Home

> M&A | Deals

M&A | Deals

Canada's Valeant in talks to buy Egyptian drugmaker Amoun Pharmaceutical

A deal could value Amoun at between $700m to $800m.

China's Bank of Communications in talks to buy 80% of Brazilian lender BBM

A deal could be announced as soon as next week, during Chinese Premier Li Keqiang's visit to Brazil.

South Africa's Brait to pay £780m for control of fashion retailer New Look

The deal pegs the UK retailer's enterprise value at £1.9bn.

Alibaba CEO Zhang: Firm to invest heavily abroad for global expansion

Zhang says if Alibaba does not globalise, it will not be able to last a 100 years.

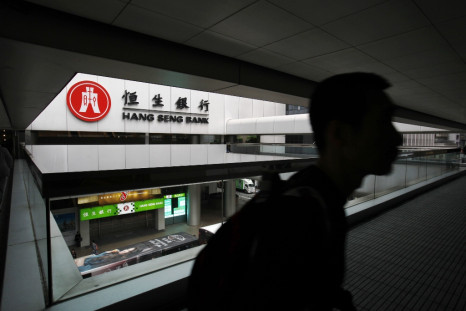

HSBC's Hang Seng to sell stake in Industrial Bank for $2.7bn

London-based HSBC owns 62.14% of Hong Kong's Hang Seng Bank.

Energy trader Castleton buys Morgan Stanley's oil unit for over $1bn

Morgan Stanley's giant physical oil trading business is the largest and oldest on Wall Street.

General Electric open to concessions to win EU approval of €12.4bn Alstom deal

GE unlikely to get unconditional EU clearance for its Alstom bid.

China's Alibaba may pump $1.2bn in Indian smartphone major Micromax

The deal will give Alibaba a near 20% stake in Micromax, valuing the Indian firm at between $5bn and $6bn.

China's Alibaba could invest in Indian smartphone major Micromax

Negotiations between Alibaba and Micromax are underway.

Pacific Rubiales Energy gets $5bn buyout offer from Alfa and Harbour Energy

Toronto-based Pacific Rubiales Energy is the largest independent oil and gas producer in Latin America.

Holcim and Lafarge bag US and Canadian antitrust approvals to merge

The cement makers won approval for the $25bn deal from EU antitrust regulators in December 2014.

British American Tobacco could raise bid for rest of Brazil's Souza Cruz

BAT's first-quarter revenue rose 1.7% at constant exchange rates, trailing the 3.5% median growth estimate forecast.

France's Norbert Dentressangle soars 36% post deal with US-based XPO Logistics

The deal will make XPO one of the top 10 logistics firms in the world and give it access to the largest fleet in Europe.

China proposes mergers to slash number of big state-owned firms to 40

The central government owns 112 conglomerates, including 277 public firms listed on the Shanghai or Shenzhen bourses.

Morgan Stanley could net $2bn from sale of Australian property arm Investa

Morgan Stanley has received over 20 bids for its Australian realty unit Investa Property Group.

Pininfarina's chairman says Italian design house may have M&A news soon

Indian auto major Mahindra & Mahindra is reportedly readying a bid for the car designer.

Facebook, Uber, and 3 German automakers interested in Nokia's maps business

The book value of Nokia's HERE maps business unit stands at €2bn.

Yahoo mulls options for $9bn Japanese division stake: Mayer

Yahoo CEO says the firm has hired advisers to help it evaluate options for the near 35% stake in the Yahoo Japan Corp.

SunGard to explore possible $10bn sale and IPO

SunGard has asked investment banks competing for advisory mandates to prepare for interviews as early as next week.

Coke to acquire China multi-grain drinks maker Xiamen Culiangwang for $400m

Deal will help Coke acquire a foothold in the fast growing multi-grain drinks category and chase growth in China.

Lafarge and Holcim detail US asset disposals ahead of merger

Lafarge to sell assets worth $450m to Summit Materials.

Investment firm Brait to buy 80% of fitness chain Virgin Active for some $1bn

Deal values the British gym at £1.3bn and the Virgin Group will retain a 20% stake in the business.

Italy's Exor bids $6.4bn for reinsurer PartnerRe to trump Axis Capital

Axis and PartnerRe had earlier agreed to an $11bn merger to create one of the world's largest reinsurers.

Nokia considering to sell HERE maps business post Alcatel-Lucent takeover

Nokia has confirmed a strategic review of its maps unit after announcing the takeover of Alcatel-Lucent.

Finland's Nokia confirms merger talks with Alcatel-Lucent

A potential deal could create a European telecoms equipment giant worth over €40bn.

D E Shaw in talks to buy Italian NPL business from Goldman Sachs

Rival US investment firms Fortress, Pimco and Bayview Asset Management have also entered the fray.

CVC Capital plans $5.3bn sale or listing of Spain's IDCSalud

Hospital group IDCSalud could be valued at up to €5bn, or a multiple of 12 times its pro-forma EBITDA of around €420m.

GE close to selling $30bn real estate portfolio

A deal with Blackstone Group and Wells Fargo could be announced on 10 April.

RBS to sell India jewellery financing unit to IndusInd Bank

RBS's India diamond and jewellery financing loan book stands at about £491m.

Circus giant Cirque du Soleil in deal talks with UK, US and Chinese firms

London's CVC Capital Partners, US-based Providence Equity and TPG, and China's Fosun International target circus major.