Taylor Wimpey Starts FY 2012 with Encouraging Patterns; HSBC assigns 'Overweight' Rating

Taylor Wimpey, the homebuilding company, says that it is too early to judge the market for the year as a whole, but the early weeks of trading in 2012 have followed the encouraging patterns of the second half of 2011, with good visitor levels, healthy reservations and low cancellations.

According to company reports, the group in Canada that trades under the Monarch brand believes that its ever improving portfolio of sales outlets is well positioned in its local markets, with aspirational products and achievable prices for its target customers. Its priorities remain value creation and margin improvement ahead of volume growth, and the group is achieving further improvement in the margins on sales in its order book.

Having delivered double digit operating margins in the UK in the second half of 2011, ahead of target, it continues to expect to deliver further steady improvement providing that current stable market conditions continue. As at 26 February 2012, the group's order book had increased by 18 per cent to £983 million (31 December 2011: £835 million).

The group reported an underlying pretax profit of £90 million ($143 million) for 2011 from a loss of £28 million in 2010, on continuing operations, close to a forecast of £88 million pounds. The sale of its North American business in 2011 also improved its financial position and allowed it to reduce debt to £117 million ($185 million) from 655 million, and proposed a final dividend of 0.38 pence.

While commenting on the full year results, analysts from Panmure Gordon said: "Like other housebuilders the group has seen good momentum in current trade, but for the time being we maintain our full year 2012 forecasts. With the stock racing past our target price in recent days our recommendation moves back to Hold from Buy."

The underlying housing market remains stable with healthy homebuyer confidence and an ongoing undersupply of new housing. The introduction of the NewBuy mortgage guarantee scheme in the coming weeks has the potential to improve the availability of mortgages for first time buyers, although the Stamp Duty exemption for first time buyers on properties valued at up to £250,000 is scheduled to end on 24 March.

"The sector was pulled up hugely after Persimmon's announcement on February 28. It was just a bit of profit-taking on that day, results were in line, there were no real shocks in there," said Shore Capital analyst Gavin Jago, who maintained a 'Hold' rating on the stock.

The company which sells homes in US under the brand name Taylor Morrison continues to maintain a positive but cautious view of the short-term trading environment, given the balance between a static UK housing market and widespread economic uncertainty. Taylor Wimpey is creating value in an improving market, its value focused strategy, high quality land portfolio, increased order book, and strong balance sheet give it a strong defensive position should conditions weaken during 2012.

"Our performance is the result of a continued focus on driving value by prioritising a further improvement in margins and return on capital. In 2011, we saw significant progress in our operational performance and I am pleased that we have reached our double- digit operating margin target ahead of schedule. While wider economic conditions remain uncertain, the UK has seen a period of continued stability in the underlying housing market and strong growth across a number of areas as shown by our order book. We feel well-positioned to deliver further improvement through our value-driven strategy," says Pete Redfern, Chief Executive.

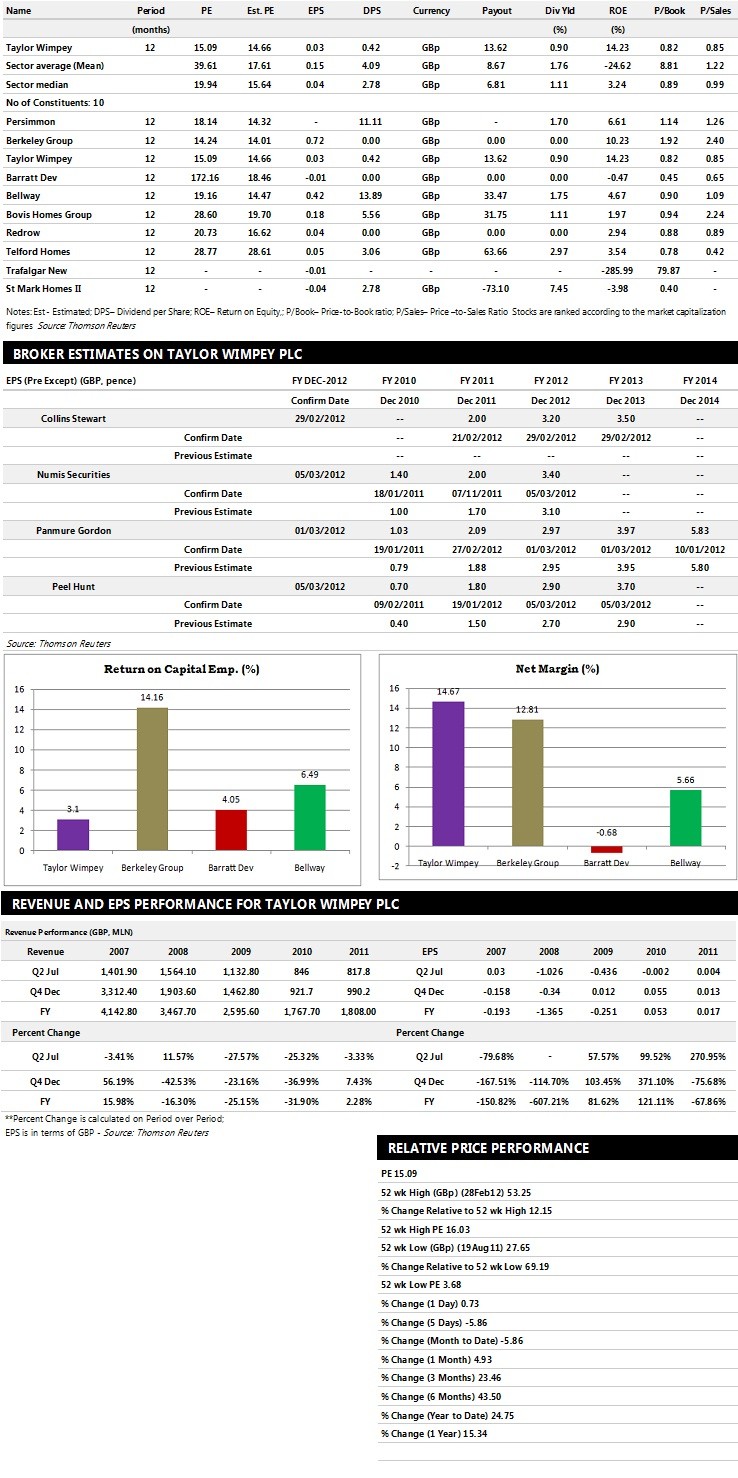

Brokers Views':

- HSBC assigns 'Over Weight' rating on the stock and raises price target to 57p from 50p

- Peel Hunt recommends 'Sell' rating

- Numis Securities assigns 'Buy' rating with a target price of 61p per share

- Deutsche Bank raises price target to 59.3p from 55.5p

Earnings Outlook:

- Peel Hunt estimates the company to report revenues of £1,817.50 million and £1,910.60 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £125.00 million and £156.80 million. Earnings per share are projected at 2.90 pence for FY 2012 and 3.70 pence for FY 2013.

- Panmure Gordon projects the company to record revenues of £1,845 million and £2,042 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £130 million and £172 million. Profit per share is estimated at 2.97 pence and 3.97 pence for the same periods.

- Collins Stewart expects Taylor Wimpey to earn revenues of £1,906.20 million for the FY 2012 and £2,036.90 million for the FY 2013 respectively with pre-tax profits of £143.40 million and £156.00 million. EPS is projected at 3.20 pence for FY 2012 and 3.50 pence for FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.