Home

> G20

G20

Everything Everywhere: UK Business Leaders Demand 4G

A study commissioned by Everything Everywhere claims that 93 percent of UK business leaders want a 4G network rolled out as soon as possible.

IMF Secures £199bn to Deal with Eurozone Crisis

Though considerable progress has been made to tackle eurozone crisis, it remains single largest threat to world economy.

Greece 70 Days Away From Default as Hedge Funds Hold Out for Cash

The eurozone debt crisis is back in full swing after talks between the debt laden Greek government and its private creditors collapsed just before the weekend.

ECB Chief Warns of Debt Contagion Spread

Mario Draghi warns MEPs that debt contagion could spread worldwide as banks face major funding constraint in new year with €750bn in eurobonds called in.

Eurozone Crisis: Cameron is 'Asleep at the Wheel,' says Shadow Minister

In an interview with the International BusinessTimes, the shadow Europe Minister, Emma Reynolds, has launched a scathing attack on the prime minister’s handling of the euro crisis.

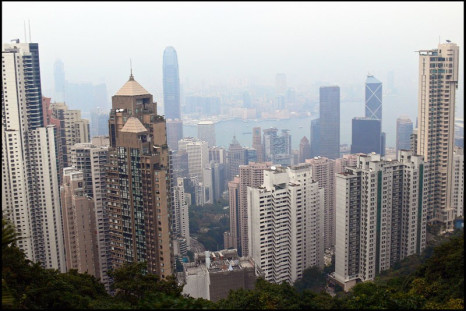

A Look at China and Hong Kong

Last week,China's National Bureau of Statistics released the welcome news that the Consumer Price Index (CPI) year-on-year rate of inflation to October 2011 had fallen to 5.5 per cent, markedly down from September's 6.1 per cent. The CPI had peaked at 6.5 per cent in July 2011.

Eurozone Crisis: What Will the New Order Look Like?

In an interview with International Business Times, Tory Peer and former shadow treasury secretary Lord Flight described the current EU model as corrupt. He offered three possible scenarios for a New Order.

New Sarkozy-Obama Exchange: Papandreou is 'Crazy and Depressed'

In another overheard exchange with US President Barack Obama at the G20 summit two weeks ago, Franch President Nicholas Sarkozy allegedly described Greek minister George Papandreou as 'crazy' and 'depressed', according to French newspaper Le Parisien. The conversation hit the headlines when Israeli Prime Minister Benjamin Netanyahu as a "liar"

Berlusconi Faces Day of Reckoning: LIVE

17:47pm That's it for today. We will start live blogging again from tomorrow morning at 0900 GMT.

Ryanair Website Teases Berlusconi Again Ahead of Crucial Vote

Even Ryanair is betting on Silvio Berlusconi's defeat after Tuesday's vote on the Italian budget that could force the 75-year old mogul to step down as prime minister.

Eurozone Crisis Means a Lot of Mileage for China

The mounting crisis that has gripped the Eurozone countries seems to have boosted China's ongoing efforts to secure a prominent diplomatic space among its western allies.

Silvio Berlusconi, Working-Class Hero? How He's Pulled it Off for so Long

With Silvio Berlusconi facing the 54th -- and possibly final -- vote of confidence of his coalition in his third term alone, many wonder how the 75-year-old media tycoon has maintained his hold over the Italian public.

Eurozone Crisis: Cameron Confirms Britain Will Plough Money into IMF Rescue Fund

The prime minister, David Cameron, confirmed to the Commons that he would be using British taxpayers money to invest into the IMF - a fund used to help ailing economies.

Silvio Berlusconi 'Could Resign Within Hours'

Italian Prime Minister Silvio Berlusconi denied media reports that he could resign within hours.

ECB Shifts Policy by Supporting Growth, Loosening Rates

The new president of the European Central Bank, Mario Draghi, will look to promote “growth” in the eurozone, according to a leading portfolio manager in the City of London.

Greek Debt Crisis: New Prime Minister by End of the Day

After 48 hours of political deadlock, Greece will name its new prime minster by the end of the day after the outgoing premier, George Papandreou, and opposition leader, Antonis Samaras, reached a consensus with the country’s president Carolos Papoulias yesterday evening.

Eurozone Finance MInisters Meet on Monday to Push Greece to Fall in Line

Eurozone finance ministers will meet in Brussels Monday, as they seek to persuade Greece to accept the terms of the next installment of its bailout package, proceed with reforms, and refrain from antagonizing donor nations.

Backstage Drama, Emotions, and Infighting Mark G-20 Summit

As resolution of the debt crisis continues to be elusive, the now-concluded Group of 20 Summit witnessed an unprecedented tendency on the part of world leaders to point fingers at each other.

G20 Summit: Angela Merkel Admits 'There’s No Firewall Deal'

The German Chancellor, Angela Merkel, has confessed that there is no deal on the table to fund the IMF or a Eurozone firewall which has sent markets tumbling across the world.

Italy Accepts IMF Monitoring Over Austerity Measures

IMF is monitoring Italy over its long delayed plan of reforms of pensions, labour markets and privatisation, EU Commission President Josè Manuel Barroso said on Friday. Under pressure from financial markets and European peers, Prime Minister Silvio Berlusconi agreed to allow International Monetary Fund to oversight the country's progress to overhaul its debt crisis.

G20 Talks 'Deadlocked' with All Eyes on Greece

With the attention of world leaders firmly on Greece, the talks at the G20 summit in Cannes appear to have hit a brick wall, according to reports.

David Cameron Faces New Eurosceptic Rebellion

The prime minister, David Cameron, faces yet another rebellion in the Commons – this time over the use British taxpayers’ money to boost the International Monetary Fund (IMF), a fiscal reserve that supports ailing economies such as Greece.

Greek Crisis: This Could Be Europe's Day of Destiny

European and world leaders at the G20 will discuss the prospect of an EU without Greece having come to terms for the first time that a Greek default is a real possibility.

Attack on Iran Likely to be Marketed as Anti-Imperialist Struggle By Ahmadinejad

Tensions between the US, its allies and Iran are mounting following a string of reports saying that the U.S. are considering attacking Iranian nuclear facilities, with the potential support and participation of both the UK and Israel.

Chaos in Italy as Deputies Urge Berlusconi to Resign

Silvio Berlusconi is feeling the pressure of a financial and political crisis as six former parliamentary loyalists sign a letter calling for a new government amid controversy over the cabinet's economic reform plan.

Silvio Berlusconi Delays Release of Latest Love Song CD Due to Financial Crisis

The breaking storm of the eurozone financial crisis has put the brakes on the publishing date of the Italian premier's "True Love" album.

Euro Gets Priority Over Greece at G-20 Meeting

World leaders are burning the midnight oil on Wednesday, in an effort to end the Eurozone crisis. They have collectively made it clear saving the Euro is more important than the outcome of the Greek referendum.

FTSE Opens Higher as Greece Proceeds with Referendum

Greek Prime Minister George Papandreou has decided to go ahead with his decision to conduct the referendum to decide on his country's future with European Union, brushing aside the market turmoil caused by his announcement Monday as "short lived."

PMQs: Leaders Clash over UK Economy

Labour’s leader, Ed Miliband clashed with the prime minister, David Cameron on the UK economy but avoided asking anything on the Eurozone issue.

G20 Summit: Greek Tragedy Overwhelms World Leaders

The G20 Summit, starting November 3, has been plunged into confusion as the shock announcement of a Greek referendum on the Eurozone bail-out has sparked anger among world leaders and confusion on the world markets.