Ted Baker Bets On New Stores, Expects FY Profits In Line With Expectations

Ted Baker, the British designer brand, expects to end the season with a clean stock position as it is scheduled to report its 2011 annual results on March 21, 2012.

Ted Baker has been very pleased with the performance across all of its markets. During 2011 the group developed its presence in international markets through wholesale, licensing, new retail stores and concessions which have continued to drive growth during the period. The board expects that profits before tax for the year will be in line with expectations, driven by the sharp rise in sales over the Christmas period.

While commenting on the trading, CEO Ray Kelvin said: "The group has delivered an excellent result over the Christmas trading period. In a challenging trading environment, this performance is a testament to the strength of the Ted Baker brand, our collections and people. Whilst we are very mindful of the wider macro-economic uncertainty, we remain focused on the strategic development of the brand and look forward to the exciting opening of our stores in Asia and New York. We are also pleased to announce the opening of a new store in May on the Brompton Road, London."

According to company reports, the group's retail sales increased 15.7 per cent in the eight weeks to Jan 7, driven by a 7.3 per cent rise in new space and gross margins were in line with expectations.

With its strong balance sheet, Ted Baker will continue to invest in long term development and keep its costs under control. The group looks forward to open its new store on Fifth Avenue, New York in the middle of 2012 as well as the openings of its first stores in Tokyo in March and Beijing in June.

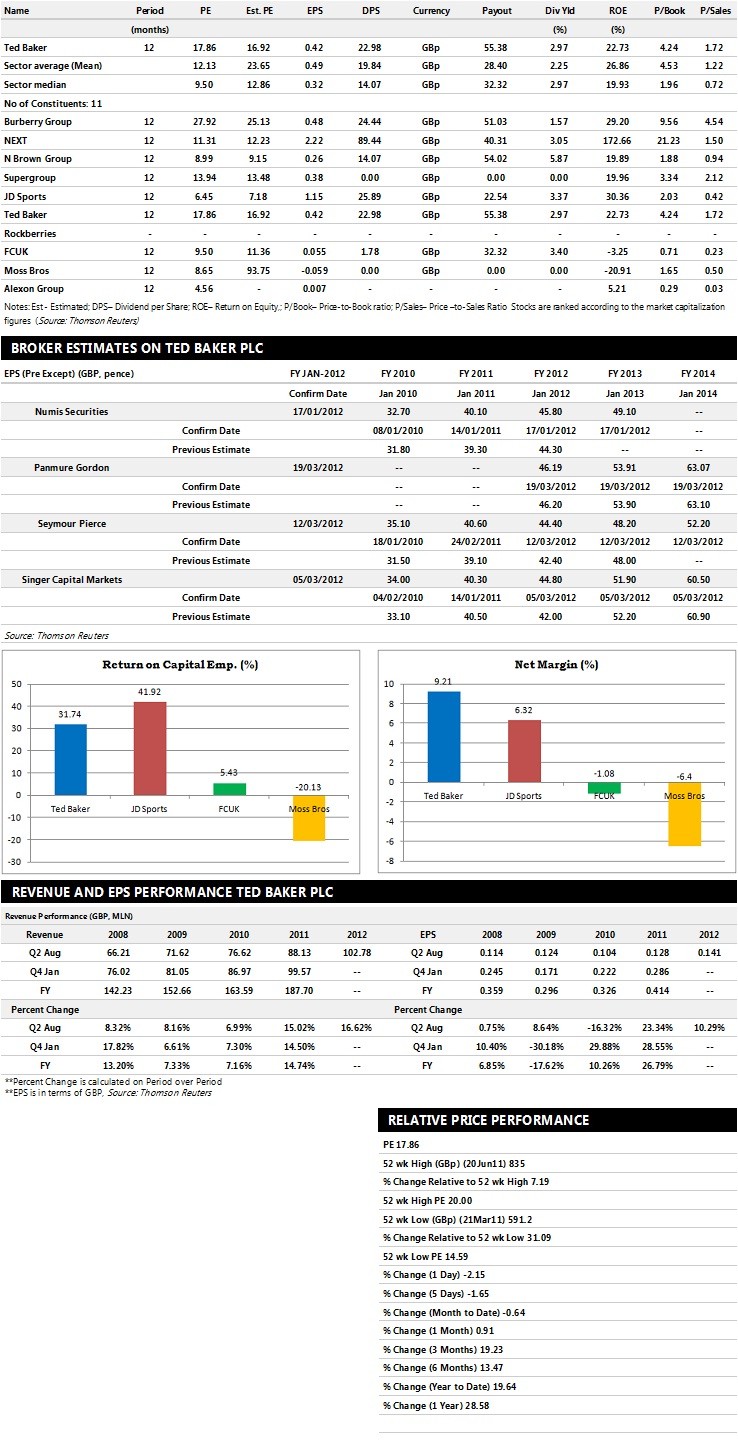

Brokers' Views:

- Panmure Gordon recommends 'Hold' rating on the stock

- Seymour Pierce assigns 'Outperform' rating

- Singer Capital Markets gives 'Hold' rating

- Espirito Santo Investment Bank assigns 'Outperform' rating with a target price of 810 pence per share

Earnings Outlook:

- Panmure Gordon estimates the company to report revenues of £213 million and £236 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £26.60 million and £30.90 million. Earnings per share are projected at 46.19 pence for FY 2012 and 53.91 pence for FY 2013.

- Seymour Pierce projects the company to record revenues of £215.30 million for the FY 2012 and £227.80 million for the FY 2013 with pre-tax profits (pre-except) of £26 million and £28.20 million. Profit per share is estimated at 44.40 pence and 48.20 pence for the same periods.

- Singer Capital Markets expects Ted Baker to earn revenues of £212 million for the FY 2012 and £229 million for the FY 2013 respectively with pre-tax profits of £27 million and £29 million. EPS is projected at 44.80 pence for FY 2012 and 51.90 pence for FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.