Time Out unveils plan to float on AIM market at London Stock Exchange

Culture and entertainment magazine Time Out has unveiled plans for a stock-market flotation, which is expected to value the company at between £185 million (€242m, $270m) and £225m. In April this year, Oakley Capital, a private equity firm that controls a 76% stake in the media business, announced plans to list Time Out on the AIM market of the London Stock Exchange.

The group, which in 2010 secured a controlling stake in the magazine-turned-digital media business from founder Tony Elliott, said it plans to raise around £90m in funds from the floatation.

The capital will partly be used to fund further expansion, while approximately £25m of the company's net debt is expected to be paid off with the funds raised from the share sale. It is understood Oakley expects to lose money in the short-term future as it continues to invest in its turnaround plan for the business.

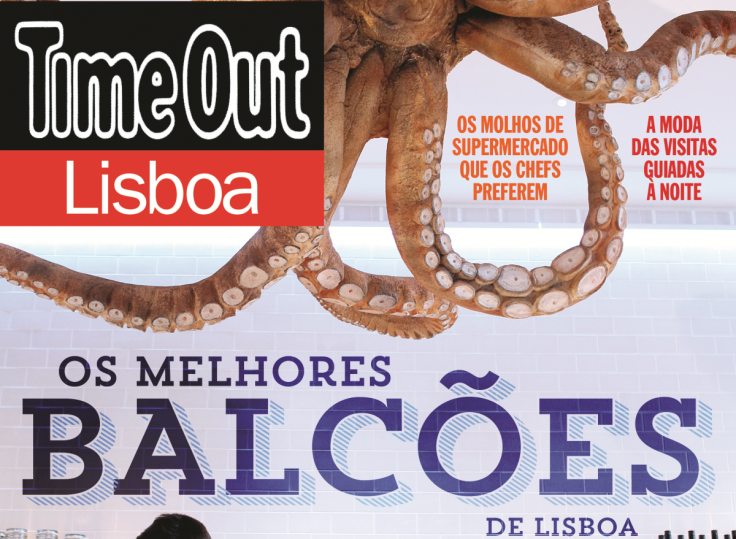

The venture firm has invested heavily in the magazine, which has since seen its free print edition being distributed in London, New York and Chicago. In November, Time Out bought its Portuguese franchise in a move to expand its European presence and it has since launched a successful food market in Lisbon.

Since completing its transformation to digital business, the company has seen revenue from its digital activities surge from 10% to almost 50% of total revenues.

However, while Time Out boasts some 111 million of monthly users, a large proportion of whom interact with the group via social media, it continues to make a loss.

Meanwhile, according to Sky News, Neil Woodford, one of Britain's most high-profile fund managers, is among those expected to purchase a stake in the company.

Along with Elliott, Lord Rose, the former chairman of Marks & Spencer and chairman of Britain Stronger In Europe, and Christine Petersen, former chief marketing officer at TripAdvisor, are also expected to be on the board.

© Copyright IBTimes 2025. All rights reserved.