China proposes mergers to slash number of big state-owned firms to 40

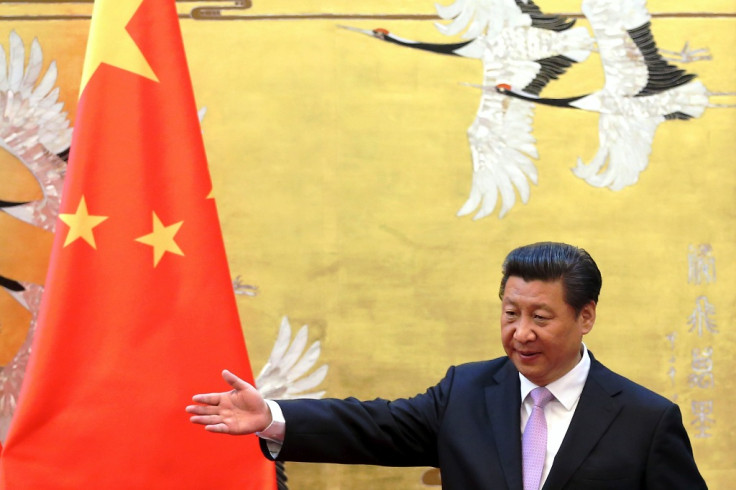

China could slash the number of government-owned conglomerates to 40 through a series of mergers, as the Communist regime pushes forward a plan to overhaul the nation's underperforming state sector, media reports said on 27 April.

At present, the central government owns 112 conglomerates, including 277 public firms listed on the Shanghai or the Shenzhen stock exchanges with a market capitalisation of over CN¥ 10tn (£1.06tn, €1.4tn, $1.6tn), the Economic Information Daily reported.

The consolidation will first take place in commercial sectors, especially in competitive industries, the newspaper said.

And Beijing is keen to prevent asset stripping or corruption during the process, avoidance of which will be "the most important and core requirement" when mergers take place involving sensitive assets, it added.

Responding to the report, the State-owned Assets Supervision and Administration Commission (SASAC), which oversees central government-controlled industrial enterprises, said the newspaper did not verify the information with the agency.

Meanwhile, Chinese stocks jumped to fresh seven-year highs on the report.

The restructuring plan is key to raising the performance of China's lumbering state sector at a time when the ruling Communist Party is trying to find the right policy mix to boost the world's second-largest economy, which expanded at its slowest pace in six years in the first-quarter.

Earlier in the month, Beijing promised to increase public scrutiny of state-owned firms' financial performance, as well as to improve leadership, to increase transparency and battle corruption.

The Central Commission for Discipline Inspection, the Communist Party's top graft-buster, is also intensifying its two-year inspections of state firms in strategic sectors, Reuters reported.

In recent weeks, automaker China FAW Group's chairman Xu Jianyi, Baosteel Group vice president Cui Jian and a general manager at China National Petroleum were all placed under investigation for alleged corruption.

CNR-CSR merger

In March, high-speed rail makers China North Railway (CNR) and China South Railway (CSR) announced that their policy-directed merger had passed overseas antitrust scrutiny. The merger of China's top two train manufacturers created a $26bn giant able to compete with rivals such as Germany's Siemens and Canada's Bombardier.

© Copyright IBTimes 2025. All rights reserved.