Charts in Focus: Eurozone Struggles with Sovereign Debt

The Eurozone sovereign debt crisis is showing no signs of abating as Greek workers strike on strict job cuts austerity measures and Spain hopes to raise €4bn through a bond auction.

While the European public cries out against public sector reform measures, raises in taxes and soaring unemployment, the countries' governments are desperately trying to shore up cash to bolster its beleaguered balance sheet and pay back debt.

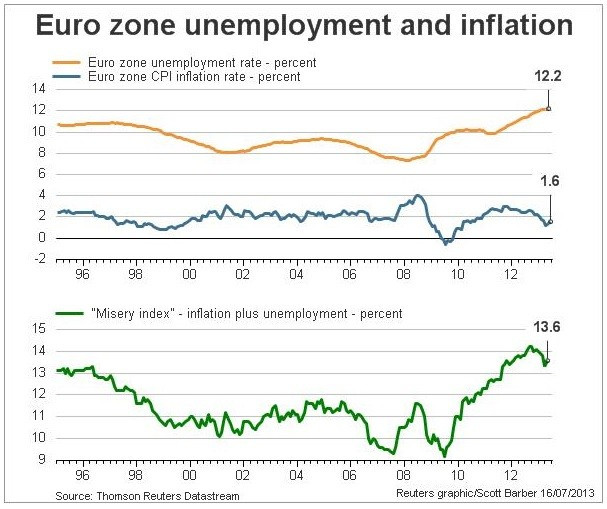

The 'Misery Index' shows that as unemployment and inflation rises, so does the economic and social costs for a country [Figure 1].

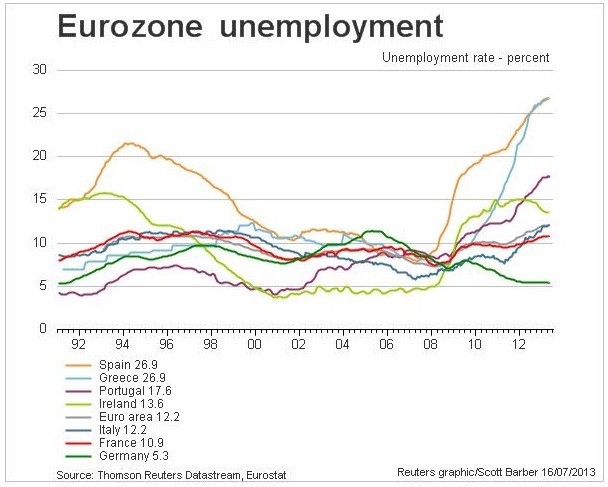

Despite International Monetary Fund (IMF) and European Union (EU) bailouts, countries are still struggling to grow. The countries most affected by the sovereign debt crisis are on a fragile recovery path [Figure 2].

The most embattled Eurozone countries are continuing to struggle with soaring unemployment. However, countries such as Greece, Spain and Italy are still set to axe more public spending and reform budgets, which will inevitably led to more job losses [Figure 3].

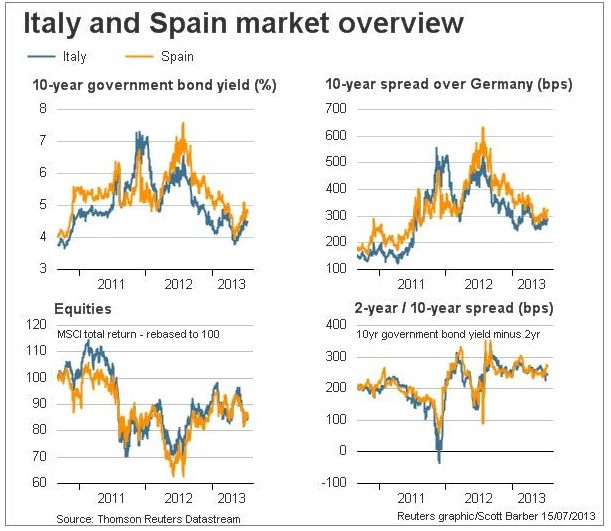

Spain is hoping to raise billions in funding through a bond auction on Tuesday but the bribery scandal surrounding Spanish Prime Minister Mariano Rajoy is likely to overshadow events. The higher the yield, the more risky the investment, so the next chart shows how investors are more wary of Spain's economic stability over recent months [Figure 4].

© Copyright IBTimes 2025. All rights reserved.