value and attract more investors.

Investors will now be able to pick from a cyclical property firm or a globally diversified conglomerate.

Revamp

Under the revamp, the companies are shifting their incorporation from Hong Kong to the Cayman Islands. Relocation proved both firms greater flexibility to distribute cash to shareholders, Reuters reported.

Shareholders in Cheung Kong will swap their shares for a new vehicle registered in the Cayman Islands, which will absorb Cheung Kong's 50% holding of Hutchison Whampoa. The combined group will then hive off the real estate assets.

A 9 January statement to the Hong Kong stock exchange said the "reorganisation and combination of the businesses of the Cheung Kong Group and the Hutchison Group [will] create two new leading Hong Kong listed companies."

The move is seen by some industry watchers as a prelude to the octogenarian billionaire accelerating his pace of overseas acquisitions and focusing less on the Hong Kong realty market, where he is battling stiff competition from mainland Chinese developers.

There was also speculation that Li was moving the registration of his companies away from Hong Kong to reduce political risk following recent democracy protests, though the tycoon has denied that was the case.

Li built his business empire from scratch some 50 years ago when he opened a plastic flower business. Forbes magazine estimates his wealth at $33.5bn.

© Copyright IBTimes 2025. All rights reserved.