Scottish Independence: S&P Claims Independent Scotland Could Get Decent Credit Rating

An independent Scotland could start off life with an investment-grade credit rating because it has a "wealthy and open" economy, according to the influential Standard & Poor's ratings agency.

Though a sterling union with the UK or joining the eurozone would benefit Scotland's credit rating, S&P added that there is no reason it could not successfully launch its own separate currency and "go it alone".

"In brief, we would expect Scotland to benefit from all the attributes of an investment-grade sovereign credit characterised by its wealthy economy (roughly the size of New Zealand's), high-quality human capital, flexible product and labour markets, and transparent institutions," said S&P in a report.

"Nevertheless, the newly formed sovereign state would begin life with comparatively high levels of public debt, sensitivity to oil prices, and, depending on the nature of arrangements with the EU or UK, potentially limited monetary flexibility.

"At the same time, Scotland's external position in terms of liquidity and investment could be subject to volatility should banks leave.

"On the other hand, if this were to happen, it could bring benefits in terms of reducing the size of the Scottish economy's external balance sheet, normalizing the size of its financial sector, and reducing contingent liabilities for the state.

"In short, the challenge for Scotland to go it alone would be significant, but not unsurpassable."

There is a political tussle between Westminster and Holyrood over a currency union.

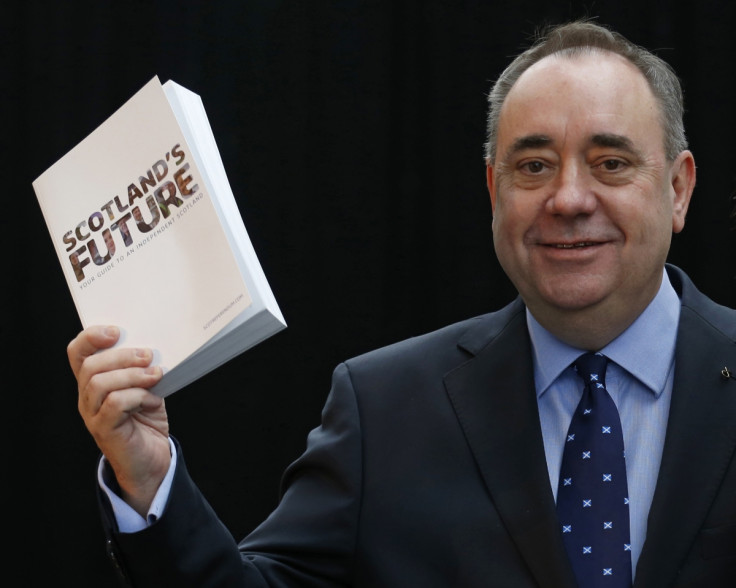

Alex Salmond, leader of the pro-independence Scottish National Party (SNP), said there is nothing the UK could do to stop Scotland using sterling. He claims a currency union would be in the UK's interests as well as Scotland's.

However, Chancellor George Osborne said it is very unlikely there would be an agreement on the terms of a currency union between the UK and an independent Scotland.

Mark Carney, governor of the Bank of England, said a currency union would require Scotland to give up monetary and some fiscal sovereignty.

Scotland's economy is reliant on revenue from the North Sea oil and gas field, but production is set to slow in the coming years.

According to the Organisation of Petroleum Exporting Countries (Opec), the average oil output in 2013 from the North Sea registered its lowest level since 1977.

There is also the question of how much of the revenues Scotland would be able to keep if it went independent, as well as how much of the UK's £1.24tn public debt it would inherit.

S&P also cautioned over the size of Scotland's financial sector relative to its GDP.

Scottish banks hold assets worth 12.5 times the nation's GDP, though S&P said the likely flight to the UK by some institutions in the wake of independence would offset some of the risk to the system.

The UK has a AAA credit rating from S&P for its sovereign debt, the top grade. An investment-grade credit rating is anything above BBB-.

Credit ratings give investors an idea of how risky certain investments are. Country ratings are an indication of how healthy the economy is and how likely or not the government is to default on its debts.

© Copyright IBTimes 2025. All rights reserved.