Tarsus Group to Report Major Events in Its History Along With FY Results

Tarsus Group, the international business-to-business media group, expects the second half of 2011 to be the most important trading period in the group's history with major events that took place in the main geographies where it operates.

The momentum it carried forward from the first half should herald a strong performance in the second half.

Tarsus is expected to release its full year results on March 7, 2012 and remains positive to its plan of growing its exposure to Emerging Markets (Project 50/13 - whereby 50% of Group revenue will be sourced from Emerging Markets by 2013) and driving organic development in all its business. This plan has already yielded tangible results with the acquisition of IFO in Turkey and notable growth from the Middle and Far East businesses.

The group continues to focus on large market leading exhibitions and the active management of its portfolio. Recently, the group has sold both its UK and US small online businesses along with Modamont in France in Q4.

According the group's trading update, the FY 2011 ended well, resulting in robust revenues and profitability. Tarsus anticipates the full year adjusted pre-tax profits to be in line with its expectations. Cash flow remained strong with net debt at December 31, 2011 at approximately £14 million - well ahead of expectations and halving of debt since the beginning of 2011.

While commenting on the groups' trading update, Investec Bank said: "The full-year 2011 like-for-like organic revenue growth, up by about 8 per cent, as "very healthy", as it points out that cash generation came in better than it expected, with net debt at about 14 million pounds compared to the bank's previous forecast of 16 million. "(The) pre-close update confirms strong 2H performance of larger global events and emerging markets. Management is clearly focusing the business on growth, evidenced by 2H Modamont disposal and a small online exit today."

It has one important event, the Off-Price Show in Las Vegas in the first quarter of 2012, and it expects that it will gain revenues ahead of the same event in the last year. The group is encouraged by the momentum of its US Medical business, Off-Price events and Labelexpo Americas, but remains vigilant given the second half weighting of its profits and the ongoing macro uncertainty in Europe. The momentum that Tarsus is building across the Middle and Far Eastern markets will favour well in 2013 when its two large biennial events recur. In the first half the year, the group acquired IFO, one of the largest independent exhibition businesses in Turkey for £10 million. It has also acquired the remaining 24.5% of the share capital of Caroo USA Inc. from David Larkin and John Rice.

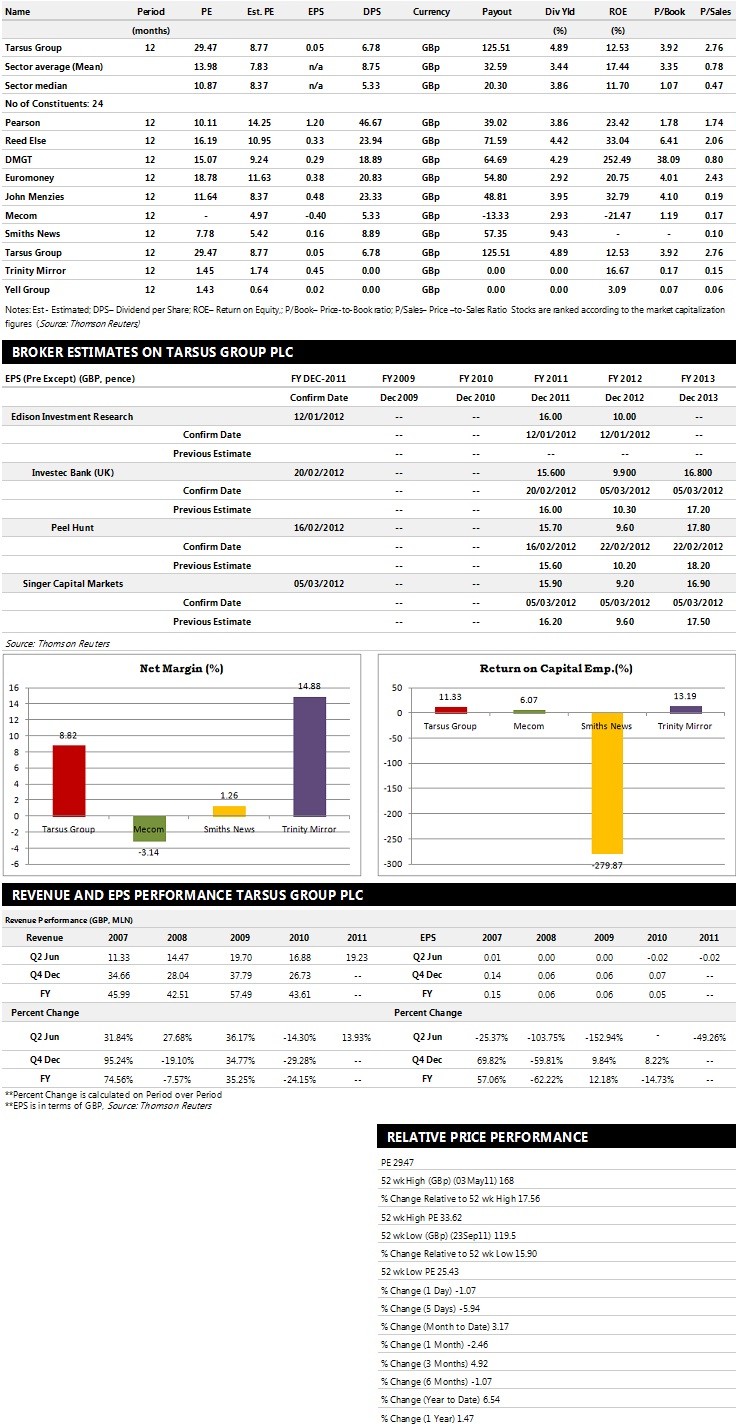

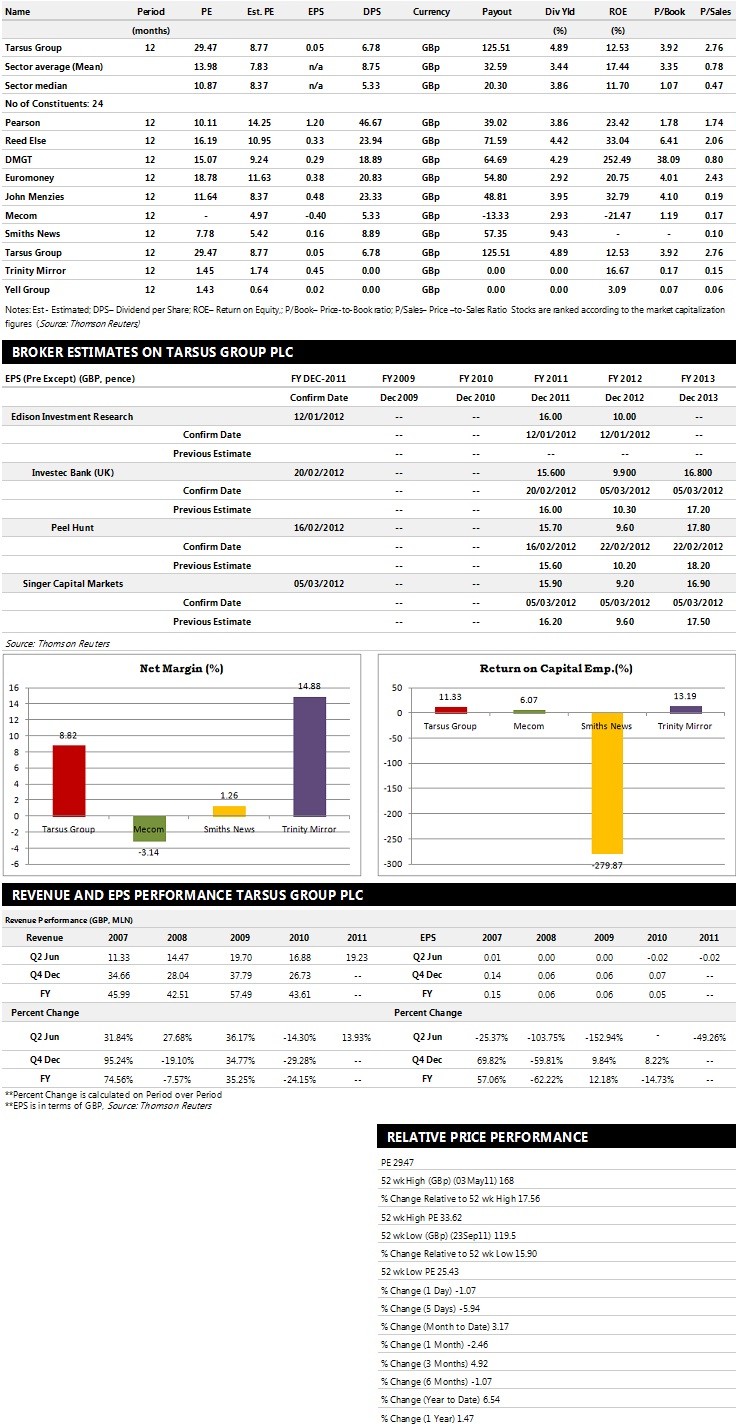

Brokers' Views:

- Singer Capital Markets recommends 'Fair Value' rating on the stock with a target price of 152.00p per share

- Peel Hunt assigns 'Hold ' rating with a target price of 155.00 pence per share

- Investec Bank assigns 'Buy' rating with a target price of 167.00 pence per share

Earnings Outlook:

- Singer Capital Markets estimates the company to report revenues of £62.00 million and £43.00 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £17.00 million and £10.00 million. Profit per share is projected at 15.90 pence for FY 2011 and 9.20 pence for FY 2012.

- Peel Hunt projects the company to record revenues of £60.10 million and £43.50 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £16.30 million and £10.60 million. Eanings per share are estimated at 15.70 pence for FY 2011 and 9.60 pence for FY 2012.

- Investec Bank expects the group to earn revenues of £61.50 million for the FY 2011 and £41.90 million for the FY 2012 with pre-tax profits of £16.10 million and £10.80 million. EPS is estimated at 15.60 pence for FY 2011 and 9.90 pence for FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.